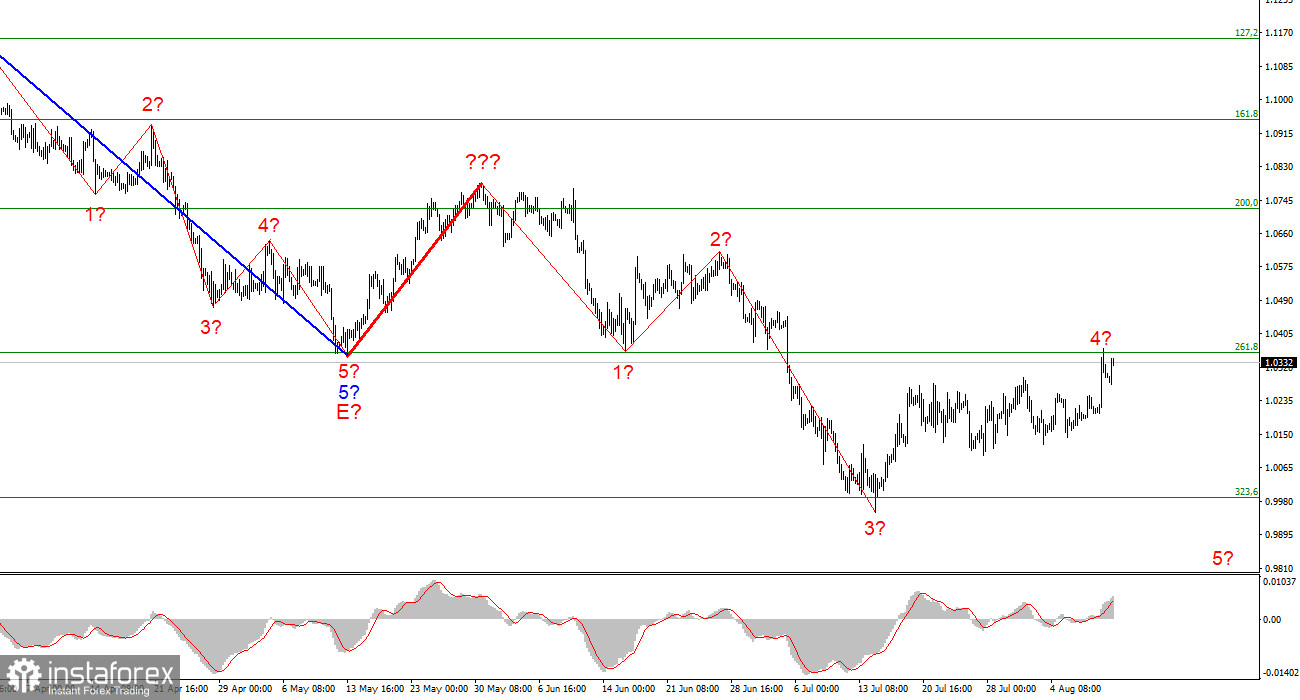

EUR/USD's wave layout on the 4-hour chart still doesn't require any revision despite the factthat the price growth within suggested wave 4 is going on much longer than expected. A new wave layout doesn't allow for the upward wave plotted by the bold red line. The whole wave structure could get more complicated and elongated. For the time being, the upward wave is supposedly still in progress. This wave could also be wave 4 of the downtrend section. If the assumption is true, the currency pair is expected to complete it and begin building wave 5. The suggested wave 4 already consists of five waves. An unsuccessful attempt of breaking 1.0356, i.e. 261.8% Fibonacci level, might indicate that the correctional wave is complete. If this level doesn't halt the pair's growth, the whole wave picture should be revised as the peak of wave 4 will go beyond the low of wave 1. Even in this case, the wave layout could retain its integrity. However, it will not be considered of an impulsive nature.

How EUR/USD trading after market digested US CPI

On Thursday, EUR/USD grew 30 basis points. The market activity calmed down today amid theempty economic calendar. Indeed, by the moment of writing this article, not a single report had been released. Hence, I was surprised to see growing demand for EUR in the morning on the back of considerably elongated wave 4. Fortunately, such big demand did not update yesterday's intraday high. So, I still expect wave 5 to emerge. Besides, I'd like to note that 1.0356 still retains the currency pair from a further climb and gives hope for a new decline in EUR.

