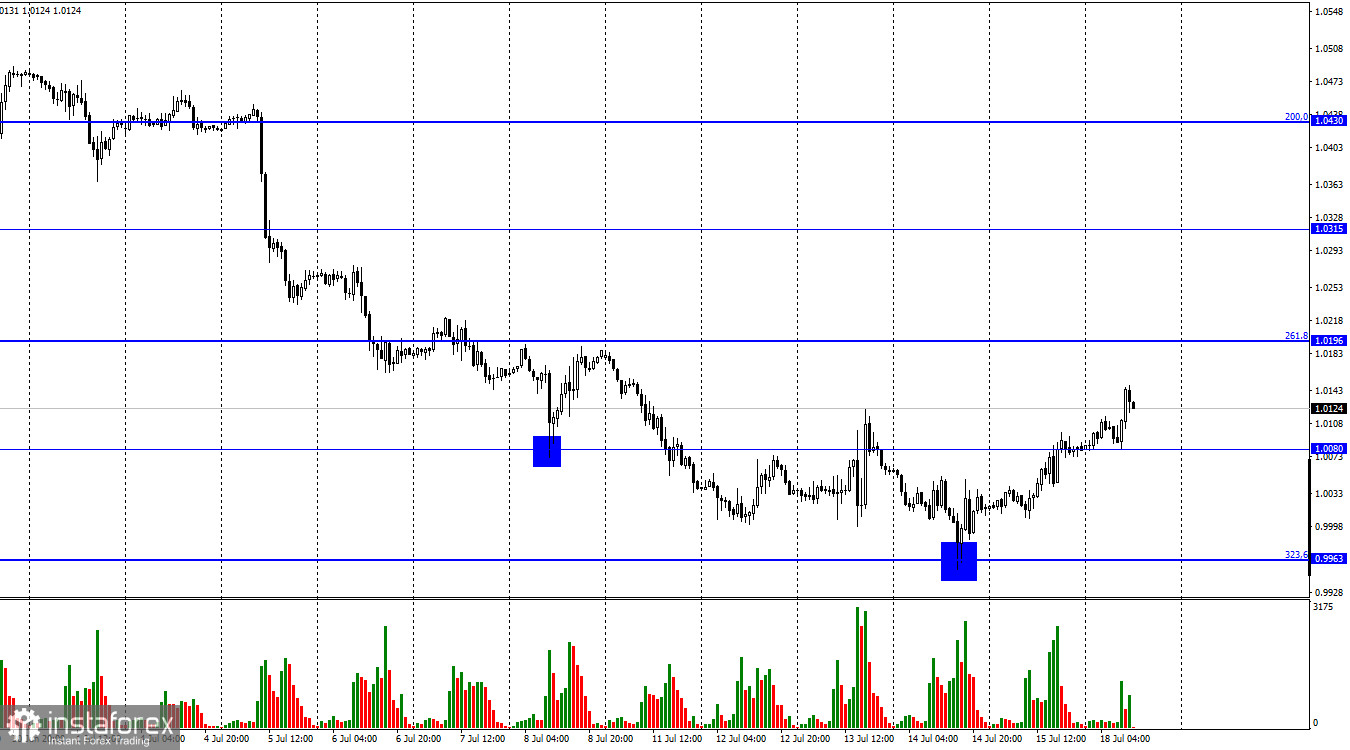

The EUR/USD pair extended its upward trend on Friday after rebounding from the corrective level of 323.6% (0.9963). Today's close was above 1.0080, allowing us to anticipate additional growth in the direction of the next Fibonacci level of 261.8% (1.0196). In recent years, the European currency has not frequently rewarded us with growth. Therefore, it is somewhat odd to watch an upward movement rather than a downward one. I can infer that bullish traders' excitement is related to the ECB meeting scheduled for Thursday of this week. The European regulator will increase the interest rate by 0.25 percent, the first time in a very long time. Christine Lagarde and other ECB board members disclosed this information a few weeks ago. Therefore, traders can purchase the euro based on the expectation of a future rate increase. How long will the euro be able to demonstrate growth if we are just talking about a single boost of 0.25 percent?

Next week, the Federal Reserve will have a meeting at which it will decide to raise interest rates by 0.75 percentage points. In addition, this is not the first time that a US regulator has hiked the rate to 1.75 percent. Thus, the disparity between the ECB and the Fed's monetary policies persists and will continue to be significant. Therefore, I do not anticipate a rapid appreciation of the euro. The ECB rate hike should also be considered, but the growth of the US dollar may restart with fresh energy next week. In addition to the ECB meeting, there will also be a report on inflation in the European Union released at the beginning of the week. Traders are already anticipating a fresh hike in the consumer price index. If forecasts are realized, the ECB will have justification to raise interest rates at its September meeting and possibly at all subsequent meetings in 2022. The European regulator is apprehensive about tightening the PEPP for fear of triggering a recession, but, if nothing is done, inflation might approach 10 percent.

