As can be seen from the charts reflecting the dynamics of the major currency pairs, today's trading day turned out to be volatile, accompanied by a sharp increase in demand for the protective yen and a drop in commodity currency quotes. In particular, the Australian dollar has sharply weakened today after the Reserve Bank of Australia once again raised the interest rate by 50 basis points, to 1.85%. The accompanying statement stated that the bank's leaders are committed to reducing inflation, which remains one of the main risks for the national economy, and noted that further decisions on monetary policy will be made based on the current economic situation.

Pressure on the Australian dollar and other commodity currencies, as well as on futures for major global stock indices (in particular, the Chinese Shanghai Composite index lost more than 2% today), is also exerting a sharp increase in geopolitical tensions in the Asia-Pacific region. As is known, US House of Representatives Speaker Nancy Pelosi is expected to visit Taiwan soon, and China has already reacted sharply to this proposed visit. The country's authorities adhere to the position of one China, including the island of Taiwan. And in response to Pelosi's possible visit to Taiwan, Beijing has formulated a number of countermeasures, including military action. "There will be serious consequences if she insists on visiting," Chinese Foreign Ministry spokesman Zhao Lijian said.

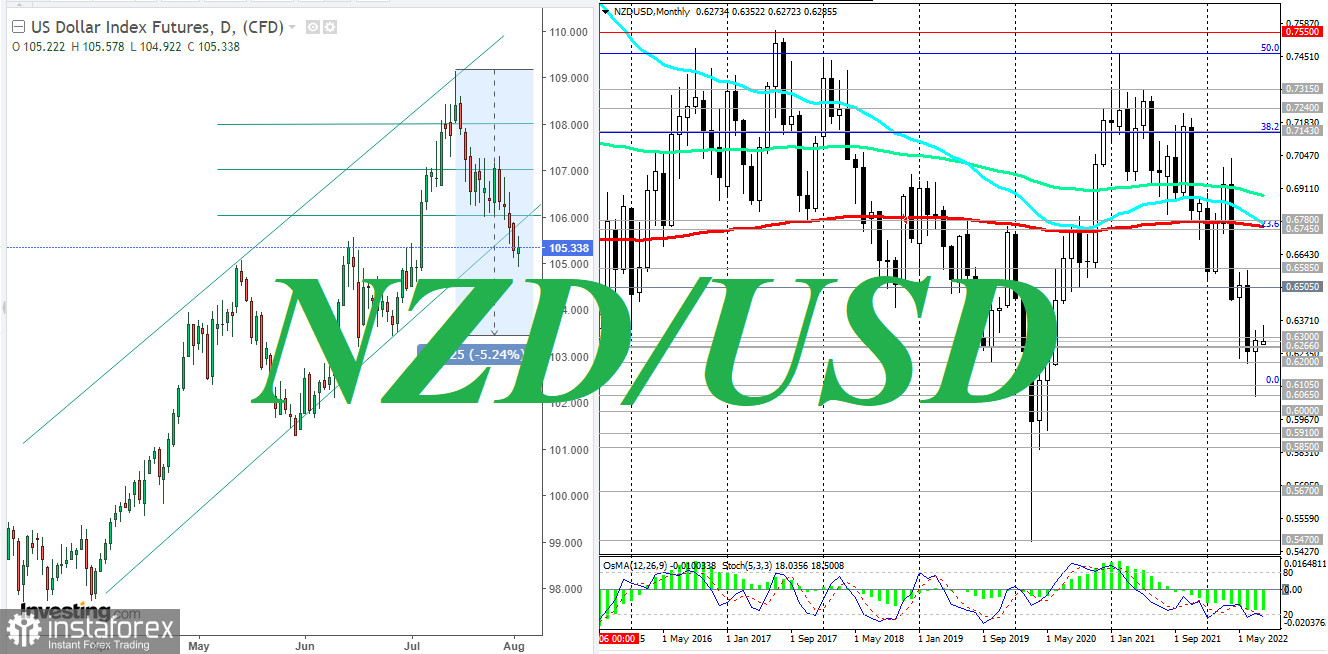

The dollar, meanwhile, stopped falling due to the events around Taiwan. The dollar index (DXY) shows modest growth today after falling in the past four days.

As of this writing, DXY index futures were trading near 105.34, 43 points below last week's close but 7 points above Monday's close. The first signal for the resumption of long positions in DXY futures will be the breakdown of the local resistance levels of 106.00, 107.00. In the meantime, investor confidence in the dollar remains low after the publication last Thursday of disappointing data on US GDP for the 2nd quarter. Yesterday's data on business activity in the manufacturing sector only added to the negative mood of investors: PMI from S&P Global came out with a value of 52.2 in July (below the value of 52.3 in June), and a similar indicator from the Institute of Supply Management (ISM) at 52.8, which is also lower than the previous value of 53.0. Note that readings above 50 indicate an acceleration in activity. However, market participants focused on the relative decline in indicators after a disappointing GDP report.

Now the Fed is expected to have a softer increase in interest rates in September and a pause thereafter. Fed officials will now have to act more cautiously with possible further tightening of monetary policy in order not to drive the US economy into a long-term recession.

Now investors' attention is on the US Department of Labor report with monthly data on the labor market, to be published on Friday. Economists' forecast suggests a slowdown in job creation (non-agricultural) to 250,000 from 372,000 in June, although the unemployment rate is likely to remain at 3.6%. If labor market data turns out to be worse than forecast, then the Fed will have less room to maneuver in planning its monetary policy parameters and more arguments in favor of taking a pause in the interest rate cycle.

The negative scenario assumes further growth of inflation against the backdrop of deteriorating macroeconomic indicators. Here, Fed officials may have to consider the wisdom of a tough stance on monetary policy. If they announce the resumption of stimulus, which is also not ruled out if the situation in the US economy worsens, the fall of the dollar cannot be avoided.

Returning to the topic of the dynamics of the main commodity currencies, today it is also worth paying attention to the NZD/USD pair. As of this writing, it is trading near 0.6285, also under pressure from negative market sentiment due to the events around Taiwan.

Since the middle of last month, NZD/USD has been developing an upward correction. However, a breakdown of the support levels of 0.6266, 0.6260 will be a signal to resume short positions.

And today, in the news regarding NZD, one should pay attention to the publication at 14:00 (GMT) of the Global Dairy Trade Dairy price index and the publication (at 22:45) of the most important indicators of the state of the New Zealand labor market.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română