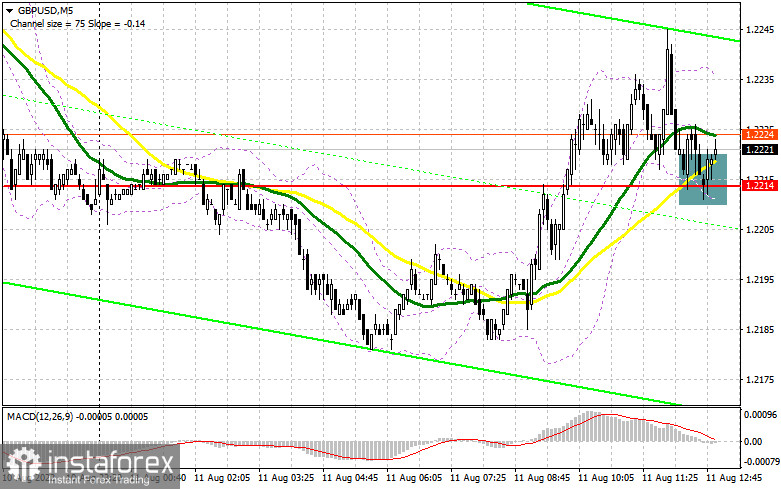

In my morning forecast, I paid attention to the level of 1.2214 and recommended deciding on entering the market. Let's look at the 5-minute chart and figure out what happened there. As a result of the pair's growth, a breakdown of 1.2214 took place in the first half of the day, but it came to the reverse test from top to bottom only closer to the middle of the European session. We received a buy signal, but its further implementation raises several questions. While trading will be conducted above this level, we expect further growth. The technical picture was revised in the afternoon.

To open long positions on GBP/USD, you need:

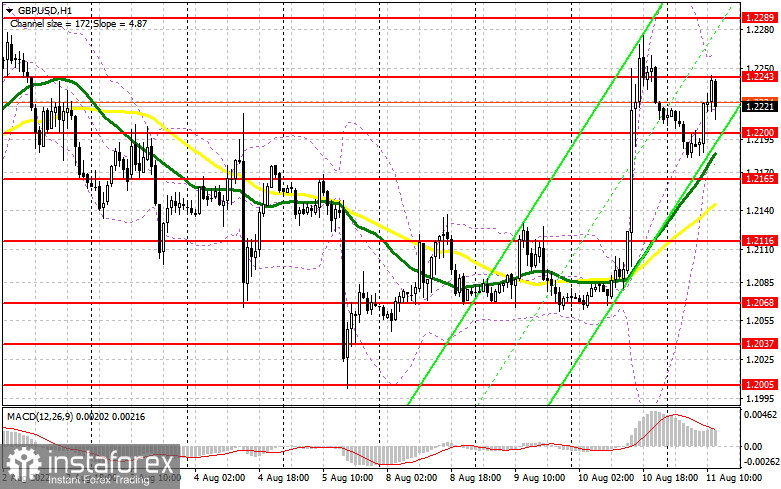

A lot will depend on the reaction to producer price inflation in the United States. In the case of a decline in the pound, in my opinion, the 1.2200 level is quite promising, just below which the moving averages are playing on the buyers' side. A false breakout there will give confidence to the bulls, and a signal to open long positions in continuation of the bullish rally observed yesterday. In this case, the target will be a new resistance of 1.2243 formed in the first half of the day. Its breakdown and a reverse test from the top down will take it to 1.2289, and a further goal will be a fresh maximum of 1.2347, where I recommend fixing the profits. If GBP/USD falls and there are no buyers at 1.2200, it is unlikely that we will see serious pressure on the pound, but this does not detract from its downward correction to the area of 1.2165. A false breakout at this level will give an excellent buy signal and ban the pair in a new side channel, where another accumulation of long positions will occur, followed by a breakdown of monthly highs. You can immediately open long positions on GBP/USD on a rebound from 1.2116 or even lower – around 1.2068 to correct 30-35 points within a day.