On the 4-hour chart, the pair reversed in favor of the EU currency after a new "bullish" divergence appeared at the MACD indicator. The pair has risen to the corrective level of 127.2% (1.0173), where the growth may halt. The return of quotes from this level will benefit the US dollar and the resumption of the decline in the direction of the corrective level of 161.8% (0.9581). A consolidation over 1.0173 will boost the likelihood of sustained expansion in the direction of the corridor's upper line.

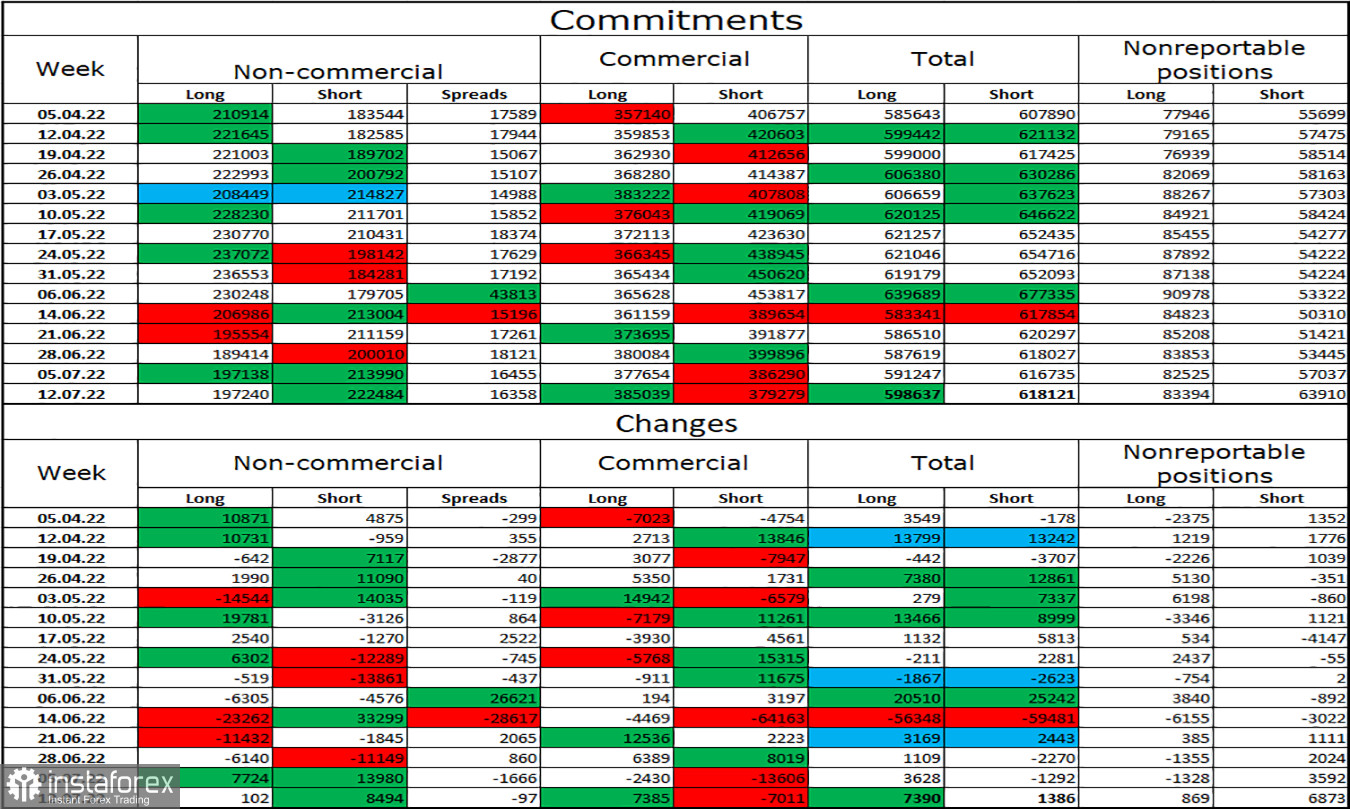

Report on Commitments of Traders (COT):

Last reporting week, 102 long contracts and 8,494 short contracts were opened by speculators. This indicates that the "bearish" sentiment of the main players has once again intensified. The total number of long contracts held by speculators is currently 197 thousand, and the number of short contracts is 222 thousand. The disparity between these numbers is not excessively large but does not benefit the bulls. Most "Non-commercial" traders have maintained a "bullish" outlook on the euro in recent months, which has not helped the euro currency. Recent COT figures indicate that new sales of the EU currency may follow, as speculators' sentiment has shifted from "bullish" to "bearish" during the past several weeks. This is the precise evolution of events that we are currently watching.

News schedule for the United States and Europe:

The economic event calendars of the European Union and the United States on July 18 include no noteworthy entries. Thus, the information background will not affect traders' sentiment today.

EUR/USD prediction and trader recommendations:

I suggested selling the pair when it reached a closing price of 1.0196, with objectives at 1.0080 and 0.9963. These two levels have been attained. When bouncing back from 1.0173 with the same objectives, sales increase. On a 4-hour chart, I advise buying the euro when the price is above the corridor with a goal of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română