Bitcoin is still firm at around $22K support. Bears managed to push the price to $22.3K but bullish activity increased and the asset recovered above $23K. Although key levels have been successfully protected, bearish pressure has soared over the past week. BTC has been on a losing streak for 7 days now. It is in a downtrend despite the low short volume.

A row of red candlesticks has formed amid a general decrease in trading activity, bullish in particular, with daily trading volumes falling to $26 billion from $35 billion.

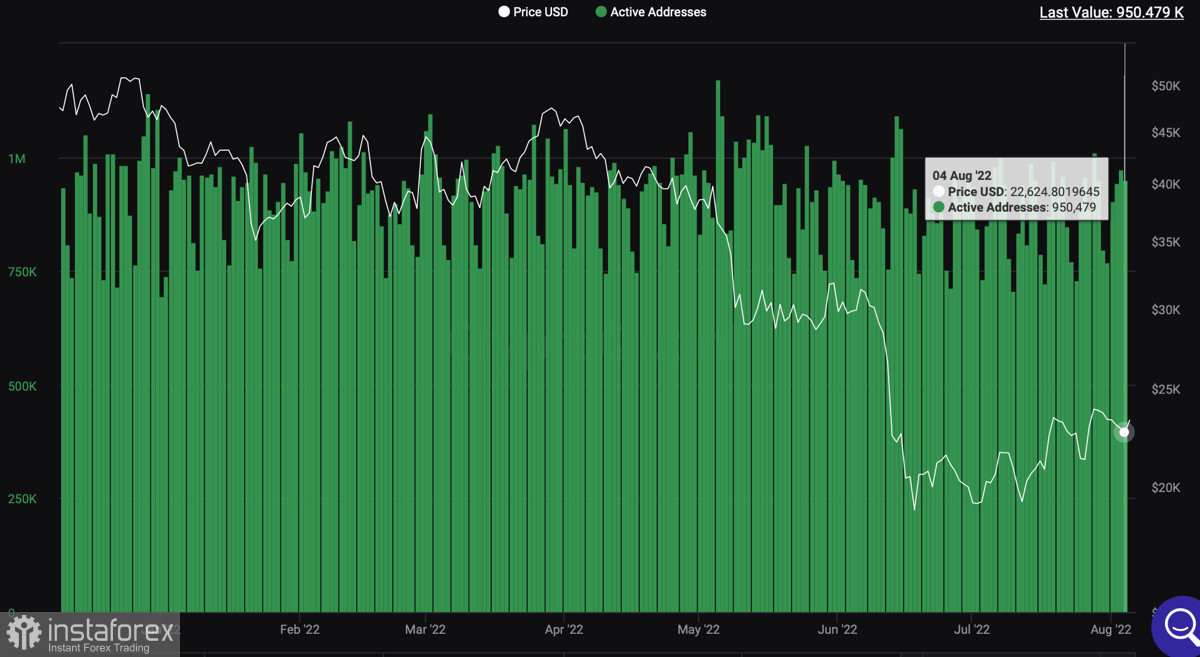

Anyway, the number of unique addresses holding BTC has increased by 950K, which is true for a period of growth and a bullish rally. With this in mind, we can assume that the market is waiting for the right moment to start an uptrend.

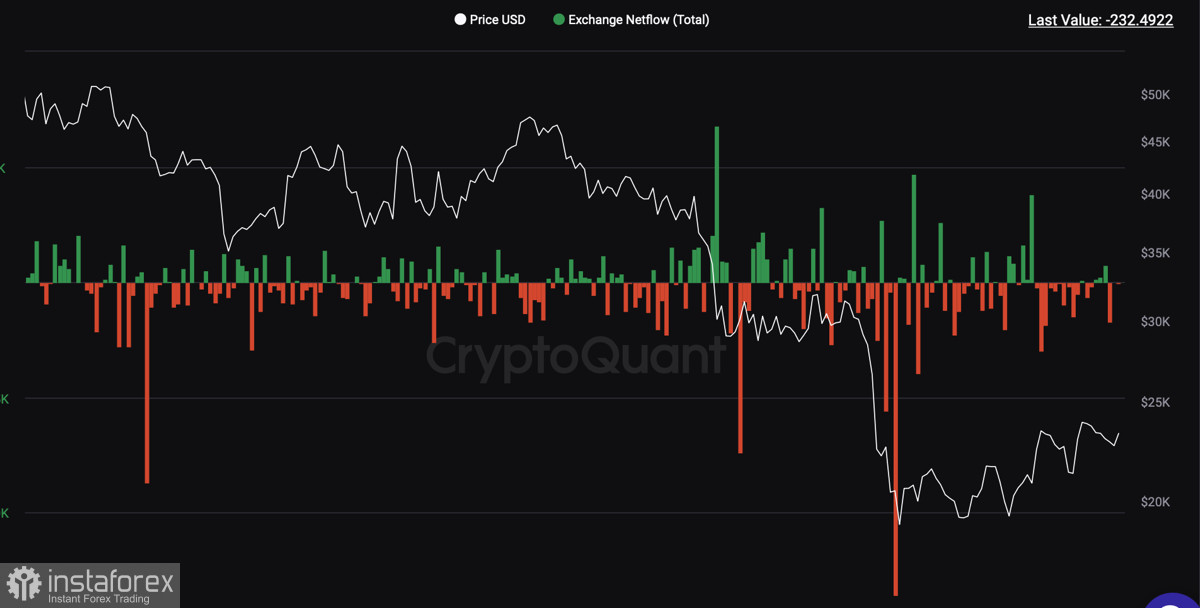

In this light, bitcoin is now under a heavy accumulation phase. According to the Exchange Netflow chart showing total BTC exchange inflow and outflow, investors continue to actively accumulate the asset. At the same time, the BTC exchange inflow keeps declining. The flow of BTC to exchanges mainly comes from miners whose gains have not recovered yet and who continue to get access to quick liquidity.

Interestingly, there is a divergence between the bitcoin price and the volume of stablecoins on exchanges, according to the Stablecoin Supply Ratio, which indicates potential buying power due to the accumulated volumes of stablecoins. In this light, BTC may rally, but before that, it is important to make sure that there will be no other limiting factors.

Given the correlation between BTC and the stock market, it is important to understand where the S&P 500 stands. The asset has successfully consolidated above the $4,000 level and reached $4,100. Technical indicators are near the overbought zone, which may signal a correction. Given that the index has reached strong resistance at $4,100, it may well be the case. Still, the MACD is moving up, indicating a strong bullish impulse.

The US dollar index has finished its corrective move and is now trying to settle at around 105. Technical indicators are mixed, meaning the index is likely to continue consolidating. Against this backdrop, DXY will possibly have no influence on bitcoin and the stock market in the short term.

In light of the current situation in related markets, a fall in the volume of stablecoins, and an increase in buying power, bitcoin is expected to show growth. Still, it is important to take into account fundamentals as they can affect the price of all financial instruments. Network and trading metrics show that the uptrend could remain, but macro factors cannot be predicted. Therefore, a stable and neutral fundamental background will be the main driving force for BTC.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română