Stocks in Europe and the US fell as investors worry about tighter monetary policy and weakening economic growth that may be talked about at the Jackson Hole Economic Symposium this week.

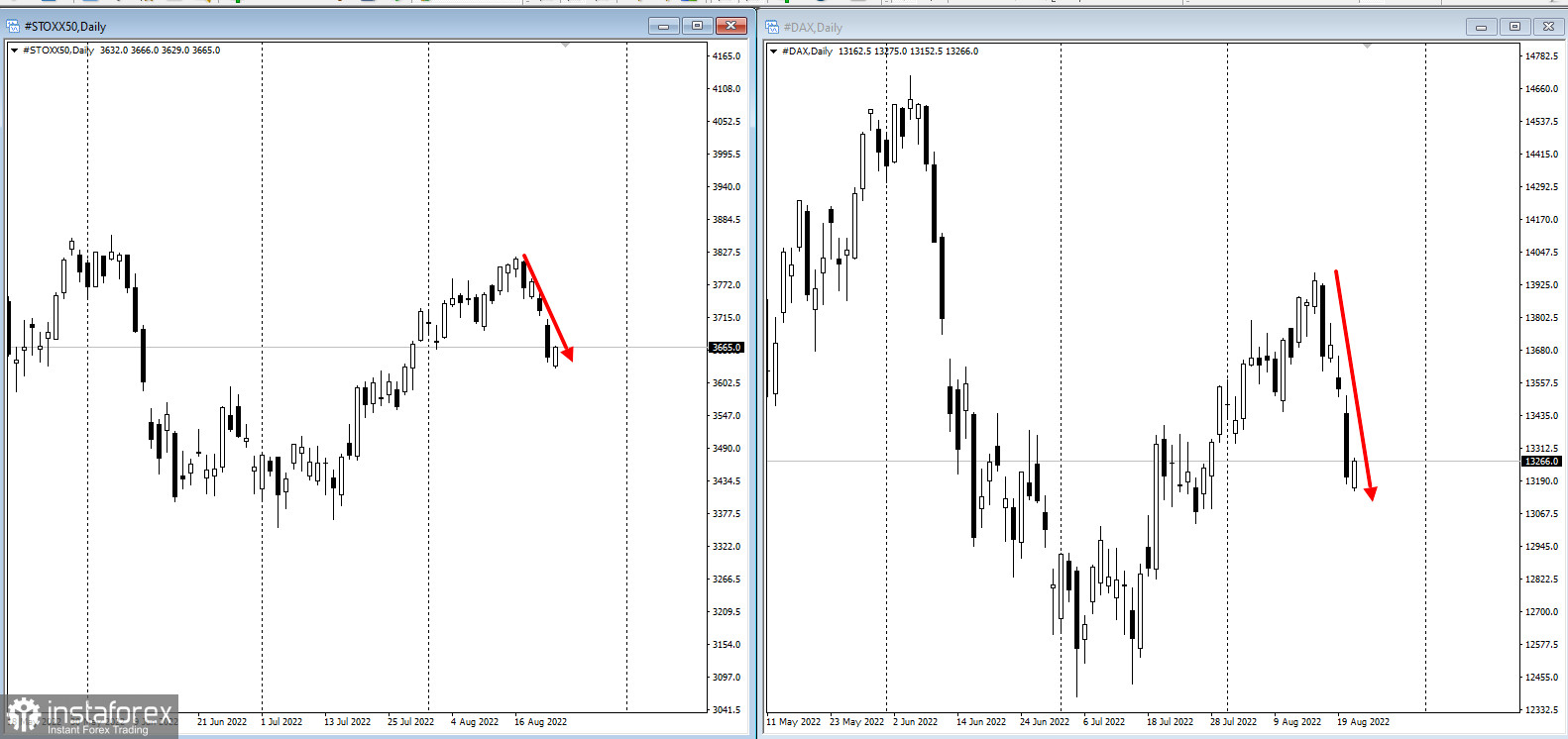

Stoxx50 declined to a three-week low, while energy stocks rose amid the possibility of OPEC production cuts.

Output in France, meanwhile, declined for the first time, mirroring a trend in Germany as Europe's largest economies suffer from record inflation and uncertainty over tensions in Ukraine. European bonds also declined.

