EUR/USD

Higher timeframes

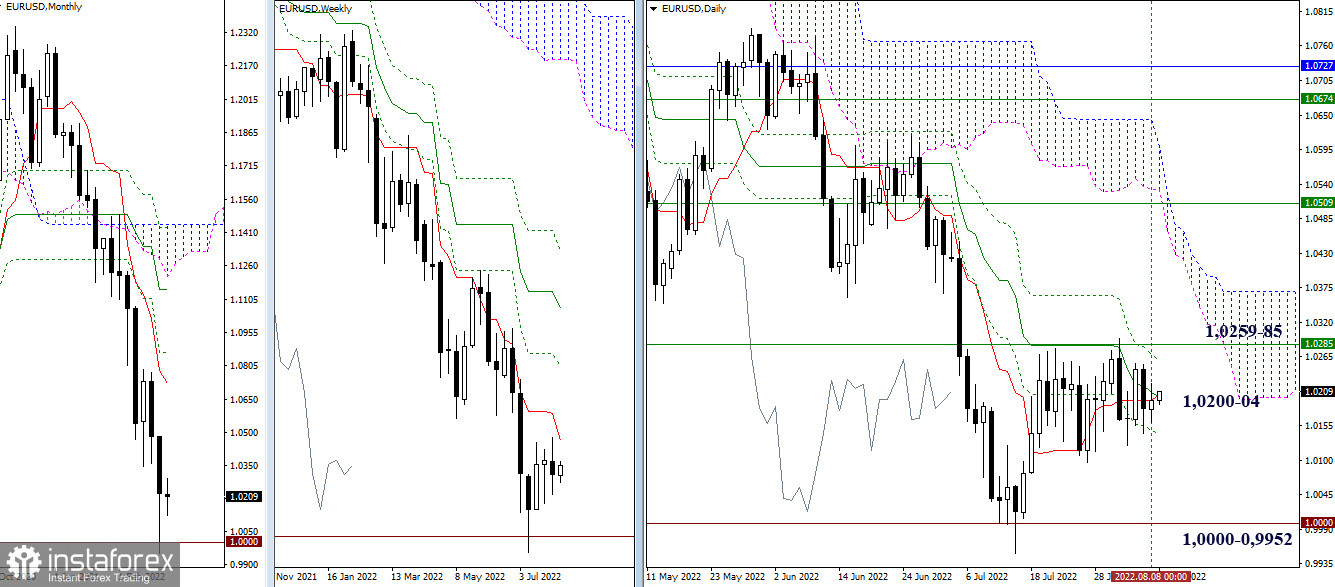

The situation has not changed significantly over the past day, so the conclusions and expectations voiced earlier remain relevant today. The center of attraction now is the daily cross (Kijun 1.0200 + Tenkan 1.0204). Bullish targets remain at 1.0259–85 (closing daily cross + weekly short-term trend). The benchmarks, which will allow bears to build new prospects, remain today at 1.0000 – 0.9952 (psychological level + minimum extremum).

