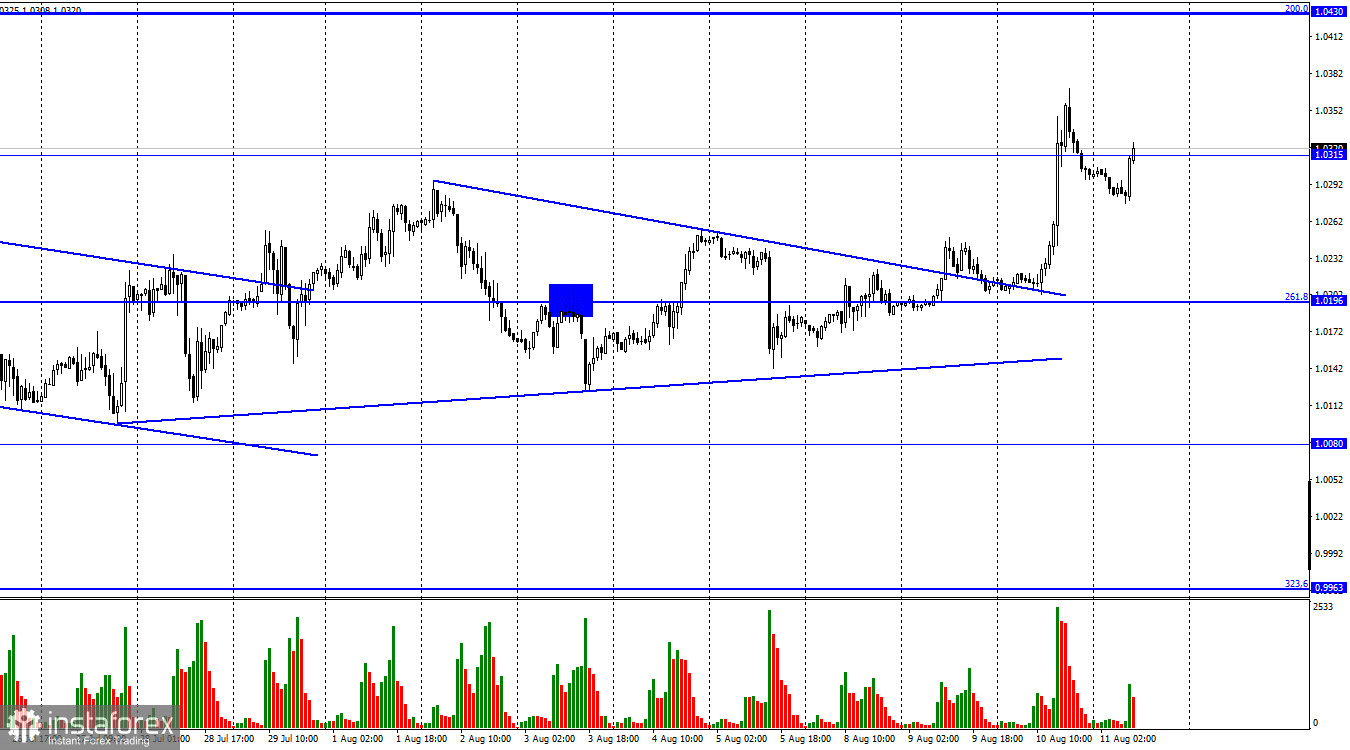

On Wednesday, the EUR/USD pair reversed in favor of the EU currency and showed strong growth toward the 1.0315 level, over which it consolidated. Then there was a slight pullback at night, and today a reversal in favor of the euro currency was performed again, and the growth process resumed. Thus, traders have changed their moods significantly in less than a day. The American inflation report yesterday turned out to be quite resonant. The long-awaited drop in the consumer price index occurred in July, and the indicator fell from 9.1% y/y to 8.5%. Of course, this is only the first step towards returning inflation to the target level of about 2%, as the Fed wants to achieve. But still, this first step is done. Why did the US currency fall? Traders and analysts often wonder why this or that movement happened, but yesterday everything was natural and logical. If inflation in the US has started to decline, then the Fed may not raise interest rates so quickly and strongly.

