As we suggested in yesterday's review, the main dollar currency pairs spent the day in ranges. Also due to the absence of important economic indicators in the economic calendar on Tuesday, history may repeat itself. Nevertheless, the market is still dominated by the general medium-term trend of dollar weakening. Thus, the DXY dollar index has been in a downward correction for the 26th day, after it reached a local high since October 2002 at 109.14 in the middle of last month.

In general, the dollar holds its positions in the foreign exchange market, but in the medium term, as we can see, it is declining.

At the beginning of today's European trading session, the dollar index DXY is near the level of 105.95, 37 points below the closing price of the previous trading day.

As we noted, there is no important news in the economic calendar on Tuesday. They will appear on Wednesday, when the latest data on consumer inflation in the US will be published.

The continued growth of inflation in the United States indicates that the actions taken by the Federal Reserve are so far of little effectiveness. Therefore, the market reaction to this release can be completely unpredictable.

Also, the Energy Information Administration of the US Department of Energy will report on the weekly change in commercial reserves of oil and petroleum products. Economists assume a reduction in oil reserves in the country's storage facilities by -0.400 million barrels after the increase in the previous week by +4.467 million barrels. I must say that this indicator has recently shown very uneven dynamics, from an increase in reserves by +8,235 million barrels in early July, to a decrease by -4,523 million barrels two weeks earlier.

However, the situation on the oil market and the volatility of oil quotes reflect the overall picture and the situation in the global economy and the financial market.

In a relatively normal economic situation and in a relatively calm geopolitical situation, with the growth of dollar quotes, oil quotes are declining.

However, as can be seen from the charts of the DXY dollar index and oil, the decline in DXY occurs amid a decline in oil quotes.

Investors are in no hurry to invest in oil market assets, given the turbulent geopolitical situation in the world and the slowdown in the global economy.

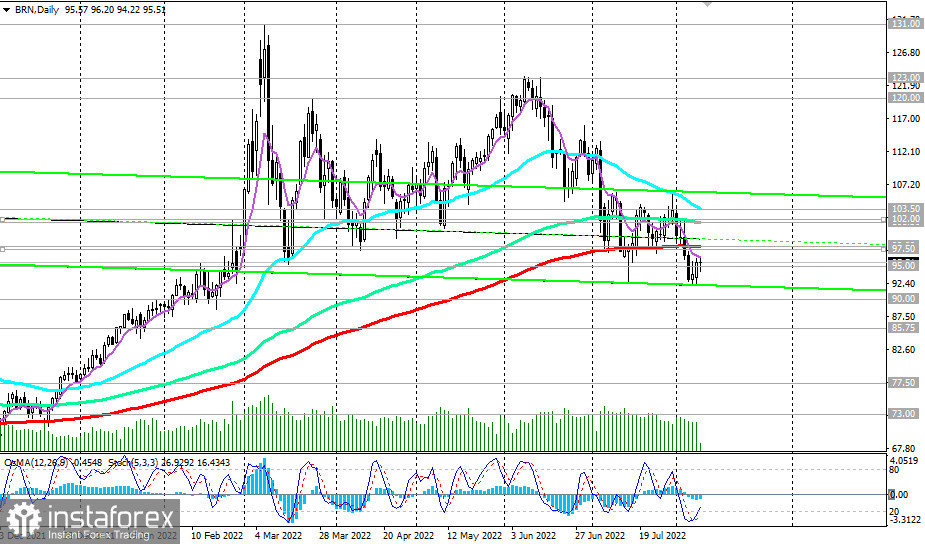

As can be seen from the charts reflecting the dynamics of Brent crude futures, the price has been trying to break below $93.00 per barrel three times in the last 5 weeks, the lowest since mid-February.

The 2 most important long-term support levels 98.00 and 95.00 have also been broken.

However, there is also a counterfactor that can resume the upward dynamics of oil prices.

Despite the efforts of the United States and some other countries, allies of the United States in this matter, releasing oil from their strategic reserves in order to lower oil prices, oil market analysts believe that the oil released in this way will not be enough to fill the missing supplies from Russia, while OPEC + is in no hurry to increase production volumes, acting on previously agreed plan. The oil coalition believes that the oil market is well balanced at the moment, and the current volatility is caused by geopolitical events.

So, just the other day (last Wednesday), the OPEC+ coalition decided to increase oil production in September by only 100,000 barrels per day. This is a drop in the bucket, given the global oil consumption in the region of about 100 million barrels per day. In addition, the cartel noted that free production capacities are limited, and they should be used carefully in response to serious supply disruptions.

And such interruptions or an acute shortage of oil, according to OPEC analysts, may happen closer to winter. "Given the possible lack of gas in Europe this winter and the potential price restriction on the sale of Russian oil in the new year, we cannot now throw every barrel on the market," said one of the sources close to the OPEC+ governing body (according to media reports).

The next OPEC+ meeting is scheduled for September 5, and most likely, the coalition will not increase production volumes, given concerns about falling demand due to a possible recession in the global economy.

At the same time, and while we are observing a downward correction in the oil market, it is likely that the current levels may be attractive for opening new deals and building up long positions. Back in early summer, Russian Deputy Prime Minister Alexander Novak said that Europe would not be able to replace Russian oil quickly, and the market price of oil would reach $300 per barrel or higher. What if it turns out to be right? The energy crisis may indeed occur this winter, as the political and economic confrontation between Russia, which is a member of OPEC+, and the West due to the military conflict in Ukraine shows no signs of weakening, and gas prices are rushing to new heights.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română