H4 – H1

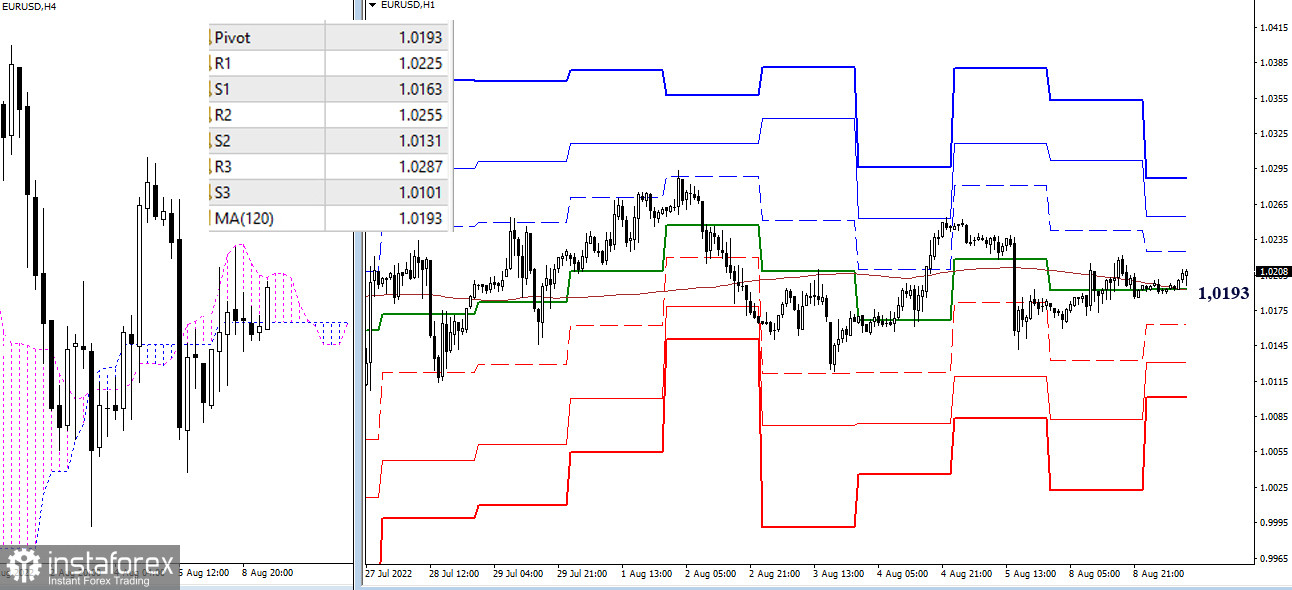

On the lower timeframes, the key levels joined forces at the level of 1.0193 (central pivot point of the day + weekly long-term trend). At the same time, the pair is in the zone of attraction of key levels, which confirms the absence of a clear preponderance of forces between the parties. The reference points for bulls within the day, in the case of an upward trend, are the resistance of the classic pivot points at 1.0225 – 1.0255 – 1.0287. In the case of a decline, then the reference points for bears are 1.0163 – 1.0131 – 1.0101 (support of the classic pivot points).

