The FOMC meeting scheduled for July 27 will be the key event of the current trading week. The US central bank is expected to hike rates by 75 basis points to 2.25-2.75%. Volatility is likely to be low before the meeting. Since the rate increase has already been priced in by the market, the focus will be on Chair Powell's comments following the rate decision.

Data on business activity released on Friday missed the market forecast. Germany's IFO indicators for June came in below the market consensus as well, with the business climate falling to the lowest level since June 2020, that is, before the pandemic. The Dallas Fed Manufacturing Index decreased to -22.6 from -17.7 (market expectations: -18.5), the lowest since May 2020. The Chicago Fed National Activity Index was unchanged at -0.19. It seems that both the United States and Europe are heading towards a recession.

The US stock market closed near Friday levels on Monday. Natural gas and oil prices are high. Next week, the focus will be on tech stock earnings reports as they will throw light on how soon the US may enter a recession.

Gazprom said that it was not interested in cutting supplies to Europe. However, in the face of sanctions, Nord Stream 1 would not be able to reach full capacity as another turbine needed to be repaired.

The situation in the market is unlikely to change throughout the week unless the Fed's interest rate decision causes market jitters.

NZD/USD

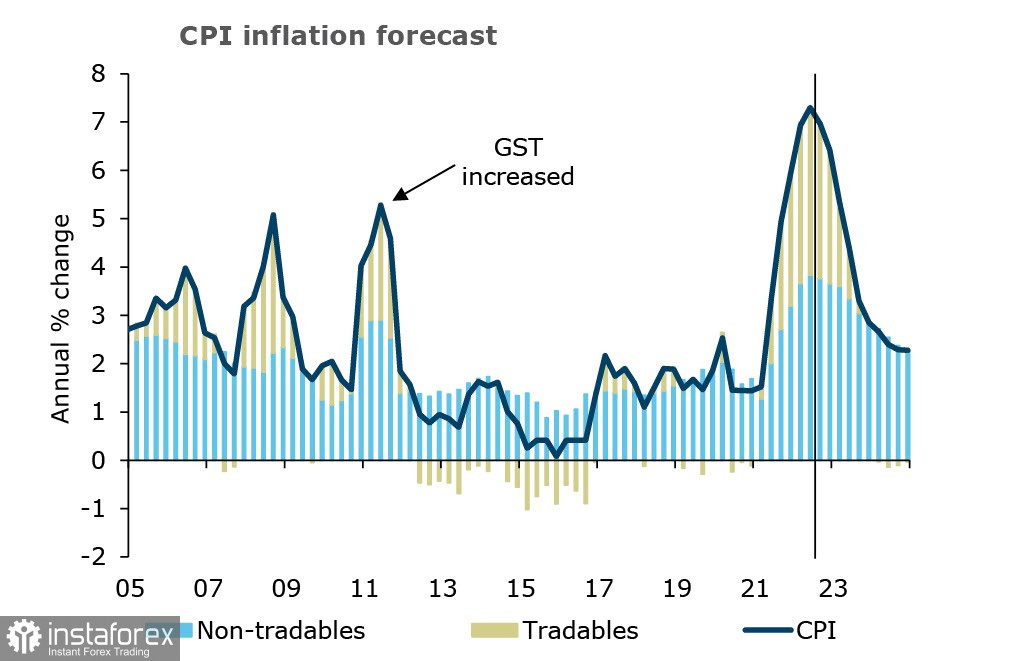

Meanwhile, inflation in New Zealand is at a record level, influenced by domestic factors. At the same time, core inflation is growing well above the forecast of the RBNZ. So, the regulator's key problem now is how to bring raging inflation under control.

The central bank is becoming more hawkish. It now sees the interest rate at 4%. It may take the RBNZ a few years to reach the 2% target on inflation.