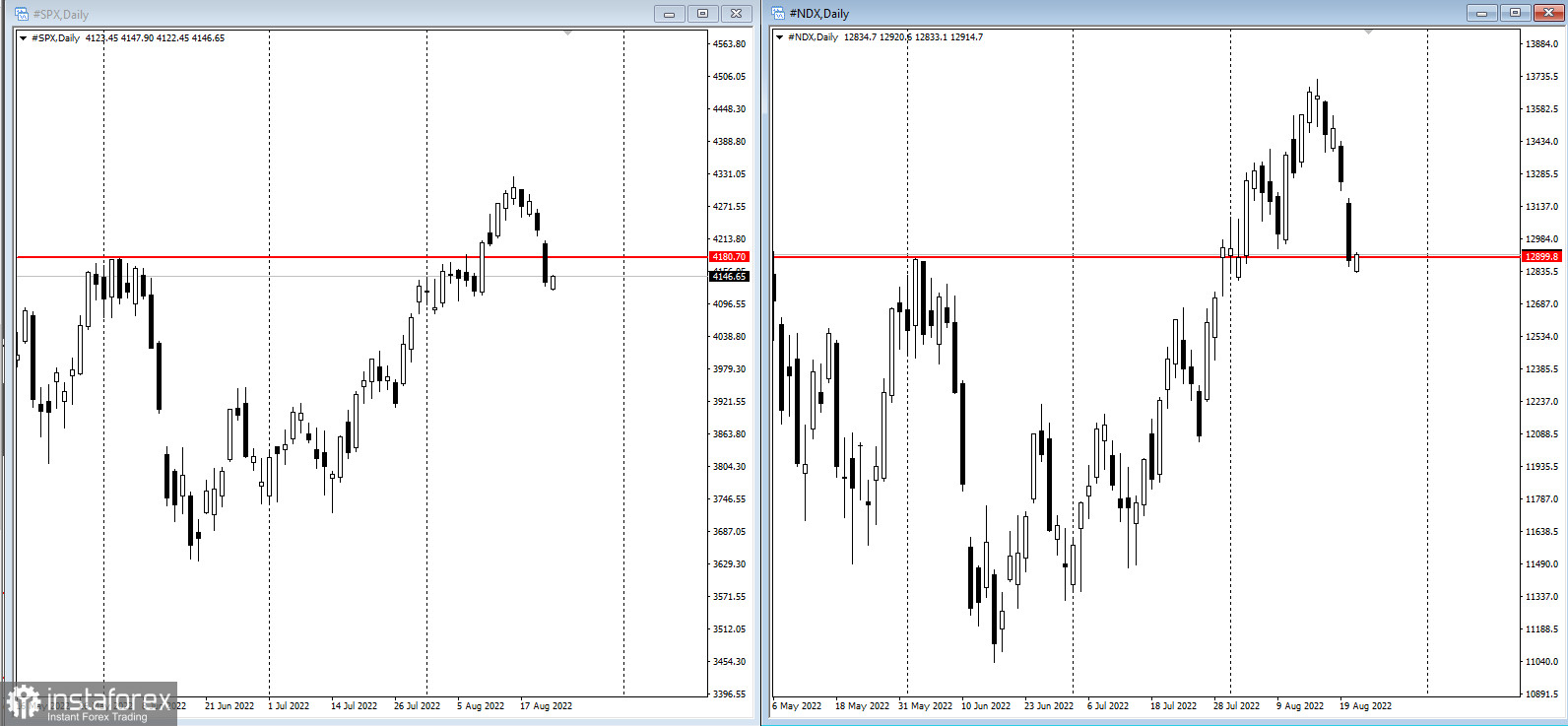

As for the US, S&P 500 and Nasdaq 100 continued to decrease, while yields on 10-year bonds remain above 3%. Dollar also traded at a five-week high.

Obviously, traders are gearing up for a potential hawkish talk at the Jackson Hole symposium later this week. The Fed's decision to slow down the US economy in order to bring inflation down will remain a key factor in global markets.

Hedge funds, which hold a key position in the derivatives market, also made record bets that the US central bank will pursue a hawkish scenario.

The Fed is clearly having a hard time trying to contain price pressure, all while preventing a recession. In addition, the risks of global growth are very clear, from the energy crisis in Europe to real estate problems in China and Covid.

With more than $30 trillion in total US debt, a 1% hike in rates would result in a massive increase in interest payments of more than $300 billion.

Other important news this week are:

- data on US new home sales, S&P Global PMI (Tuesday);

- speech of Minneapolis Fed President Neil Kashkari (Tuesday);

- report on US durable goods, mortgage applications and pending home sales (Wednesday);

- data on US GDP and jobless claims (Thursday);

- Jackson Hole economic symposium (Thursday);

- release of minutes of the ECB meeting for July (Thursday);

- speech of Fed Chairman Jerome Powell at Jackson Hole (Friday)

- report on US personal income, PCE deflator and consumer sentiment (Friday)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română