GBP/USD

Analysis:

According to the dominating trend, the quotes for the British pound in its primary pair continue to travel toward the bottom of the price chart. During the entirety of the current month, the unfinished portion of the primary wave produced a counter-reversal from the strong support zone. Price is nearing the lower boundary of the preliminary target zone.

Forecast:

During the upcoming week, it is anticipated that the present price increase will conclude within the projected resistance. After that, you can anticipate a lateral drift followed by a reversal. Most certainly, the drop will commence by the end of the week.

Potential reversal zones

Resistance:

- 1.2270/1.2320

Support:

- 1.1960/1.1910

Recommendations:

In the foreseeable future, there will be no conditions for purchasing the British pound. It is advised to avoid trading this pair until the resistance area reveals definite sell signals.

AUD/USD

Analysis:

Since February of last year, the Australian dollar's value has been slowly declining. Since April 5, the unfinished portion of the trend has started counting. In the previous month and a half, quotes have formed a counter-correction within their framework. At the moment of examination, it resembles a stretched airplane the most. This wave's structure is not complete.

Forecast:

At the start of the upcoming week, the general upward trend is anticipated to continue until its completion in the resistance zone. After that, a change in direction is anticipated in the flat, followed by a resumption of the descent. The support zone represents the expected lower limit of the pair's weekly movement.

Potential reversal zones

Resistance:

- 0.7050/0.7100

Support:

- 0.6860/0.6810

Recommendations:

Purchasing the Australian dollar is fraught with risk. They must minimize the quantity as much as possible. With a cautious approach, you should avoid transactions until your vehicle confirms the emergence of sell signals in the zone of resistance.

USD/CHF

Analysis:

Since May 12, a downward correction in the shape of a shifting plane has been emerging within the context of the overall bullish trend on the primary Swiss franc pair. The movement has reached its conclusion. The wave has significant potential to be the beginning of a large-scale approaching wave.

Forecast:

At the start of the coming week, it is anticipated that the bearish rate will continue, with its completion in the area of settlement support. In this zone, you can then wait for a reversal to form. By the end of the week, the likelihood of a resumption of the upward trend and a price rise to the resistance zone will have increased.

Potential reversal zones

Resistance:

- 0.9660/0.9710

Support:

- 0.9400/0.9350

Recommendations:

In the next few days, trading activity on the Swiss franc market will be limited to individual trading sessions using fractional lots. Only once the confirmation signals of your trading methods materialize will purchase be feasible.

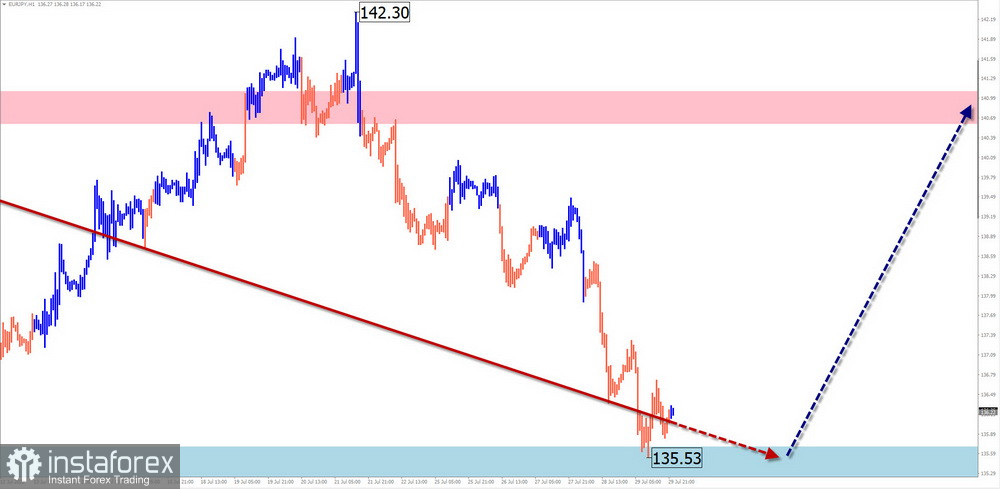

EUR/JPY

Analysis:

Following the ascending wave model of the euro/yen cross since March 7, the price has been building a downward correction throughout the last two months. The wave structure appears complete, but there are no indications of a direction change on the chart. The number of quotations has reached the limit of solid support for the senior TF.

Forecast:

At the start of the forthcoming week, it is anticipated that the movement will occur mostly in the lateral plane, with the establishment of conditions for a change in direction. Price increases are more probable by the end of the week. The computed resistance indicates the upper limit of the pair's anticipated weekly movement.

Potential reversal zones

Resistance:

- 140.60/141.10

Support:

- 135.70/135.20

Recommendations:

There are no requirements for selling a cross on the market for pairs. It is advised to keep an eye out for potential purchase signals near the settlement support zone.

In simplified wave analysis (UVA), all waves consist of three components (A-B-C). Each TF analyzes only the final, incomplete wave. The solid backdrop of the arrows indicates the developed structure, while the dashed background indicates the anticipated movements.

Attention: the wave algorithm does not account for the duration of the instruments' temporal movements!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română