The main event of Friday will be the publication of the report of the United States Department of Labor, which will take place on Friday. Unemployment is almost certain to remain unchanged, while 290,000 new jobs could be created outside of agriculture. This is about one and a half times more than is necessary to maintain the stability of the labor market. Therefore, the unemployment rate will definitely not rise in the near future. Rather, it has the potential for further decline. This fact will allow the US dollar to strengthen significantly.

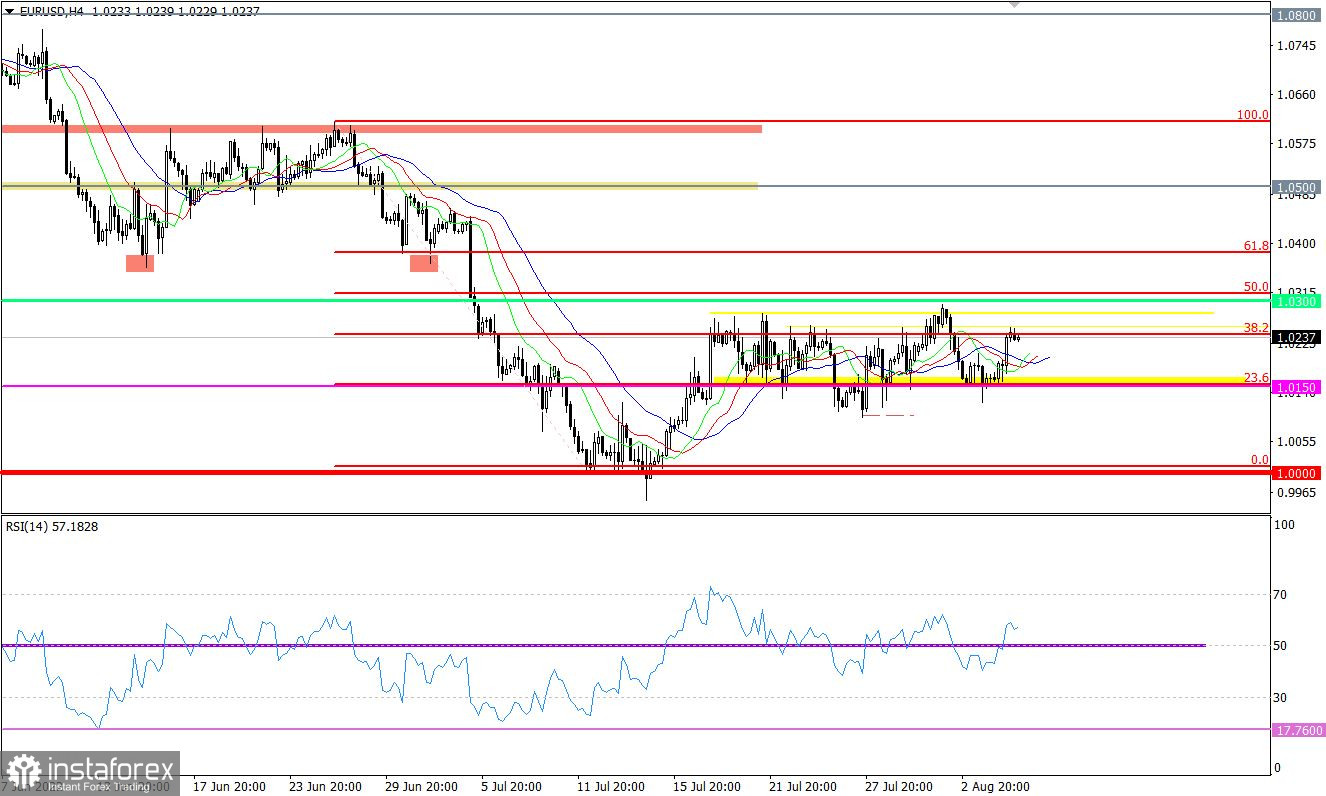

The EURUSD currency pair continued the cycle of fluctuations within the horizontal channel of 1.0150/1.0270. As a result, the price rebounded from the lower border of the flat. Consistent movement in a closed range indicates the traders' indecisiveness to the main move. As a result, a protracted flat attracts abundant attention from speculators, which sooner or later will lead to a strong outgoing impulse.

The technical instrument RSI H4, following the price rebound from the lower border of the flat, crossed the 50 middle line upwards. This signal only indicates the bounce method, but not the end of the flat. RSI D1 is moving along the 50 line, this move corresponds to a horizontal channel.

The moving MA lines on Alligator H4 have a variable signal due to the price movement within the sideways range. At this time, there is a buy signal, which corresponds to the recent rebound of the price from the lower border of the flat. Alligator D1 has red and green MA lines intertwined, this signal indicates a slowdown in the medium-term downward trend.

Expectations and prospects

Despite the obvious signs of overheating of the horizontal channel due to its long formation, the method of rebounding the price from one or another boundary is still relevant in the market. Thus, another increase in the volume of short positions in the region of 1.0250/1.0270 cannot be ruled out, which will lead to a price rebound towards the lower border.

Cardinal changes in the form of an outgoing momentum signal will be relevant if the price stays outside one of the control levels: 1.0300 - when considering the upward development of the market; 1.0100 - if market participants are oriented towards a hike towards the parity level.

It is worth noting that the signal must be confirmed in a four-hour period.

Complex indicator analysis has a variable signal in the short-term and intraday periods due to the current flat. At the moment, the indicators point to long positions on the euro, due to the convergence of prices with the upper border of the flat. Technical instruments in the medium term are still focused on a downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română