It means that the US regulator may raise the rate by only 0.50% in September, although traders discussed an increase of 0.75% a week ago as a base option. And some allowed an increase of 1.00%. But now, everything is changing unless the next inflation report indicates a new acceleration of the indicator. The US dollar fell due to traders' understanding of the following simple truth: now, the Fed's actions aimed at US monetary policy will weaken, become softer, and in the near foreseeable future, the Fed will refuse to raise the rate further. A week ago, it was not obvious, but now it is likely that before the New Year, the Fed will stop tightening the PEPP, and in the first half of next year, it will be even slightly lower. Now the move is for the ECB. If the European Central Bank continues to raise the rate (which traders are not waiting for right now), this will already support the euro currency.

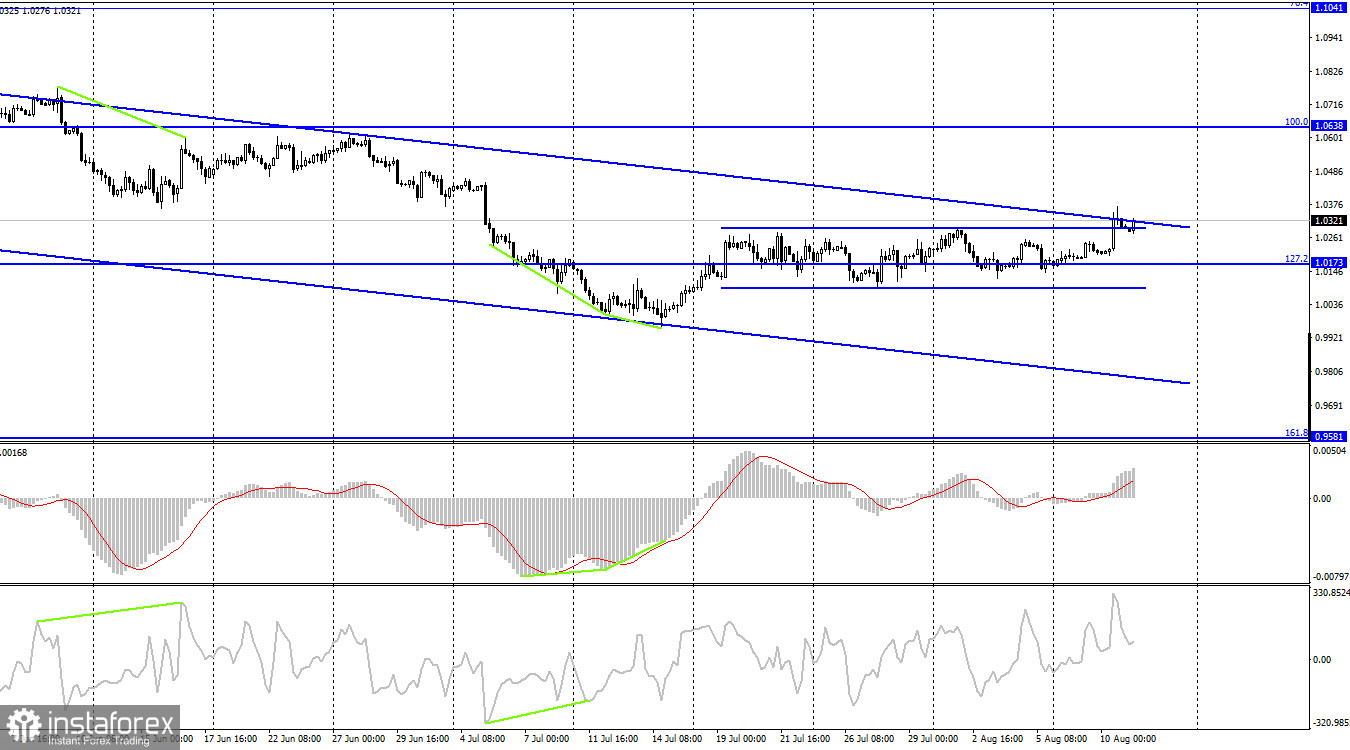

On the 4-hour chart, the pair continues to remain above the level of 127.2% (1.0173). Yesterday, it also performed an increase to the upper line of the descending trend corridor but could not consolidate above it. Thus, the quotes got out of the side corridor, but the fall may resume in the direction of the corrective level of 161.8% (0.9581) if bull traders fail to close the pair above the descending corridor, which still characterizes the current mood of traders as "bearish." Brewing divergences are not observed in any indicator today.

