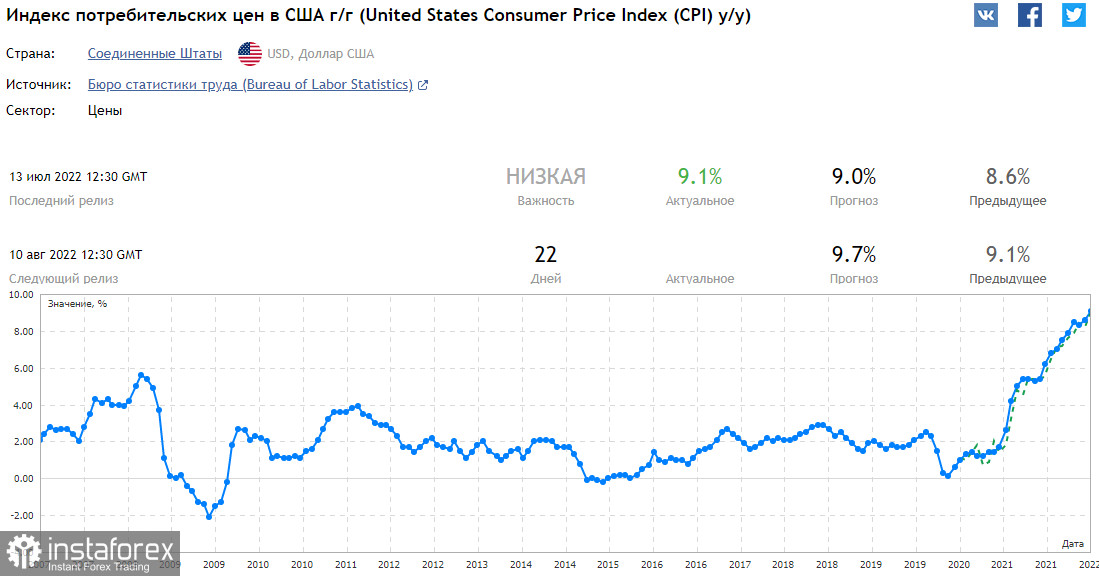

A new trading week begins amid the absence of publications of important macroeconomic indicators in the economic calendar. New drivers for the growth or fall of the dollar may appear on the market on Wednesday: fresh data on consumer inflation in the US will be published. As expected, the Consumer Price Index (CPI), which determines the change in prices of a selected basket of goods and services over a given period and is a key indicator for assessing inflation and changes in consumer preferences, will be released in July with a value of +0.2% and + 8.7% (in annual terms).

Core CPI (food and energy excluded from this indicator for a more accurate estimate) will be released at +0.5% and +6.1% (on an annualized basis), which indicates continued inflationary pressure in the US economy.

Theoretically, data better than the forecast should strengthen the dollar, because they will indicate the need for further action on the part of the Federal Reserve to curb high inflation. However, it is impossible to call the current situation in the US and most of the world economies normal. Moreover, the continuing growth of inflation in the US speaks of the low effectiveness of the actions taken by the Fed so far.

Therefore, the market's reaction to this release can be completely unpredictable.

In the meantime, the markets continue to be under the impression of last Friday's data from the US Department of Labor. As follows from this report, the number of new jobs in the non-farm sector of the US economy grew by 528,000 in July, while the unemployment rate fell to 3.5%. The forecast assumed a decrease in the rate of creation of new jobs (outside the agricultural sector), to 250,000 from 372,000 in June, although the unemployment rate was expected at the same level of 3.6%.

Strong data improved dollar buying sentiment and fueled expectations of further interest rate hikes from the Fed this year.

Data on the US labor market came out after the release of disappointing data on the country's GDP for the second quarter a week earlier and slightly smoothed out the negative impact on the dollar of the negative value of GDP.

The DXY dollar index again exceeded 106.00 due to strong data from the labor market, reaching a local intra-week high of 106.81. Futures for the DXY dollar index were trading near 106.38 on Monday, maintaining a positive trend.

And yet, market participants will carefully analyze the macro data coming from the US in order to better understand the direction of the dollar's further dynamics.

And there was no important news in the economic calendar on Monday. Most likely, major dollar currency pairs will spend Monday and Tuesday in ranges.

As for the dollar index (in the MT4 trading terminal, the dollar index is reflected as CFD #USDX), then, as we already noted and wrote the day before, "early signals to buy DXY futures will correspond to the breakdown of local resistance levels 106.00, 107.00, 108.00". As you can see, the first resistance level of 106.00 has been taken. Now the breakdown of the levels of 107.00, 107.50, 108.00 will be a confirming signal for building up long dollar positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română