Analysis of positions and tips on trading EUR

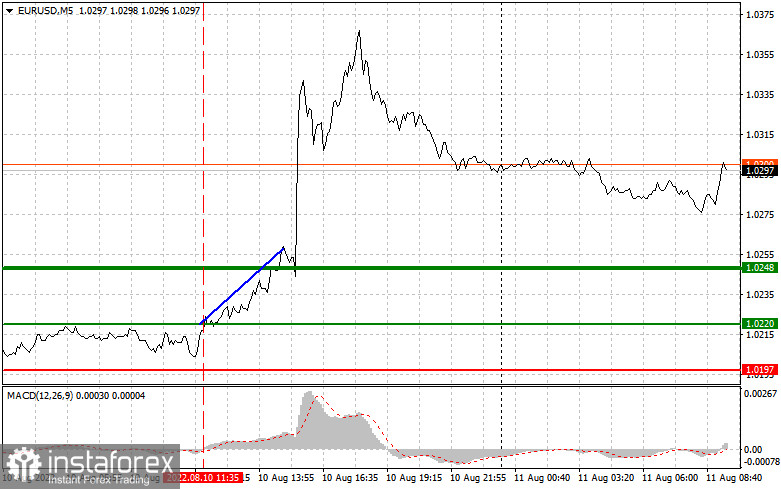

The test of 1.0220 occurred at a time when the MACD indicator had just started to rise from the zero level. It confirmed the correct entry point into long positions. As a result, the pair grew by 30 pips. If you decided to trade after the release of US inflation data, the profit could be more than 100 pips. There were no other entry points.

Trades ignored data on the Consumer Price Index for Germany and Italy as they were mainly focused on the US CPI report. Consumer prices dropped sharply, which fueled demand for risky assets. Investors have been anticipating it for a long time. Today, the economic calendar for the eurozone does not contain any reports that could affect market sentiment. To this end, the euro is likely to keep climbing as well as the euro/dollar pair. I would advise you to trade according to scenario No. 1. In the afternoon, reports on the US Producer Price Index and the Core Producer Price Index, excluding food and energy prices, for July are on tap. A decline in inflation is sure to be a bullish factor for the euro. It will weaken the US dollar, which will generate a buy signal. The initial jobless claims report will not be of great interest to investors since these are just weekly figures. Given the level of unemployment in the United States, even significant changes will hardly lead to a surge in volatility.

Buy signal

Scenario No.1: today, it is recommended to open long positions on the euro if the price reaches 1.0310 (the green line on the chart), aiming at 1.0364. At 1.0364, it is better to close long positions and open short ones, keeping in mind a correction of 30-35 pips from the given level. The pair could grow higher amid a strong bullish trend. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price approaches 1.0278. At this moment. the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may also trigger an upward reversal of the market. The pair is expected to jump to the opposite levels of 1.0310 and 1.0364.

Sell signal

Scenario No.1: it is recommended to open short positions on the euro if it hits 1.0278 (the red line on the chart). The target will be the 1.0264 level where I would advise you to close short positions and open long ones, keeping in mind a correction of 20-25 pips from the given level. The pressure on the euro will return only if the Producer Price Index rises. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price slides to 1.0310. At this moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also trigger a downward reversal of the market. The pair is predicted to decline to the opposite levels of 1.0278 and 1.0246.

What is on the chart:

The thin green line is the entry point where you can buy the trading instrument.

The thick green line is the estimated price where you can place Take profit or lock in profits manually as the pair is unlikely to rise above this level.

The thin red line is the entry point where you can sell the trading instrument.

The thick red line is the estimated price where you can place Take profit or lock in profits manually as the pair is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. Before the release of important fundamental reports, it is better to stay out of the market. It helps beginners avoid losses due to sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place Stop-Loss orders to minimize losses. Without placing Stop-Loss orders, you can lose the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Relying on spontaneous trading decisions based on the current market situation is a losing strategy of an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română