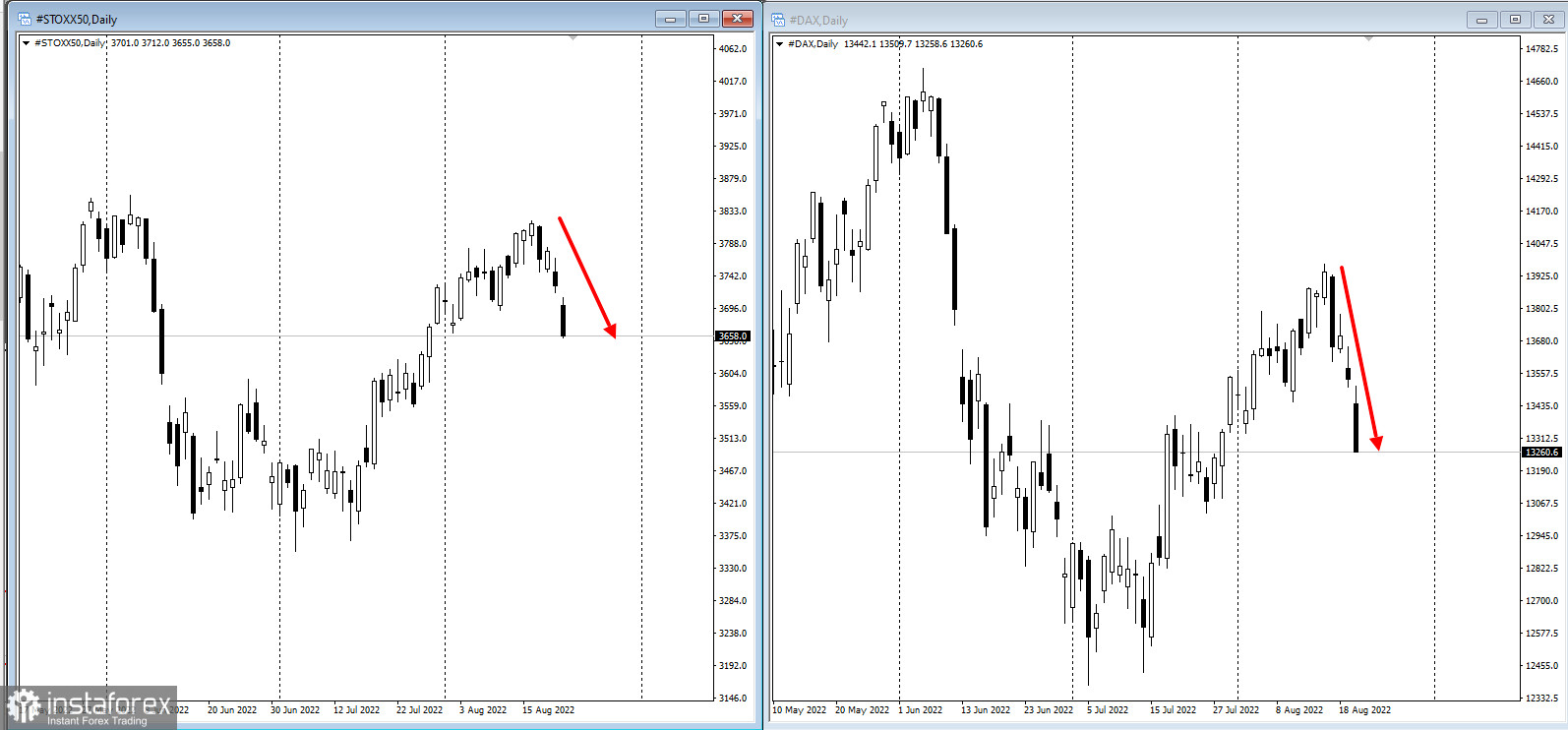

On Monday, European stocks collapsed along with US equity futures as the Federal Reserve's focus on monetary policy tightening and concerns about the impact on economic growth put pressure on investor sentiment.

