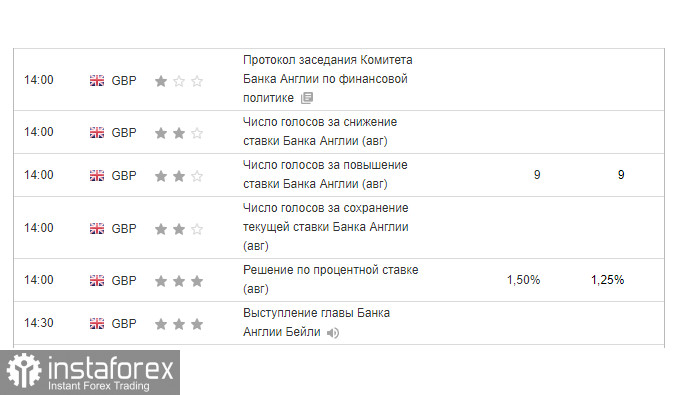

This week, the Bank of England is expected to push through the biggest interest-rate increase in 27 years and unveil its strategy for unwinding some of the £895 billion ($1.1 trillion) of stimulus it delivered over the past decade.

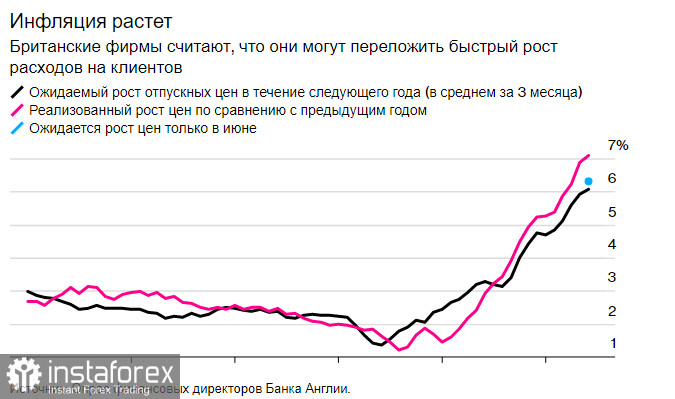

The measures would accelerate a historic tightening of monetary policy to curb the largest surge in inflation in 40 years. Governor Andrew Bailey and his colleagues warned that prices could jump by 11% this year, well above the 2% target.