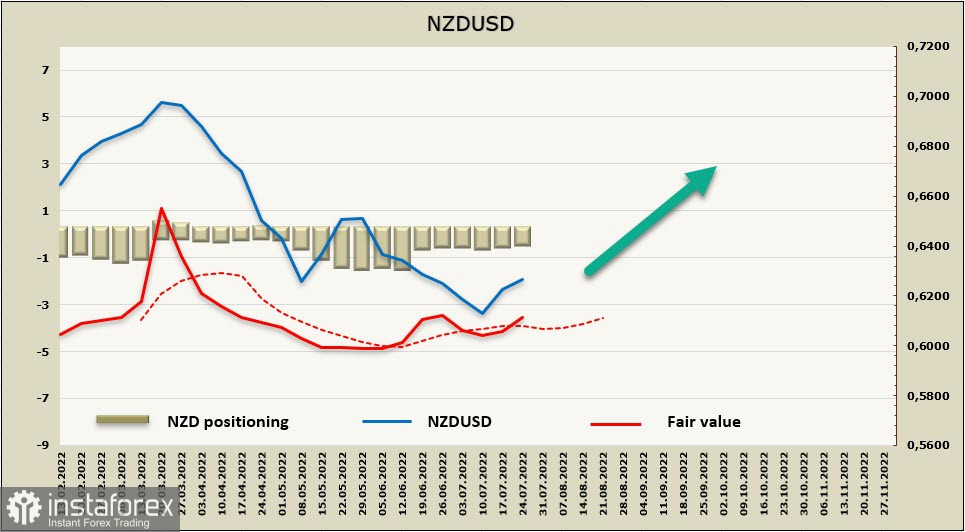

According to data from CFTC published on Friday, the NZD net short position decreased by 95 million in the reporting week to -229 million. NZD trading volumes are traditionally low. Sentiment in the market is bearish, and speculators do not expect the kiwi to suddenly rise against the dollar. The settlement price is now slightly higher, so corrective growth may continue.

A week earlier, we suggested that the correction could rise to the 0.6270/90 resistance zone. This assumption turned out to be accurate. Since the settlement price reversed upward, the kiwi could go even higher. Next technical resistance is seen in the 0.6380/90 zone, in line with the 23.6% extension from the fall that began in February. Resistance is weak and not seen as a long-term target.

AUD/USD

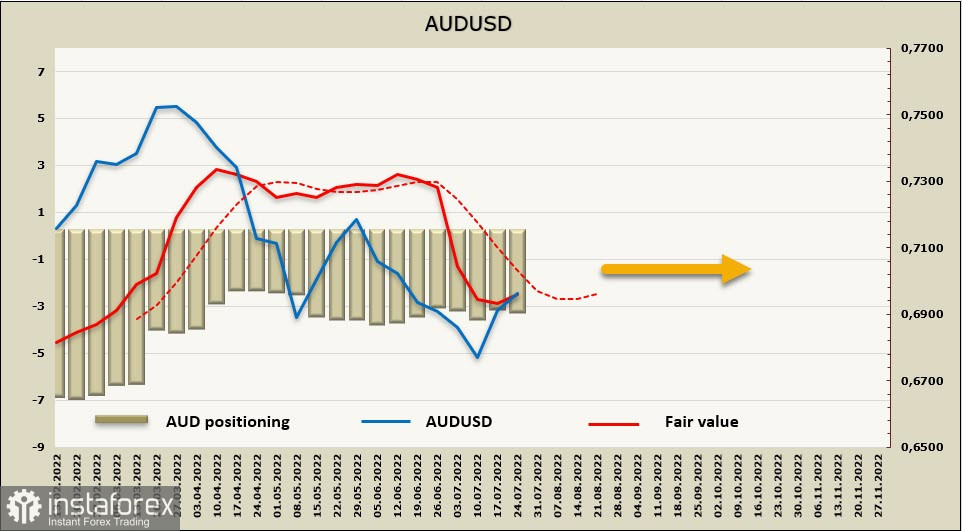

On Wednesday, Australia will see the release of the inflation report for the 2nd quarter. Figures are forecast to come in at 6.2% versus 5.1% in the 1st quarter. Inflation in the country is high but still lower than in Europe, the US, or New Zealand, which gives the RBA some room for maneuver. If actual results meet the forecast, inflation will hit its record levels since 1990.

The Aussie dollar remains bearish. The settlement price is below the long-term MA, which means the current increase in price can be seen as corrective growth.

A week earlier, resistance was in the 0.6930/50 zone. The target has already been reached. Growth may extend to the next resistance zone of 0.7060/70. The general trend remains bearish. Therefore, another deep descending wave is likely as soon as the correction ends. The long-term target stands at 0.6464.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română