Another trading week has started promisingly for Bitcoin and the cryptocurrency market. Most of the coins moved in the green zone, and the market capitalization reached the level of $1.13 trillion. Trading activity is gradually recovering, and the upward movement of the major cryptocurrencies gives confidence to the entire market. Bitcoin bulls finally consolidated above the $23k level, which gave the market a signal for further growth. However, above the $23k level, things are not going well for the main cryptocurrency.

The coin re-formed a strong green candle that tested the $24.3k level. However, the price was subsequently squeezed below $24k amid increased selling pressure. The $24k level has been tested six times in the last three weeks but has not been broken. This indicates serious bearish volumes near the round mark and local weakness of the bulls. Despite the recovery in trading activity after the opening of the American session, trading volumes are still insufficient to hold the $24k level and build on the bullish success. As of August 9, this is influenced by three factors, two of which are negative.

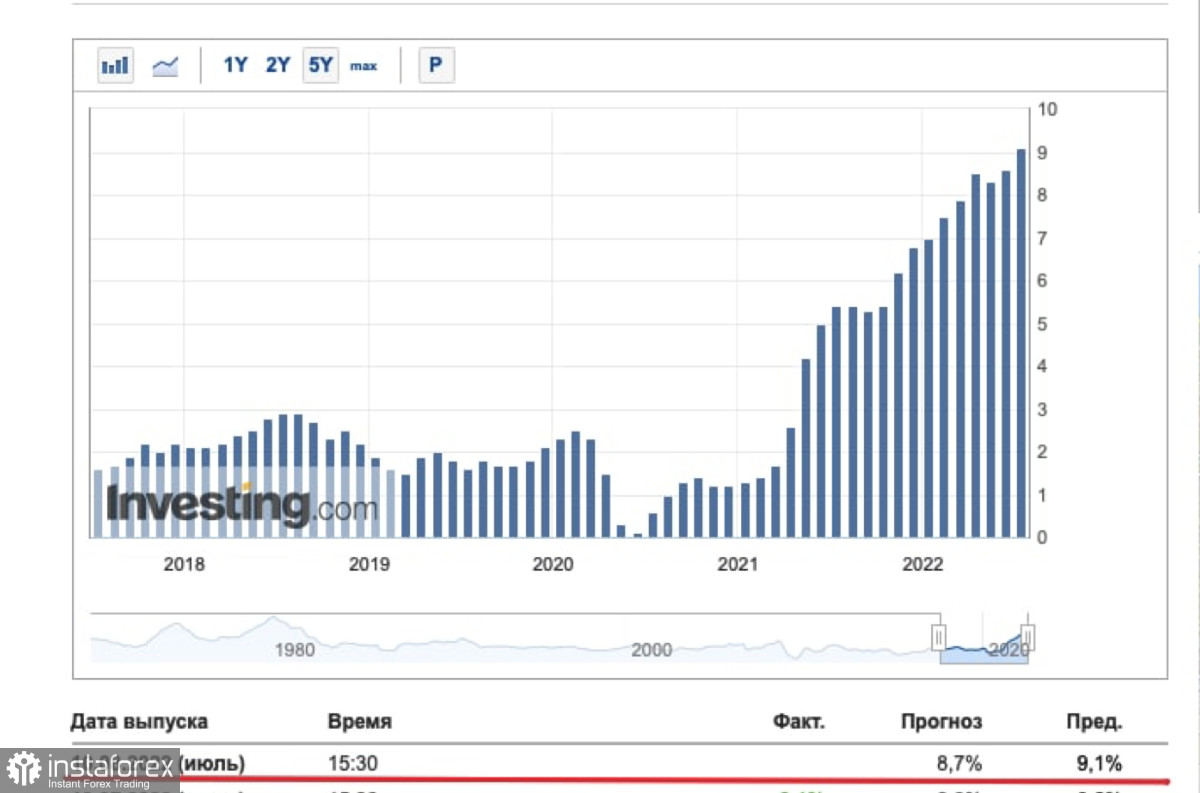

The first is to publish reports on the movement of the CPI. Given the macroeconomic and geopolitical situation, the consumer price index is the main guide for investors. It allows you to determine the future policy of the Fed and, therefore, the direction of the trend of stock indices and cryptocurrencies. And although Fed Chairman Jerome Powell said that the regulator will proceed from facts, not forecasts, the market focuses on forecasts. According to the latest data, the CPI is expected at 8.7%, and the current price movement is already adjusted to these expectations. Based on this, Bitcoin can expect a flat trend if the forecasts come true, a retest of the $20k level if the CPI turns out to be higher than the forecasts, and a probable breakdown of $24k if the index falls above expectations.

