Bitcoin continues its upward movement after the successful breakdown of the downward trend line. Bitcoin reached a local high at $23.6k, and unleashed its hands for the upward movement of the altcoin market. Together with Ethereum, BTC filled the market with liquidity, thanks to which the market capitalization broke through the $1 trillion mark. At the same time, there is an increase in trading volumes and the number of unique addresses in the Bitcoin network. The fear and greed index has reached 30, which indicates a surge of positivity in the market.

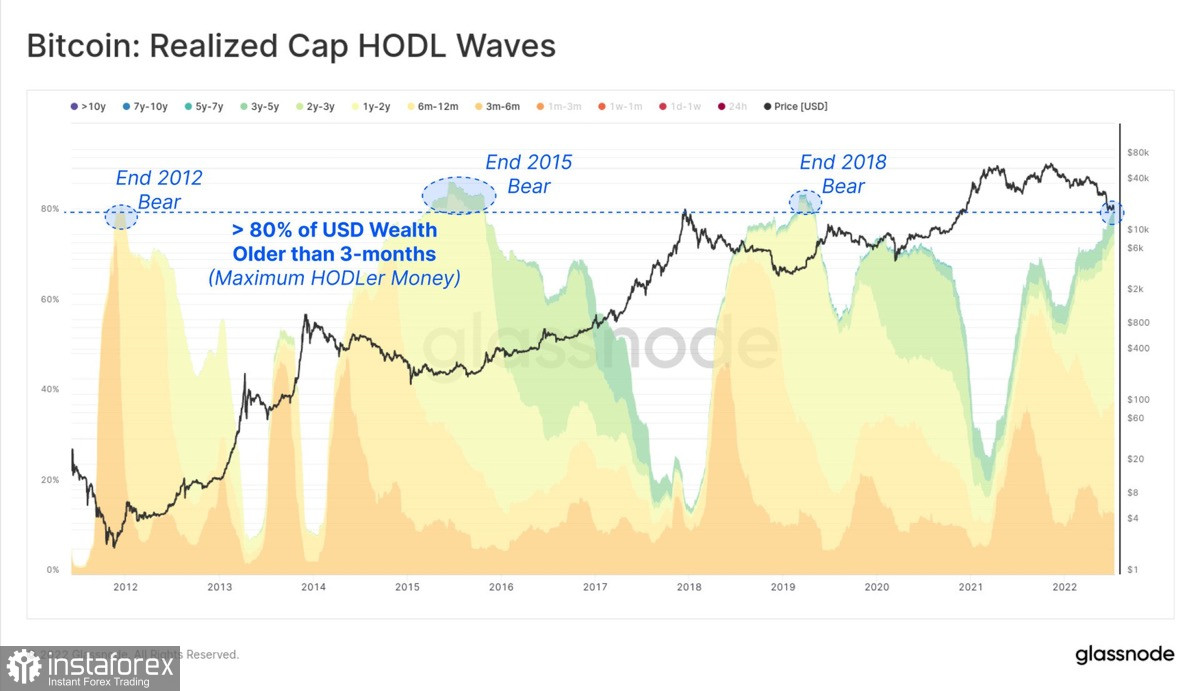

Glassnode's claim that around 80% of Bitcoin investments had been inactive for three months accompanied the market's overall upturn. Historically, this foreshadowed the formation of a local bottom and the end of the capitulation period of market players. The crypto community began to actively discuss the likely completion of the downward movement and the transition to the phase of positional growth.

To figure out if everything is so joyful, you need to analyze the US dollar index. The upward movement of Bitcoin and the entire market would be impossible (or would be much more modest) if the DXY index was not in a correction. The dollar hit a 20-year high at 109 before starting to decline. The correction lasted three days, and as of July 20, DXY reached a strong support zone at 106. At the same time, technical indicators point to a gradual stabilization of the situation. The RSI index and stochastic are gaining flat dynamics, but the MACD continues to decline. These factors indicate that Bitcoin and other cryptocurrencies have room for upward movement.

On the Bitcoin daily chart, we see the continuation of bullish signals despite the peaking of technical indicators. The asset broke through the descending trend line and reached $23.5k. Thus, the important area of $22.8k–$23k was broken, where large volumes of wallets with a balance of 1000 BTC were concentrated. Cryptocurrency takes a short pause to gain a foothold above an important resistance level, also indicated by the RSI index and the stochastic oscillator. The metrics have fully implemented the bullish momentum and started to move in a flat direction, indicating a local pause. At the same time, we do not see bearish volumes, indicating the likelihood of further upward movement.

Despite the overall positive, several important factors indicate the imminent end of the bullish movement. The first and most obvious one is related to miners who sold 14,000 BTC just last week to get quick liquidity. It is important not to forget that mining companies have lost about 50% of their usual income, and the rise in the price of Bitcoin pushes them to sell coins to obtain the liquidity needed to reduce the credit burden.

Large investors have also started selling off their coins. Wallets with a balance of 1000 BTC have started selling their stocks since last week. The fourth largest "whale" has sent more than 15,000 BTC to the crypto exchange over the past two days, which put pressure on the price and slowed down the upward movement. The current accumulation rates are not enough to offset the influence of such a powerful factor.

And the icing on the cake is the Fed meeting on July 26–27. About a week ago, the regulator was forced to launch a printing press to stabilize the exchange rates of EUR and other currencies. It means that at the next meeting, the Fed will have no choice but to raise the key rate by a record 100 basis points. It will strengthen the US dollar and the DXY index, which means the crypto market will lose liquidity again.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română