Yesterday, the market was overwhelmed by euphoria immediately after the US CPI release. Analysts rushed to revise their forecasts, predicting a stronger climb of EUR/USD. Analysts speculated that the Federal Reserve would have to raise interest rates at a slower pace and the US dollar would lose favor with investors. Today, the agitation ebbed away and investors revived the idea that the US dollar remains the number one's reserve currency. From my viewpoint, the Federal Reserve is still far away from the moment to change its hawkish rhetoric to a dovish one. Interest rates will go on increasing for at least half a year ahead, though there is a question at what pace the Fed will make further rate hikes. It doesn't really matter. Some analysts say that demand for the US dollar will wane on the back of further monetary tightening for 6 months ahead. Perhaps the market is in limbo now. It should clear up its sentiment and make up its mind about the trajectory of the trading instrument.

Conclusion

According to my wave analysis, I make the conclusion that the downtrend section is still in progress. If so, we can sell the trading instrument with the targets at around 0.9397 which matchesthe 423.6% Fibonacci level. We should sell at each MACD's down signal, bearing in mind ongoing wave 5. In case of a successful breakout of the 261.8% Fibonacci level, the viable sell trading plan could be cancelled.

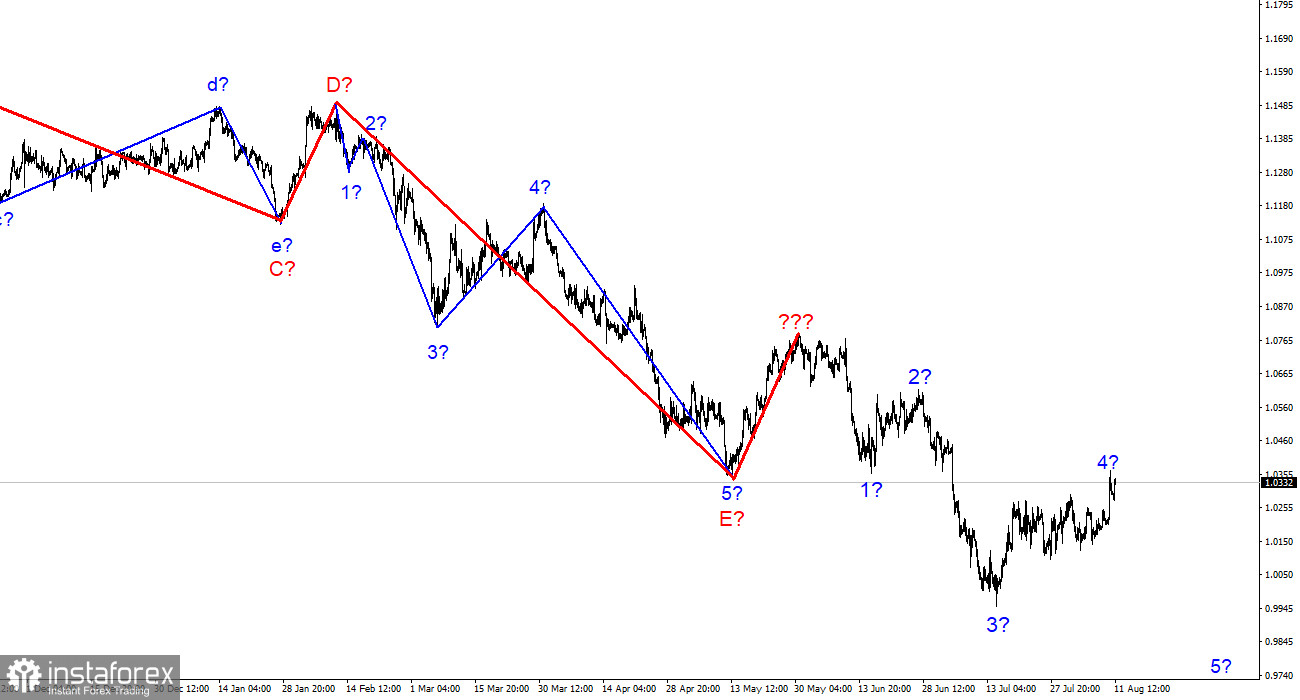

On a senior timeframe, the wave structure of the downtrend section is getting more complicated and elongated. The section might be extended and look lengthy. My idea is to pick three- andfive-wave standard sections from the whole picture and plan positions with their help.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română