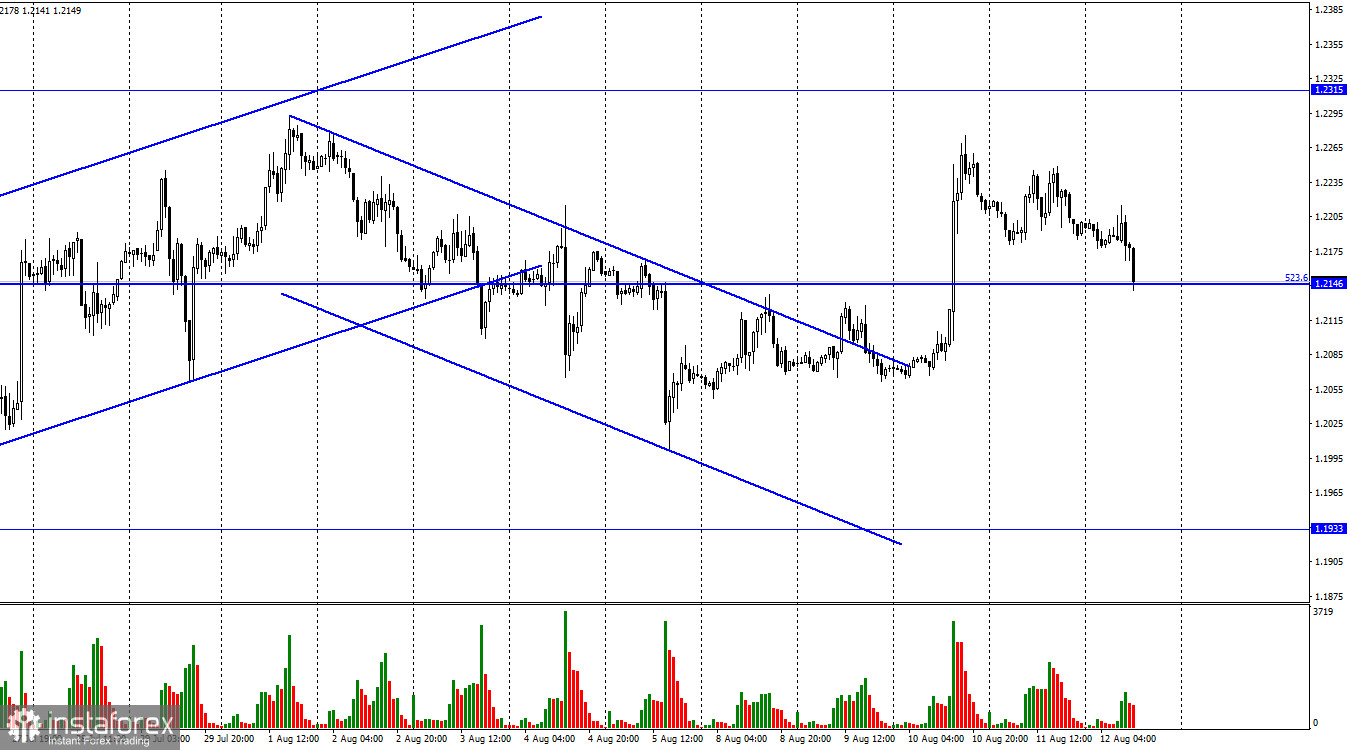

According to the hourly chart, the GBP/USD pair performed a new reversal in favor of the US currency on Thursday. And on Friday, it continued falling to the corrective level of 523.6% (1.2146). And at the moment, the British dollar has already fallen to the values observed on Wednesday before the release of the US inflation report. The entire advantage of the British pound was lost in just two days. Today, of course, the British reports greatly impacted the mood of traders. But is this the case? The GDP indicator in the second quarter fell by 0.1% q/q and grew by 2.9% y/y. Traders' expectations were lower in the first and in the second case. Thus, the real GDP values turned out to be better than expected. In this case, the pound had to show growth. GDP for June was -0.6% with expectations of -1.3% m/m, and over the past three months, it has fallen by 0.1% with a forecast of -0.3%. All four variations of the GDP report were stronger than traders' expectations, but the British dollar still fell. Okay, let's look at the other reports. Industrial production in June increased by 2.4% y/y, and traders expected growth of 1.6%.