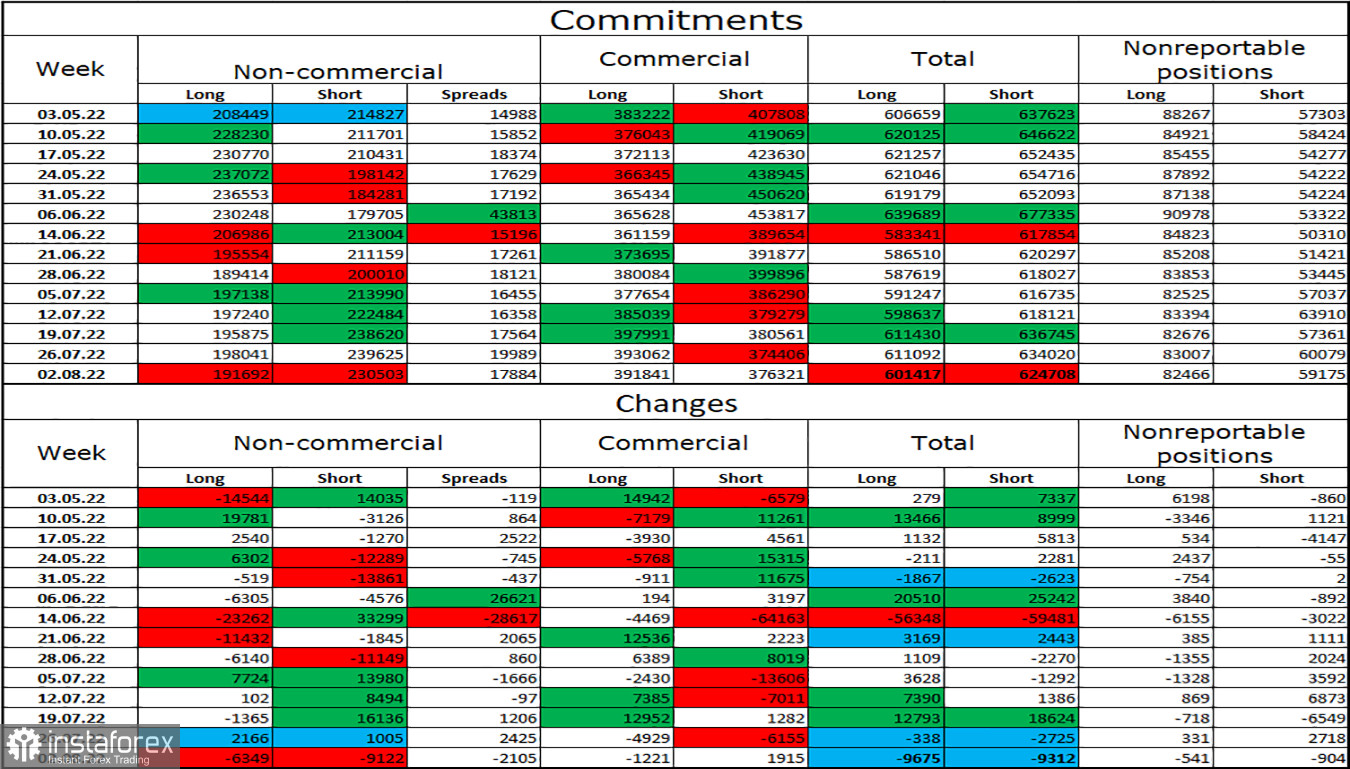

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 6,349 long contracts and 9,122 short contracts. This means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators now amounts to 191 thousand, and short contracts – 230 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro has failed to show convincing growth in the last four weeks. Thus, it is still difficult for me to count on the strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair.

News calendar for the USA and the European Union:

US - number of initial applications for unemployment benefits (12:30 UTC).

On August 11, the calendars of economic events of the European Union and the United States did not contain important records. The influence of the information background on the mood of traders today is likely to be absent.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper line of the corridor on the 4-hour chart with a target of 0.9581. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română