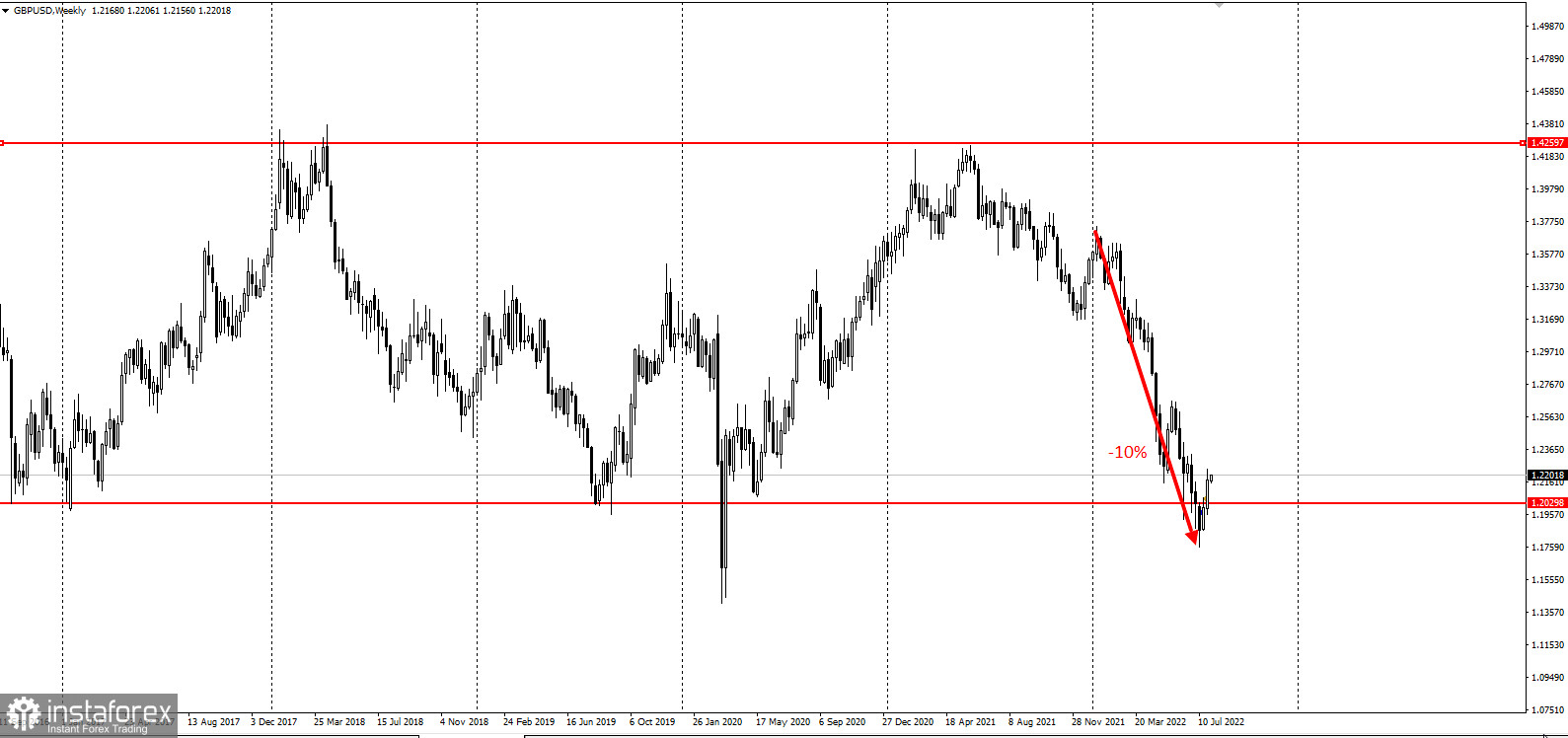

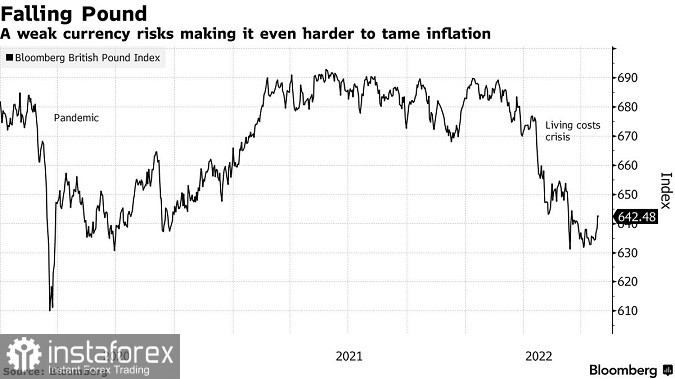

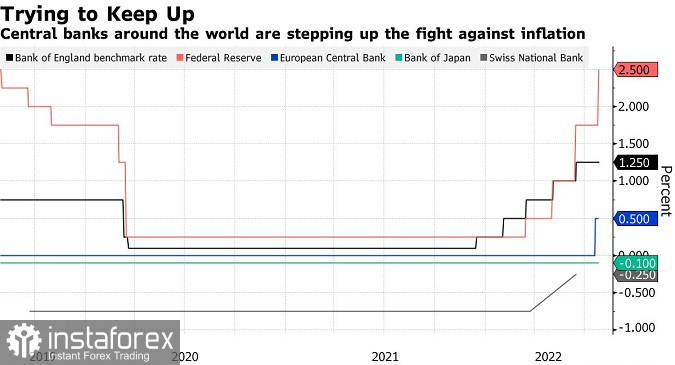

The UK central bank is also concerned about falling behind peers, especially the US Federal Reserve, which raised rates by a total of 1.5 points in its last two meetings. For the Bank of England (BOE), rate increases also will underpin the value of the pound, which has fallen 10% against the dollar this year.

"The BOE signaled at its June meeting that it would 'act forcefully' if it saw signs of persistent inflationary pressure. We think the data since then will lead to a 50 basis point increase in August. Our base case is the central bank will then revert to more traditional 25-basis point increments following this meeting, taking rates to 2.75% by February. The risk is that a faster pace of tightening continues in the fall," senior economist Dan Hanson said.

Investors anticipate a 70% chance of a half-point increase in the BOE''s benchmark rate to 1.75%, the highest since the global financial crisis in 2009. While most economists also see a move of that scale this week, some, including Morgan Stanley and NatWest Markets say a quarter point is more likely, citing rising recession risks.

A decision is due on August 4.