Compared to May, production decreased by 0.9%, and traders were waiting for a fall of 1.2%. It turns out that the production report was better than expected, but the pound is still falling today. I can assume that not only the British reports influenced the mood of traders. The same speeches by some FOMC members, who assured that there would be no rejection of the plan to tighten the PEPP, could help the dollar to start a new growth much more than weak British statistics. After all, the GDP data was really weak, and traders were more pessimistic. But the reports themselves don't get any better from this pessimism. Accordingly, the fall of the British on Friday is quite natural. In the longer term, I am also inclined toward the fall of the pound sterling. Bulls had a good opportunity to buy the pound on the weak inflation report and sharply increased fears about the transition to the "dovish" scenario of the Fed, but they did not take full advantage of it.

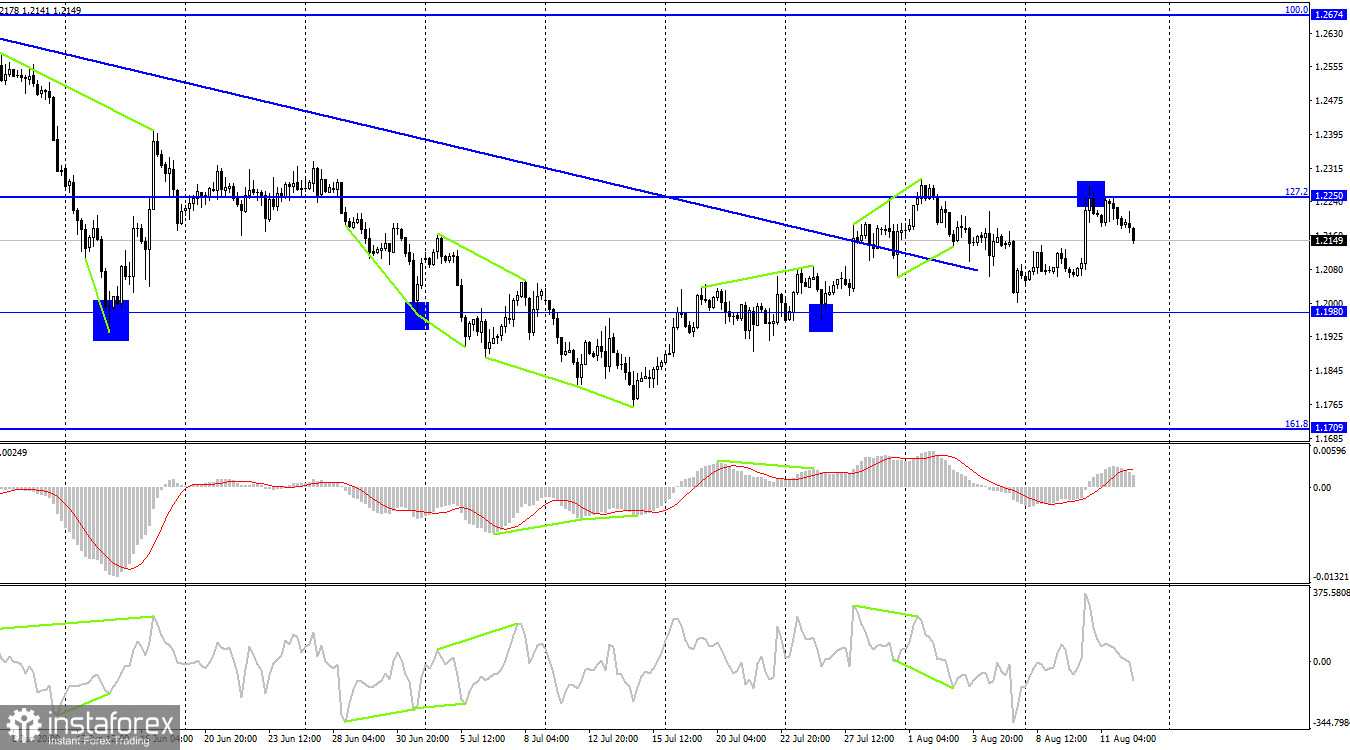

On the 4-hour chart, the pair performed a rebound from the corrective level of 127.2% (1.2250) and a reversal in favor of the US currency. Thus, the fall resumed in the direction of the 1.1980 level. Emerging divergences are not observed in any indicator today. Fixing the pair's exchange rate above the level of 1.2250 will increase the chances of further growth of the British pound in the direction of the next Fibo level of 100.0% (1.2674).