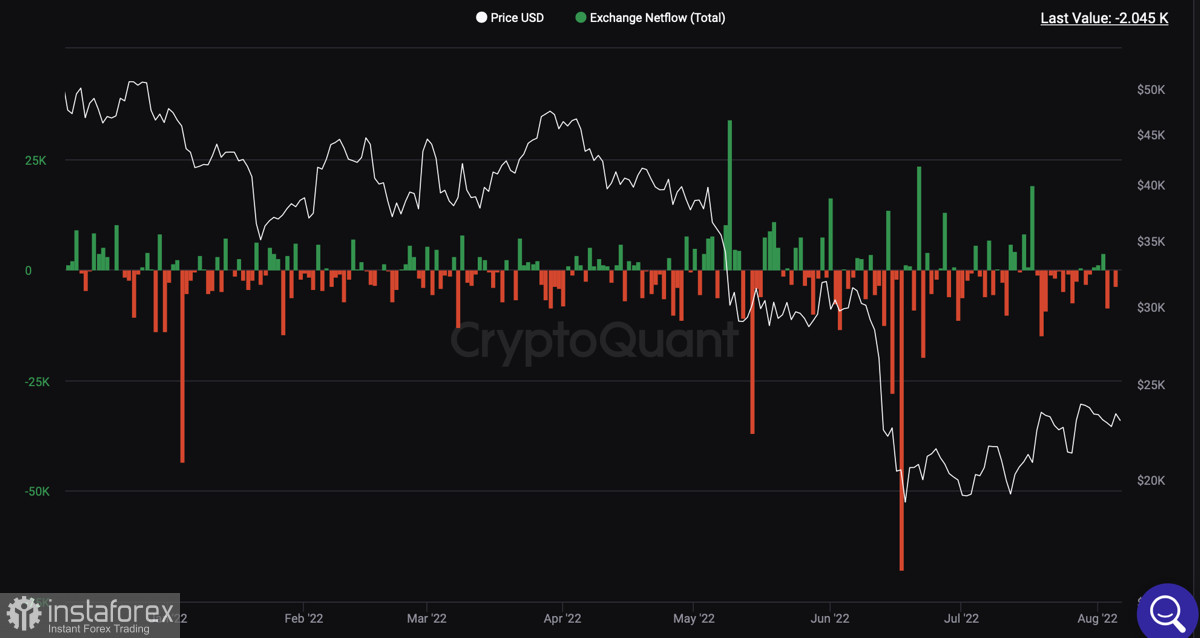

In anticipation of the publication of data on inflation, trading activity in the market has been reduced to a minimum, especially by institutional investors. This significantly limits the upward potential of the Bitcoin price. And here we are approaching the second negative factor, which contributes to increased pressure on BTC/USD quotes. We are talking about miners who continue to suffer losses following the results of the current bear market. Mining profitability has been falling since March. July was no exception, and BTC mining companies dropped another 9%. In search of available liquidity, miners are selling off their bitcoin holdings, putting pressure on the price and complicating the upward move, including a $24k retest.

The third factor in the weak upward movement in the price of Bitcoin is cumulative. In recent weeks, the asset has been growing on positive news, as can be seen from the impulsive bullish jerks and the subsequent local correction with the main support lines being held. There was also an increase in the volume of active addresses with a non-zero balance. This indicator rose to 2.7 million, which is a signal for the growth of bullish sentiment.

But at the same time, trading volumes did not grow during the day, which indicates a certain overheating of the asset and a lack of liquidity for growth. Therefore, Bitcoin needs consolidation to stabilize the ratio of addresses and trading volumes. The only thing that will help speed up this process is low volatility and macroeconomic calm.

Technical indicators indicate that Bitcoin has been in a consolidation for the last week. The asset consistently moves within the $22.5k–$24k range with clear bullish signals (retesting $24k six times). The relative strength index is moving along the 40–60 area, a positive sign indicating the stabilization of the metric and the preservation of buying activity. Stochastic and MACD have also become flat, which indicates the need for consolidation before the next breakout. Most likely, a breakthrough will occur in the coming days due to the positive dynamics of the CPI. However, as we saw in June, inflation is an unpredictable thing.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română