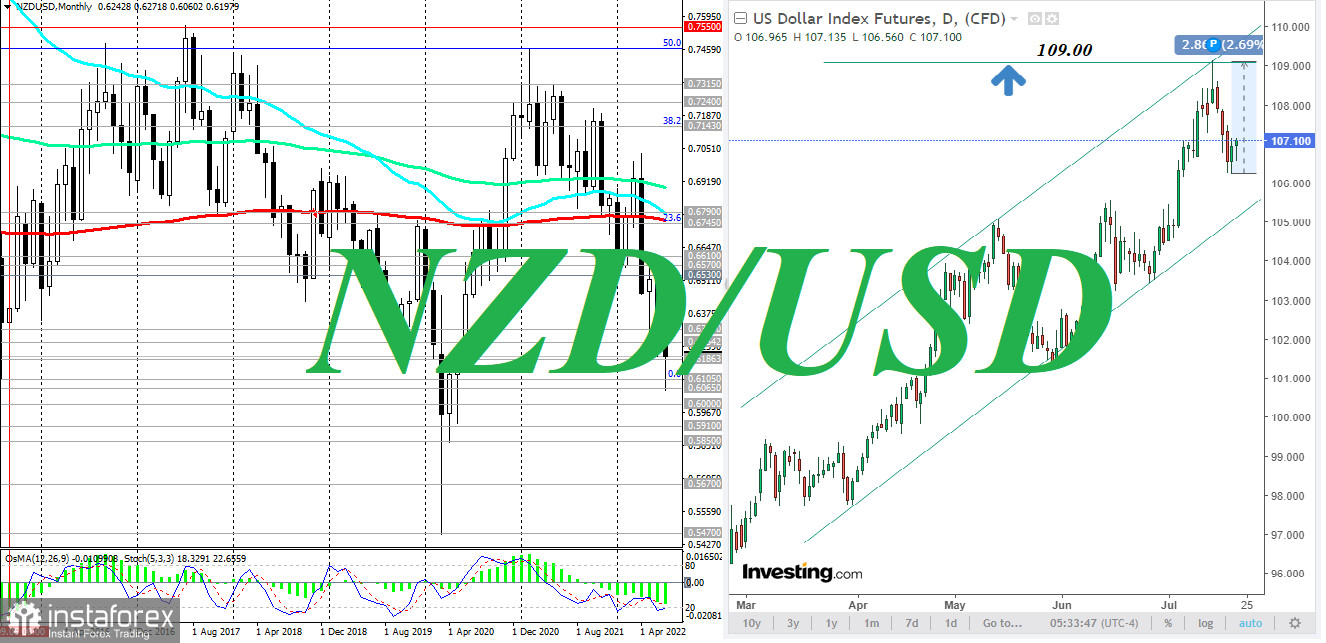

After falling in Asia, the dollar index again turned to growth at the beginning of Thursday's European trading session. At a point, DXY futures were trading near 107.10, 87 points above Wednesday's local intraweek low of 106.23. Given the strong bullish momentum and the long-term upward trend in DXY, a breakdown of the local resistance level at 109.00 will be a signal to increase long positions in DXY futures "with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and November 1985."

If the strengthening of the dollar against the main European currencies is rather restrained, then it is noticeably strengthening against the main commodity currencies: Canadian, Australian, New Zealand dollars.

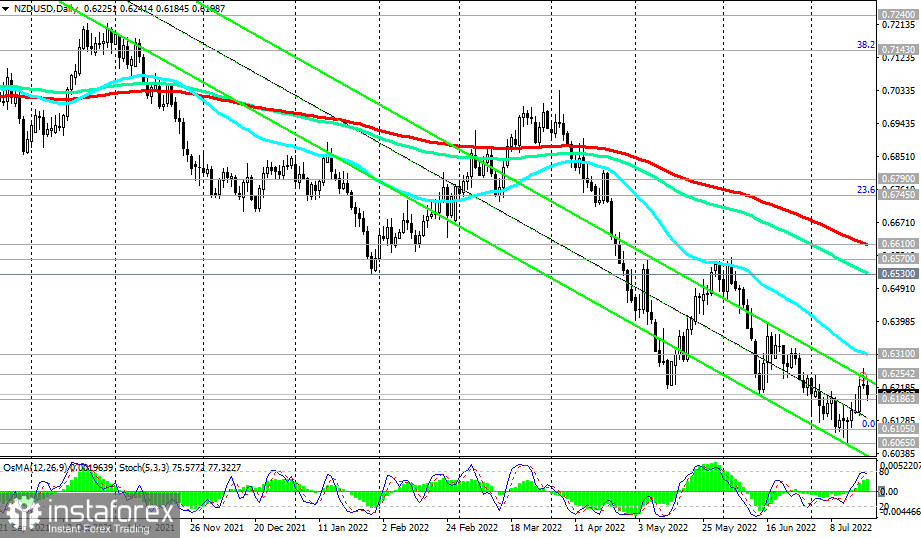

As for the latter, last week (Thursday) it reached a new 26-month low at 0.6060, moreover, after the Reserve Bank of New Zealand raised the official rate (OCR) by 50 bp for the third consecutive time last Wednesday, up to 2.5%.

The accompanying RBNZ statement said: "The Committee agreed that it remains prudent to continue to tighten monetary conditions at the pace necessary to maintain price stability and support maximum sustainable employment. The Committee acknowledged that there is a risk of higher consumer price inflation in the near term and downside risks are emerging in the medium term." RBNZ leaders also decided to keep raising the OCR (official money rate) to a level where they are confident that "consumer price inflation will settle within the target range." The RBNZ acknowledged that a sharp rise in consumer prices is possible in the short term, as the situation in the energy market remains highly uncertain (at the moment, the annual inflation rate is 7.3%, which is the absolute peak in 30 years). Economists predict that by the end of 2022, the RBNZ interest rate may be increased to 3.5%, and up to 4% by 2024.

The New Zealand dollar and the NZD/USD pair reacted rather reservedly to this rather tough RBNZ decision, perhaps because it was expected.

Commodity currencies are under pressure from the news that the Nord Stream 1 gas pipeline has resumed gas supply after 10 days of maintenance. Gas and oil prices were falling on Thursday.

The next 2-week report of the Global Dairy Trade was also published on Tuesday. According to published data, the dairy price index, which reflects the weighted average price changes in percentage terms, again decreased in the previous reporting period and came out with a value of -5.0% (after a decrease of -4.1%, -1.3% in the previous periods).

The economy of New Zealand in many ways still has signs of raw materials. Moreover, the main share of New Zealand exports falls on dairy products and food products of animal origin.

No particularly important economic news in New Zealand is expected for this week and the next. Therefore, the dynamics of the NZD/USD pair will depend on the general situation on the commodity market and on the dynamics of the US dollar. For now, it continues to dominate the FX market, while NZD/USD, having declined since the opening of Thursday, is trading in the zone of an important short-term support level of 0.6186.

Market participants were closely following the course of the European Central Bank press conference. It was expected that following this meeting, the key interest rate will be raised by 0.25% (up to -0.25%), and the ECB's rate on deposits for commercial banks - up to 0.25%.

During the press conference, ECB President Christine Lagarde will explain the bank's decision on rates and likely outline the prospects for the central bank's monetary policy in the coming months. You need to be prepared for a sharp increase in volatility during this period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română