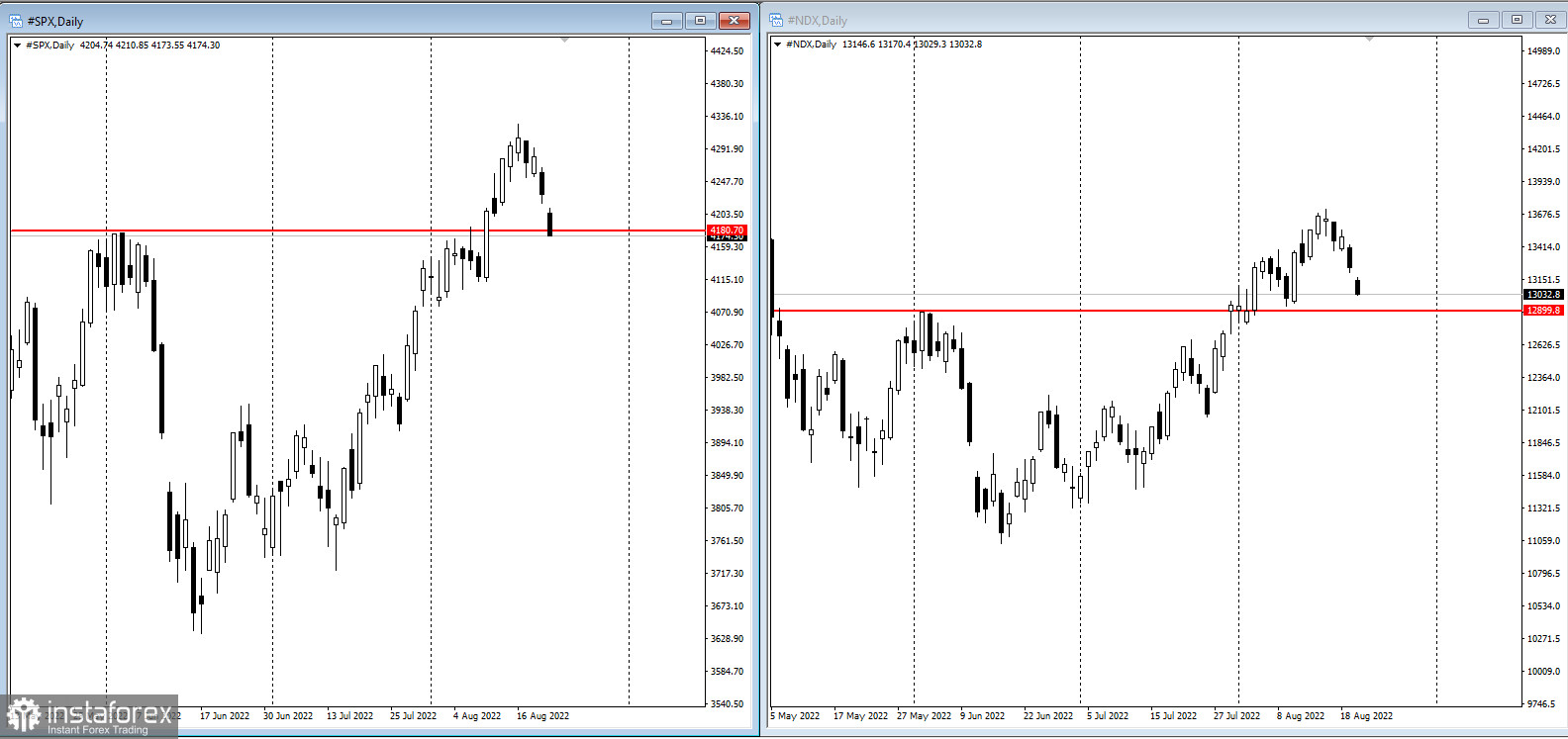

S&P 500 and Nasdaq 100 futures fell more than 1% each. 10-year Treasury yields remained almost unchanged, while 2-year bond yields rose by nearly five basis points, deepening the inversion of the yield curve, which is seen as a sign of recession. The dollar spot index climbed to a five-week high.

The Stoxx Europe 600 index fell to its lowest level in more than three weeks with carmakers and the tech sector among the leading broad-based declines.

MSCI Inc.'s Asia-Pacific share index fell for a third straight day with losses evident in most major markets except for some gains in China, where a move by banks to cut lending rates aided property developers.

A jump in global stocks from June's bear market lows is fizzling after repeated Federal Reserve policymakers warned that interest rates were going higher, raising fears of a recession in the US. Investors are also aware of the looming acceleration of the Fed's balance-sheet reduction. So-called quantitative tightening will come into effect next month, and will add pressure on riskier assets that have benefited from ample liquidity.

The latest MLIV Pulse survey suggests that stocks and bonds will tumble again, even though inflation has likely peaked: some 68% of respondents believe the most destabilizing era of price pressures in decades is eroding corporate margins and sending stocks lower.

"It is likely central bankers, including Fed Chair Jerome Powell, will remain hawkish in dealing with inflation, albeit with a bit of caution creeping in given the emerging economic downturn," Shane Oliver, head of investment strategy at AMP Services Ltd. wrote in a note.

A key factor for markets this week is the Fed's decision to hold a symposium in Jackson Hole, Wyoming. The recent jump in stocks has weakened financial conditions, making it difficult to fight inflation.

The Jackson Hall symposium gives Powell a platform to revisit market expectations for a turn toward slower rate hikes. Recent rates have stimulated the recent rebound in stocks. However, they are vulnerable to the possibility of persistently elevated price pressures even as economic growth stumbles.

On Monday, Chinese banks trimmed annual and five-year key lending rates in response to the National Central Bank's decision last week to cut its key interest rate.

The Moscow Exchange Index continues rising and is likely to break through technical resistance at a quote of 2.2100:

What to watch this week:

- US new home sales data, S&P Global PMI, Tuesday;

- Fed's Neel Kashkari speaks at Q&A session, Tuesday;

- US durable goods, MBA mortgage applications, pending home sales, Wednesday;

- US GDP, initial jobless claims, Thursday;

- Fed annual policy symposium in Jackson Hole, Wyoming, Thursday;

- ECB's July minutes for July, Thursday;

- Fed Chairman Powell speaks at Jackson Hole, Friday;

- US consumer income, PCE deflator, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română