***

GBP/USD

Higher timeframes

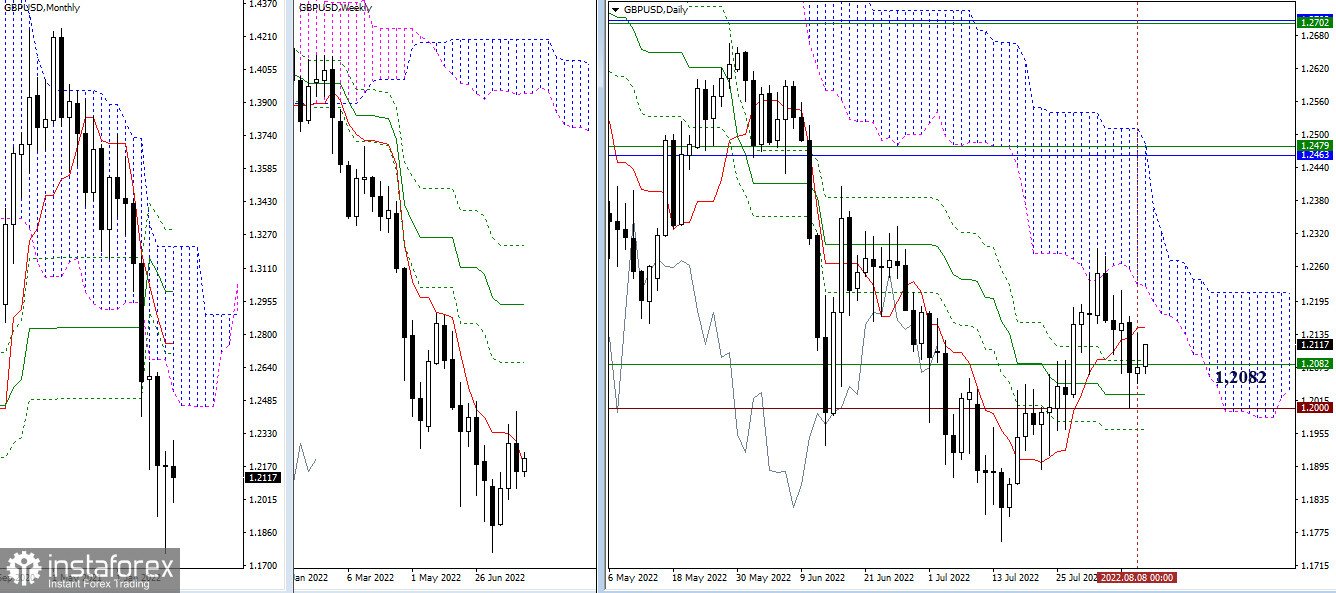

For the last working day, the pound could not change anything. It remains in the attraction zone of the weekly short-term trend (1.2082). Due to the fact that the situation has not changed, the location of all the main reference points has remained the same. For bears, it is important to overcome the support (1.2026 - 1.2000) and liquidate the daily golden cross (1.1963) in the near future. For bulls, the following reference points are important: 1.2148 (daily short-term trend) - 1.2227 (lower limit of the daily cloud) - 1.2293 (maximum extremum).

H4 – H1

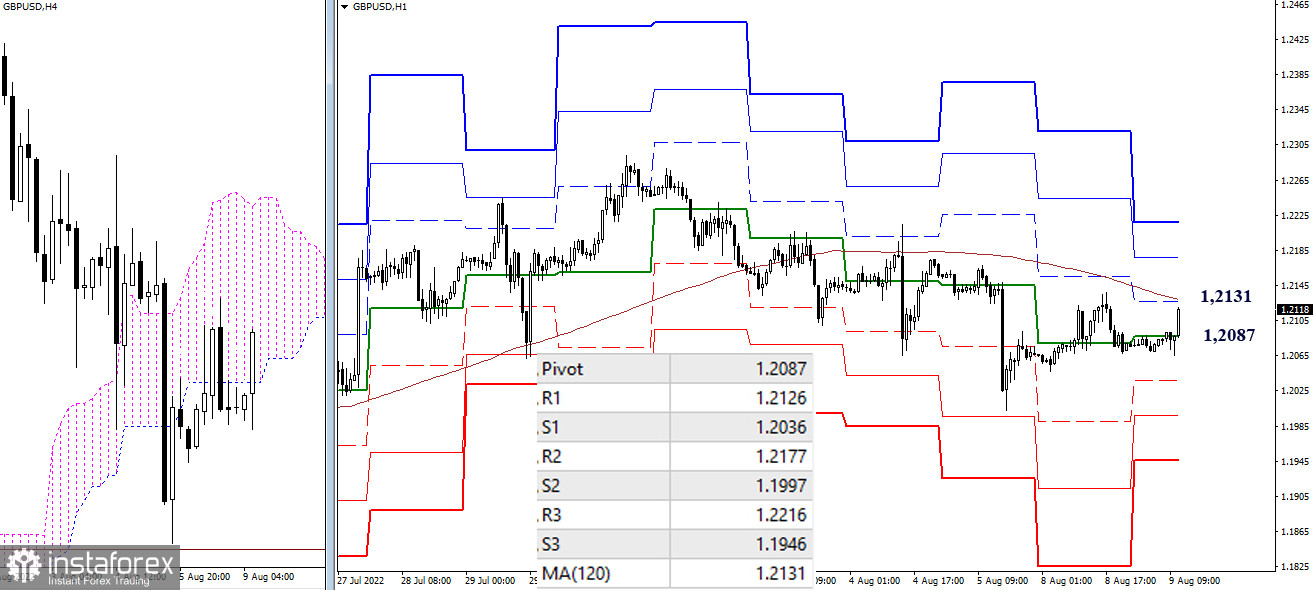

The lower timeframes are currently busy testing the key levels, which are at 1.2087 (central pivot point) and 1.2131 (weekly long-term trend), as well as interacting with the resistance of the H4 cloud (1.2091 - 1.2187). Bullish targets, in the case of continued rise within the day, are 1.2177 - 1.2216 (resistance of the classic pivot points). For bears, the support is at 1.2036 - 1.1997 - 1.1946 (support of the classic pivot points).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română