The move complicates the economic backdrop for the candidates vying to replace Boris Johnson as prime minister. Foreign Minister Liz Truss and former Finance Minister Rishi Sunak are seeking to woo members of the ruling Conservative Party with a package of measures to help people cope with surging bills and energy prices.

The BOE's rate rises are taking money out of people's pockets by increasing borrowing costs. Figures published by the central bank on Friday showed the effective interest rate on new mortgages rose to 2.15% in June, the highest level since late 2016. The rate has jumped 65 basis points since November.

So far, the Bank of England has raised rates five times since December, moving in no more than quarter-point steps. The Fed's actions and a series of above-forecast UK inflation readings prompted British policymakers to reconsider their more gradual response and promise to act "forcefully" if necessary.

The last time the BOE raised interest rates by 50 basis points was in February 1995, when the government set the cost of borrowing with advice from the central bank.

At the time, the fear was that the economy was growing at a rapid and unsustainable pace. GDP was expanding at around 4% a year, inflation had picked up and business surveys showed wholesale prices rising. Clarke had already announced half-point moves in both September and December 1994.

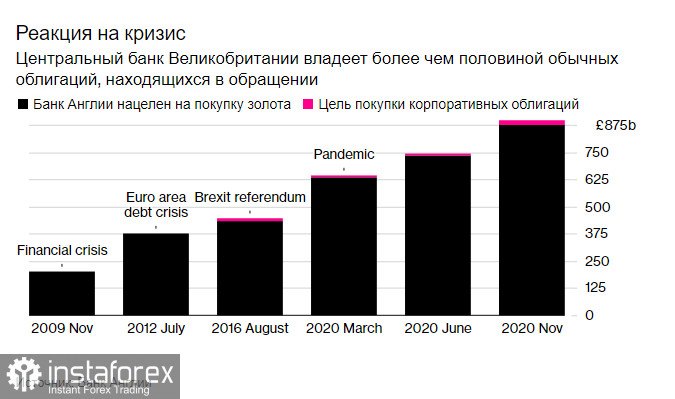

This week's decision will pivot the BOE further away from more than a decade of easy money to stimulate the economy through the financial crisis and then the coronavirus pandemic. The BOE bought £895 billion of government and corporate bonds during that time to keep a lid on borrowing costs in financial markets.

Bailey said the decision this week will include details about how the BOE will sell off part of the portfolio. In February, it stopped reinvesting the proceeds of matuiring assets. Now it's considering active sales, which Bailey said could be in the region of £50 and £100 billion in the first year of the program.

Together, the rate increases and asset sales mark a massive shift away from the easy money policy prevailing in the past decade and are designed to raise borrowing costs to more normal levels. Investors are betting that the key rate reaches nearly 3% by early 2023, while economists are more cautious.

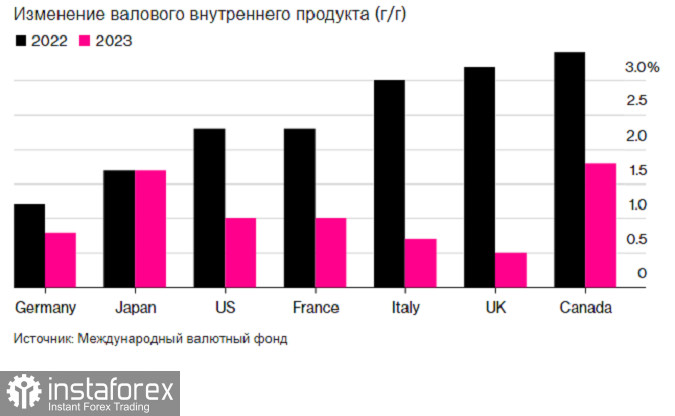

It is also highly unusual for the bank to raise rates while the economy is facing a high risk of recession. The International Monetary Fund estimates that the UK may suffer the slowest growth in the Group of Seven industrialized nations next year after recovering from the pandemic more quickly than most.

Headwinds for the economy include the worst squeeze on consumer spending power in two decades and Britain's decision to exit the European Union, which has reduced trade and robbed industries such as construction and hospitality of foreign workers.

Firms across the economy are experiencing chronic labor shortages, despite recent signs that the strains are easing. Almost 400,000 people of working age have dropped out of the workforce since Covid-19 first hit, reflecting an increase in long-term sickness and people taking early retirement.

While the outlook weakens, the BOE is looking on with alarm at signs that inflation expectations are now well above the 2% target. Business surveys show executives expect strong inflation to persist for years and plan to raise prices aggressively to protect their profit margins.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română