According to UK bank Barclays, the decision to hold bitcoin could hurt Tesla's upcoming second-quarter earnings. According to analyst Brian Johnson, with Bitcoin's drop to $19,000 at the end of the second quarter, Tesla could end up reporting an impairment of roughly $460 million.

"With Bitcoin ending the quarter at ~$19k (well below TSLA's likely purchase price range of ~$32-33k), we expect TSLA to take an impairment charge in the quarter of ~$460mn or ~$0.40 per share," Johnson said in a note.

"With Bitcoin ending the quarter at ~$19k (well below TSLA's likely purchase price range of ~$32-33k), we expect TSLA to take an impairment charge in the quarter of ~$460mn or ~$0.40 per share," Johnson said in a note.

Tesla is scheduled to report its earnings this Wednesday.At the beginning of 2021, an SEC filing revealed that Tesla bought $1.5 billion in Bitcoin. At the time, Bitcoin was worth around $30,000.Since then, Bitcoin has seen massive ups and downs, rising to its all-time high of $69,000 in November 2021 and ending the second quarter of 2022 near $19,000, which was around 70% off its record highs. Bitcoin was trading at $21,905.For Tesla, this means a loss of about $11,270 per coin, which is around $460 million in total based on the calculation that it purchased 42,000 tokens.Bitcoin was hit this year as as investors exited their risk-on positions, and contagion risks impacted all cryptocurrencies. However, some analysts are getting slightly more optimistic about the future of Bitcoin, as the world's largest cryptocurrency breached $22,000.

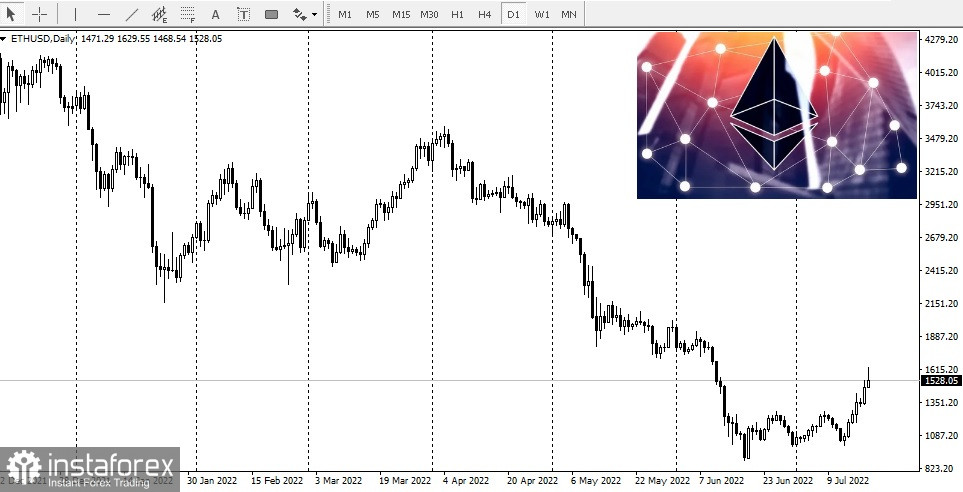

The published inflation data is another blow to economic and social well-being, as the Federal Reserve are forced to be more aggressive. However, Bitcoin has risen by over 10% since the news, and Ethereum has climbed by almost 40%.

The published inflation data is another blow to economic and social well-being, as the Federal Reserve are forced to be more aggressive. However, Bitcoin has risen by over 10% since the news, and Ethereum has climbed by almost 40%.

When the market starts reacting positively to negative news, this is a signal that a local bottom could be in for now, as fear may have caused the news to be priced in.

When the market starts reacting positively to negative news, this is a signal that a local bottom could be in for now, as fear may have caused the news to be priced in.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română