To open short positions on GBP/USD, you need:

Bears are not very active yet, as they are waiting for data on producer prices in the United States, the growth of which may slow down, leading to another upward jerk of the pair to the area of 1.2243. For the protection of this level, you need to throw all your strength since going beyond it will provide buyers with new support from major players. The optimal scenario for opening short positions will be a false breakout in the area of 1.2243, which will return pressure on the pound to reduce to the nearest support of 1.2200, formed in the first half of the day. Bears like air need to close the day below this level if they plan to return to the market and stop yesterday's bullish madness. A breakout and a reverse test from the bottom up of 1.2200 will give an entry point for sale with a fall to 1.2165, and a more distant target will be the area of 1.2116, where I recommend fixing the profits. With the option of GBP/USD growth and the absence of bears at 1.2243, the bulls will have a real chance to continue the rally and update the monthly highs. In this case, I advise you not to rush with sales: only a false breakdown in the area of 1.2289 will give an entry point to short positions in the expectation of a rebound of the pair. In the absence of activity, there may also be a jerk up to the maximum of 1.2347, where you can open short positions immediately for a rebound, counting on the pair moving down by 30-35 points within the day.

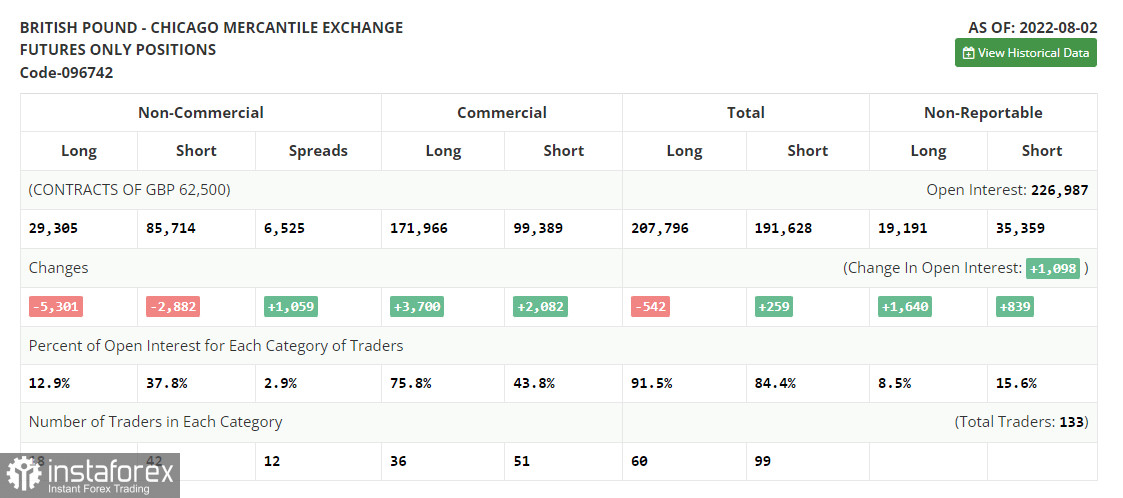

The COT report (Commitment of Traders) for August 2 recorded a reduction in both short and long positions, but the decline in the latter turned out to be greater, which led to an increase in the negative delta. This suggests that many traders continue to fear what is happening to the UK economy now and what the aggressive policy of the Bank of England may lead to. Last week, the regulator raised interest rates by 0.5 points at once, which was the most significant change in policy over the past 27 years. The Central Bank is ready to sacrifice the economy's growth rate, which is inexorably declining, to cope with the record level of inflation, which by October this year will reach 13.0%, according to official forecasts. But even in such conditions, one should not lose faith in the British pound, which is quite oversold against the US dollar. If the US inflation data surprises investors in the near future, the growth of the GBP/USD pair may resume. The COT report indicates that long non-commercial positions decreased by 5,301 to 29,305. In contrast, short non-commercial positions decreased by 2,882 to 85,714, which led to an increase in the negative value of the non-commercial net position to the level of -56,409 from the level of -53,990. The weekly closing price rose to 1.2180 against 1.2043.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română