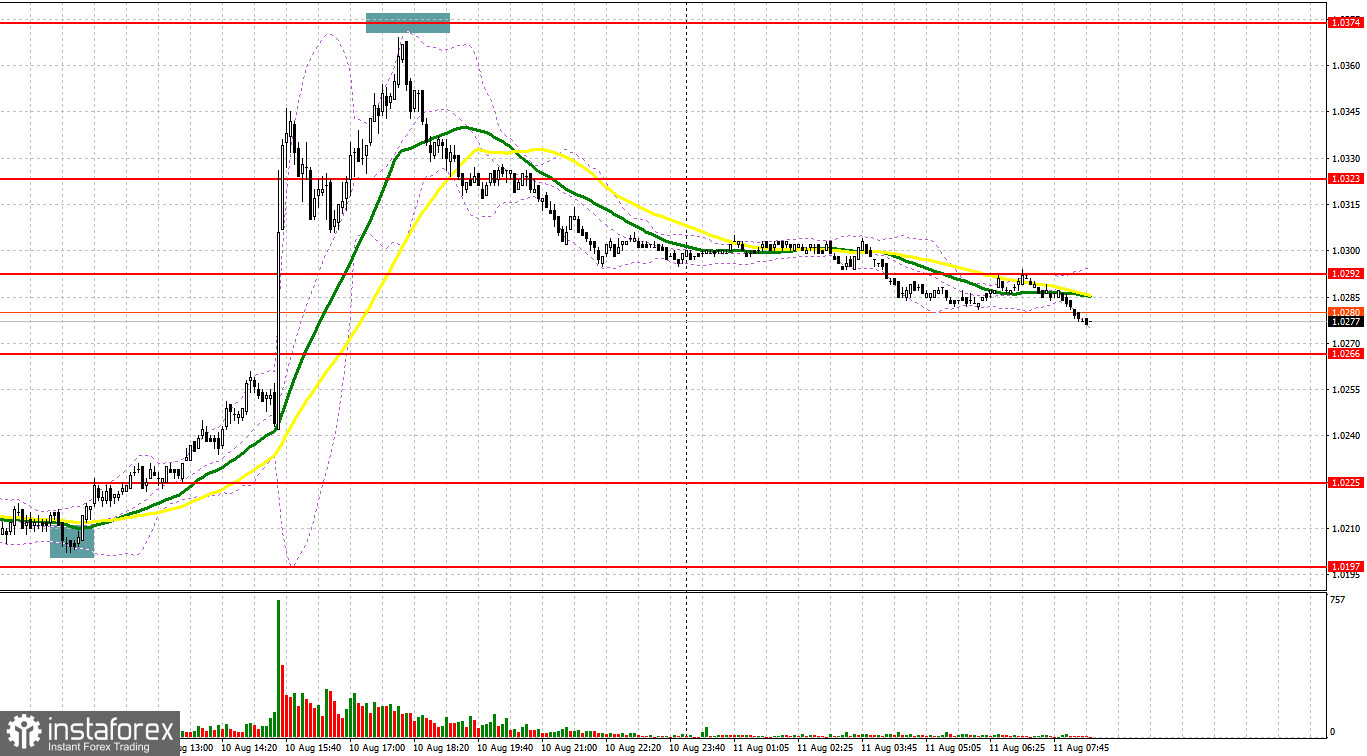

Only one signal to enter the market was formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.0205 level in my morning forecast and advised you to make decisions on entering the market. The pair's decline in the area of 1.0205 in the first half of the day and a false breakout there - all this led to an excellent entry point into long positions, which I emphasized in the morning. As a result, the upward movement amounted to about 35 points, after which the pair rested on the nearest resistance at 1.0240. After the release of the US inflation data, the demand for the euro increased sharply, which led to the pair's uncontrolled movement up to the area of 1.0374. Just a couple of points missing before the test of this level, so I failed to enter short positions there. No other signals were generated.

When to go long on EUR/USD:

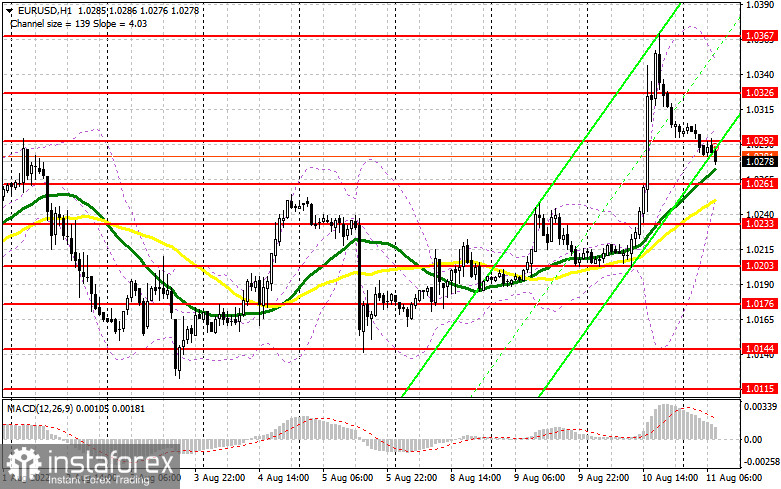

The reduction in inflation in the US caused the pair to sharply rise, which was quite expected, as the data made it possible for investors to once again pay attention to undervalued risky assets. Today we are waiting for another report on producer prices in the US, which should also please economists. Therefore, the lower the euro will sink in the first half of the day, the more attractive it will be for buying. If the pair drops to the area of the nearest support 1.0261 formed on the basis of yesterday and where the average moving averages play on the bulls' side, forming a false breakout at this level will provide the first signal to open long positions in hopes of continuing to build an upward trend with the prospect of returning to 1.0292. A breakthrough and test from top to bottom of this range creates another signal to enter long positions with the possibility of moving up to 1.0326, breaking above which will not be as easy as it seems. The bears will try to take control of the market there with the prospect of building the upper boundary of a new downward channel.

