The Canadian report on the growth of the labor market, which was published last Friday, remained in the shadow of the US Nonfarm. The USD/CAD pair followed the greenback, thanks to which the price approached the borders of the 30th figure. However, the bulls did not celebrate their triumph for long. Bears have once again seized the initiative, pulling the loonie to the 1.2840 mark. A kind of "pull-push" has been observed in pairs for several months. Since June, USD/CAD bears have been trying to settle below the 1.2800 mark, while bulls, respectively, regularly conquer the 30th figure. But none of the parties has yet fulfilled the minimum program. And this is despite the fact that there is high volatility in the pair – for example, in early July, the pair reached 1.3220, but almost immediately rolled back. At the end of July, the loonie strengthened to the level of 1.2780, but could not hold its positions. As a result, USD/CAD has been fluctuating within the range of 1.2800-1.3000 for the third month, temporarily overcoming the boundaries of this range, but returning back each time.

Therefore, the price dynamics of recent days should not surprise – this is, so to speak, a "demo slice" that reflects the current situation for the pair.

It is noteworthy that USD/CAD bulls were unable to develop an upward movement despite the disappointing Canadian data in the labor market. While US Nonfarm, on the contrary, pleased dollar bulls with strong numbers. But after a short-term growth, the pair turned 180 degrees and regained the positions lost on Friday.

Let me briefly remind you that, according to published data, 528,000 jobs in the non-agricultural sector were created in America in July. The unemployment rate dropped to 3.5%, but wages showed a positive trend (5.2%). In the private sector of the economy, as well as in the manufacturing sector, the US labor market showed its best side: almost all components of the release came out in the green zone.

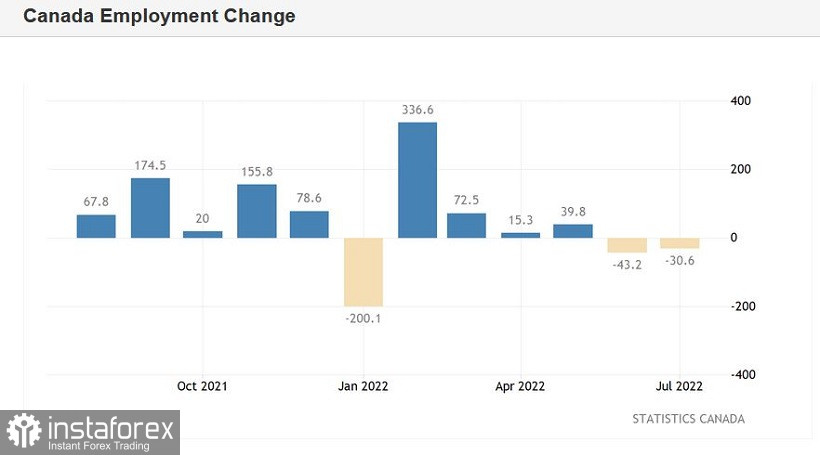

What can not be said about the "Canadian Nonfarm". The number of people employed in Canada in July decreased by 30,000. This indicator has been in negative territory for the second consecutive month. The components of both full and part-time employment decreased in July. At the same time, most experts expected to see an increase in the indicator by 20,000, but instead it collapsed to the level of -30,000. The unemployment rate remained at 4.9%, although experts predicted a slight increase to 5.0%. But it should be noted here that this indicator refers to lagging economic indicators, so in this context it is necessary to focus on more timely data. Which frankly disappointed.

Another indicator, which was published last Friday, was also disappointing. We are talking about the index of business activity in the manufacturing sector of Canada (PMI index from Ivey). This indicator is calculated by Ivey Business School based on a survey of managers of industrial enterprises. It dropped significantly in July, falling to 49 points. The index crossed the key 50-point mark for the first time since January of this year.

And yet, despite such alarming signals from the Canadian labor market, the USD/CAD pair not only remained within the above range, but also showed character, regaining the positions lost on Friday. In my opinion, such "stress resistance" of the Canadian currency is explained by the position of the Bank of Canada, which, following the results of the July meeting, made it clear that it would raise the interest rate further until inflation slows down its growth. Meanwhile, the latest inflation release suggested that in September the Canadian central bank will raise the rate by 75 basis points. In particular, on an annualized basis, the overall consumer price index came out at 8.1%: this is the strongest result since February 1983.

Let me remind you that in July, the Bank of Canada raised the interest rate by 100 basis points at once, contrary to forecasts of a 75-point increase. At the same time, the central bank said that it was not going to stop there: according to Bank of Canada Governor Tiff Macklem, a proactive rate hike would cool the internal inflationary pressure. At the same time, Macklem did not talk about the further pace of rate hikes – he only stressed that the central bank would maintain a hawkish course. Given the growth rate of the CPI, it can be assumed that in September the Bank of Canada will raise the rate by either 75 or (at least) 50 points.

Thus, despite the general (background) dominance of the greenback in the foreign exchange market, the US dollar is very vulnerable when paired with the loonie. Therefore, the upward surges of USD/CAD to the borders of the 30th figure can be used as an excuse to open short positions. The downward targets are 1.2870 and 1.2800 (respectively, the upper and lower boundaries of the Kumo cloud on the D1 timeframe).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română