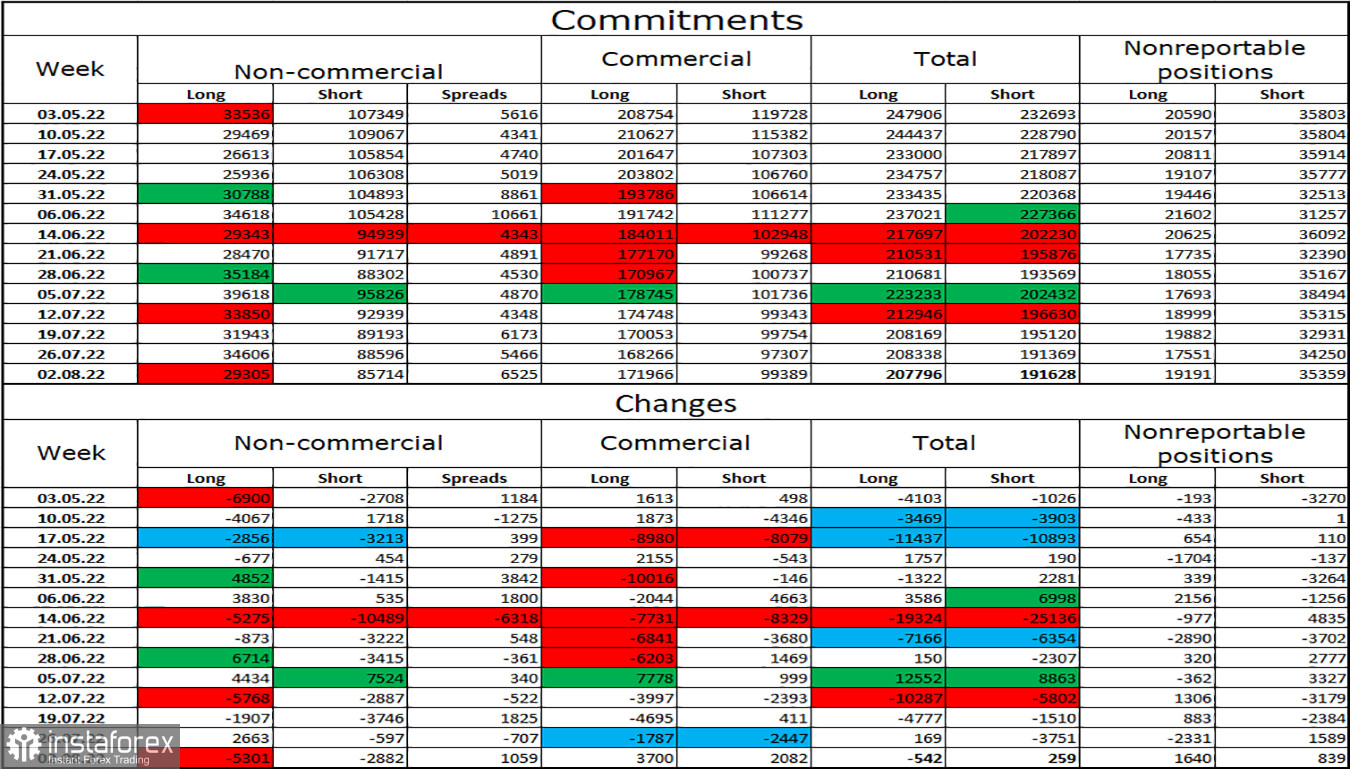

Commitments of Traders (COT) Report:

Over the past week, the mood of the "Non-commercial" category of traders has become a little more "bearish." The number of long contracts in the hands of speculators decreased by 5,301 units, and the number of short contracts decreased by 2,882. Thus, the general mood of the major players remained the same – "bearish," and the number of short contracts still exceeded the number of long contracts by several times. The big players remain mostly in the pound sales, and their mood has not changed much lately. The pound has been showing growth in recent weeks, but COT reports make it clear that the Briton may resume its decline, as the positions of bull traders are in no hurry to improve enough to count on an upward trend.

News calendar for the USA and the UK:

UK – GDP reports (06:00 UTC).

UK – industrial production report (06:00 UTC).

US - consumer sentiment index from the University of Michigan (14:00 UTC).

On Friday in the UK, all the reports were released, and these were the day's most important reports. The only report in the US is unlikely to have much impact on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommended new sales of the British when rebounding from the level of 1.2250 on the 4-hour chart with a target of 1.1980. Now they can be kept. I recommend buying the British when fixing above the level of 1.2250 on a 4-hour chart with targets of 1.2315 and 1.2432.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română