If the EUR/USD declines and there are no bulls at 1.0261, the pressure on the pair will seriously increase, as we can safely talk about the complete overlap of yesterday's euro growth after the release of the US inflation report. This will open the way to 1.0233, and further support at 1.0203, where I recommend taking profits. If you miss this level, you can say goodbye to the upward trend, as the pair will again hang in the horizontal channel. I advise you to buy EUR/USD immediately on a rebound only from 1.0176, or even lower - in the area of 1.0144, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Yesterday, the bears had no choice but to capitulate after the inflation report. However, they waited for the moment and dealt a good blow to the bulls' positions, forming a rather powerful downward correction at the end of the day. Now the bears' main task is to protect the resistance at 1.0292, as having missed this level, the bulls will again begin to act more aggressively. Considering that there are no statistics in the first half of the day for the euro area, bears have every chance to cope with this. The best scenario for selling the euro in the current conditions would be to form a false breakout at the level of 1.0292. An equally important task is to take control of the nearest support at 1.0261, slightly above which the moving averages go. A breakdown and consolidation below this range, as well as a reverse test from the bottom up - all this creates another sell signal with the removal of bulls' stop orders and a larger movement of the pair to the 1.0233 area, where bears will start to have difficulties - as picking up this level without a fundamental US statistics could be unlikely to succeed. Consolidating below 1.0233 is a direct road to 1.0203, where I recommend to completely exit short positions. A more distant target will be the area of 1.0176.

In case EUR/USD moves up during the European session, as well as the absence of bears at 1.0292, which is more likely, I advise you to postpone short positions to 1.0326, as the bulls become active again and will count on a decrease in US producer prices in July this year and another sharp jerk of the pair to the upside. Forming a false breakout at 1.0326 will be a new starting point for entering short positions. You can sell EUR/USD immediately on a rebound from the high in the area of 1.0367, or even higher - from 1.0437, counting on a downward correction of 30-35 points.

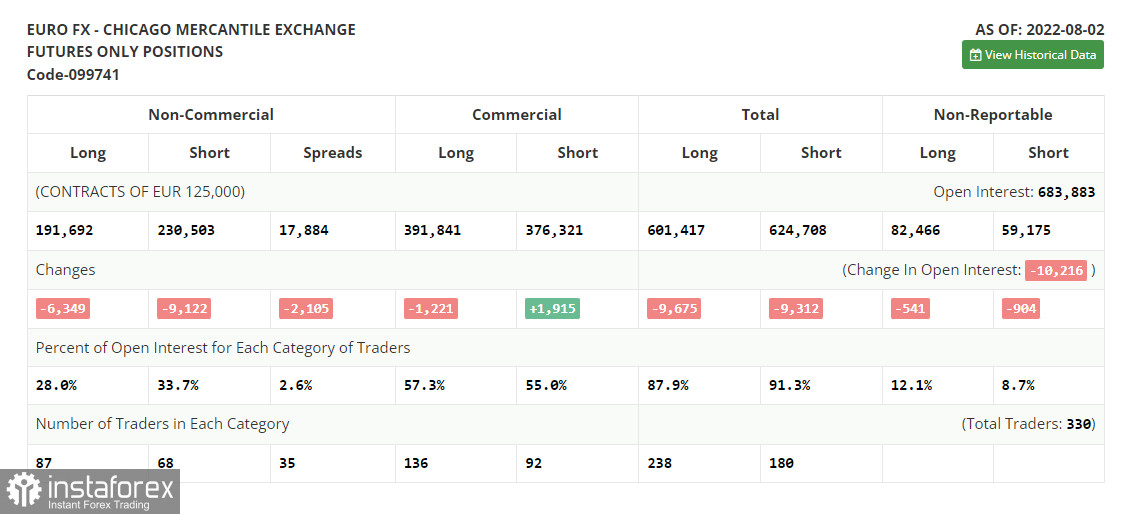

COT report:

The Commitment of Traders (COT) report for August 2 logged a sharp decline in both short and long positions, but the decline of the latter turned out to be greater, which continues to indicate the gradual end of the bear market and an attempt to find a market bottom after reaching parity for the euro against the US dollar . Last week, the statistics on the eurozone were not as pleasing, which cannot be said about the data on the US and a strong labor market, which once again reminded investors that even in conditions of high inflation, the US economy can confidently survive the impending recession and high interest rates. The decline in the positions of bulls and bears can rather be attributed to the summer period. The activity of traders may become even lower in August and this should not be surprising. In the near future, we will find out how things are going with inflation in the US and whether the recent aggressive hikes in the key interest rate by the central bank have benefited. If inflation in the US begins to decline, this will be a clear reason to build up long positions in risky assets. The COT report indicates that long non-commercial positions decreased by 6,349 to 191,692, while short non-commercial positions decreased by 9,122 to 230,503. At the end of the week, the overall non-commercial net position, although it remained negative, rose slightly from -41,584 to -39,811, which indicates a continuation of the market turning towards euro bulls. The weekly closing price increased and amounted to 1.0206 against 1.0161.

Indicator signals:

Moving averages

Trading is conducted above the 30 and 50-day moving averages, which indicates the euro's succeeding growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator around 1.0261 will act as support. In case of growth, the upper border of the indicator in the area of 1.0335 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română