The closer Fed Chairman Powell's speech at Jackson Hole, the lower the demand for risky assets. Hawkish signals from Fed officials lately, as well as hawkish rhetoric from the ECB about raising rates even amid growing recession risks in Germany, have led to a reassessment of markets' views. The energy crisis in Europe and news that UK inflation has reached 18.6% suggest that inflation has not yet peaked. There remains a risk that inflation will remain high for longer without aggressive actions by central banks.

The reduction in demand for risk leads to an increase in government bond yields and a decline in stock indices. At the same time, the commodity market has so far been kept from falling, helped by the statement of Saudi Arabia's Energy Minister, in which he noted the high volatility and lack of liquidity in the futures market, which, in turn, may force OPEC+ to take action.

Most likely, trading will go mainly within the existing ranges till Friday, the advantage will be used by the US dollar, yen, and other protective assets.

NZD/USD

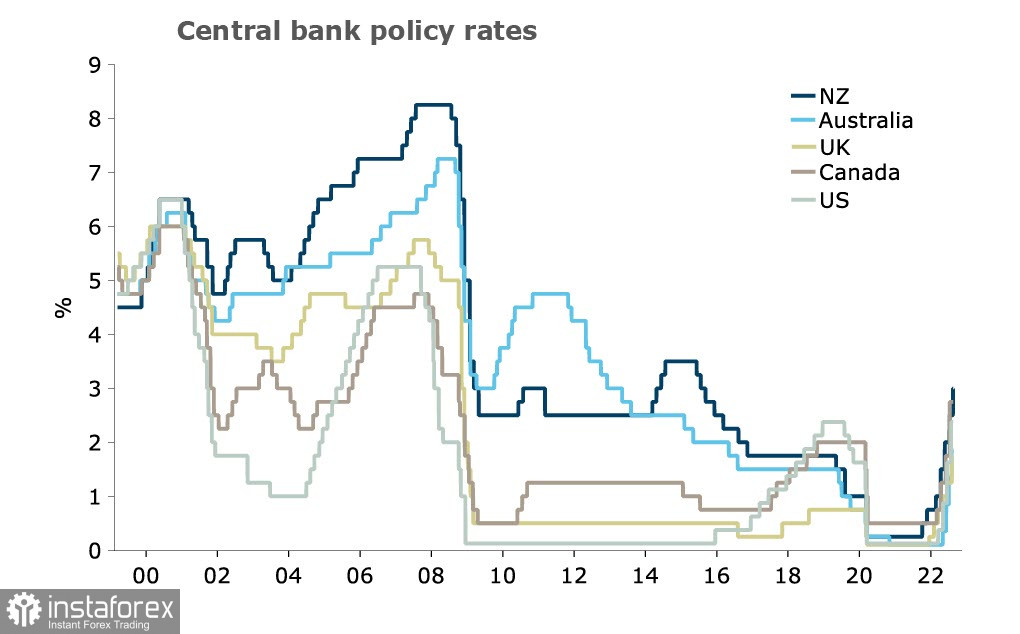

The RBNZ, as expected, raised the rate at the end of last week's meeting by 50 points to 3.0%, and the rhetoric of the accompanying document was generally hawkish, with the 2023 peak rate forecast raised to 4.1% from 3.9%.

The RBNZ is the leader in terms of the growth rate of the interest rate.

Inflationary pressures in New Zealand have been much stronger than the RBNZ had previously expected, so the rate forecast has been raised, and even the threat of an approaching recession will not give reason to stop it, as it is best to raise rates and curb inflation before a recession arrives.

Another important point in the RBNZ statement is the possibility of upward revision of the neutral rate, if such a revision is made, it may force the Central Bank to raise the interest rate to the same level, otherwise, the Central Bank will not be able to maintain a balance between the stimulative and restrictive policies.

Apparently, the neutral rate has already increased. This is indicated by the fast growth in average wages in the private sector which added 7% y/y. It is forecasted to rise to 8.5%, which adds to inflationary pressures and increases the chances of a rate hike to 4% by the end of the year. If things go that way, it would give the kiwi a bit of an advantage over the US dollar.

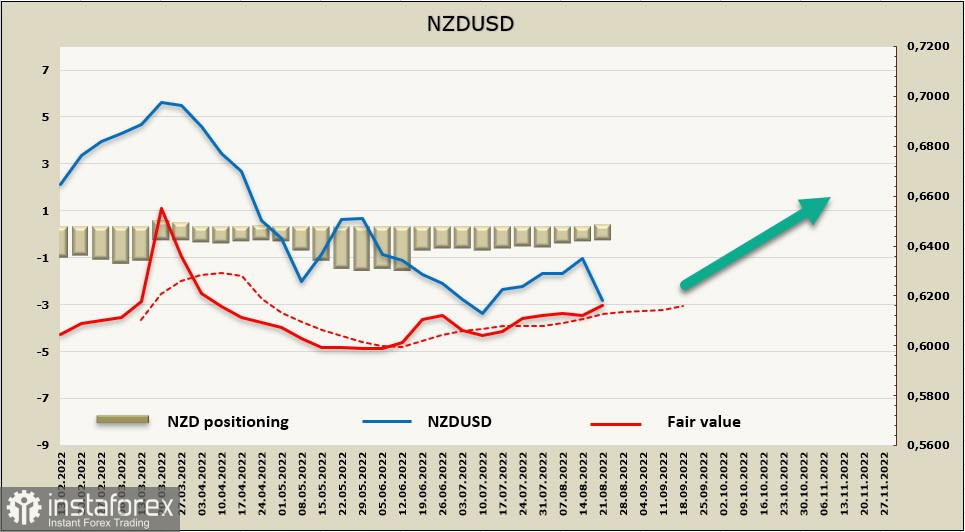

The NZD positioning is still close to neutral, the weekly change is +130 million, the bullish outperformance is 112 million, and the estimated price is holding above the long-term average despite the sell-off on the spot.

We may consider the downward movement as corrective, the New Zealand dollar might find support at the current level, and has chances to hold above the swing low of 0.6050. The scenario, in which an attempt to rise to the swing high of 0.6463 with the subsequent transition to the sideways range will follow in the coming days, has higher chances of realization than the continuation of the decline.

AUD/USD

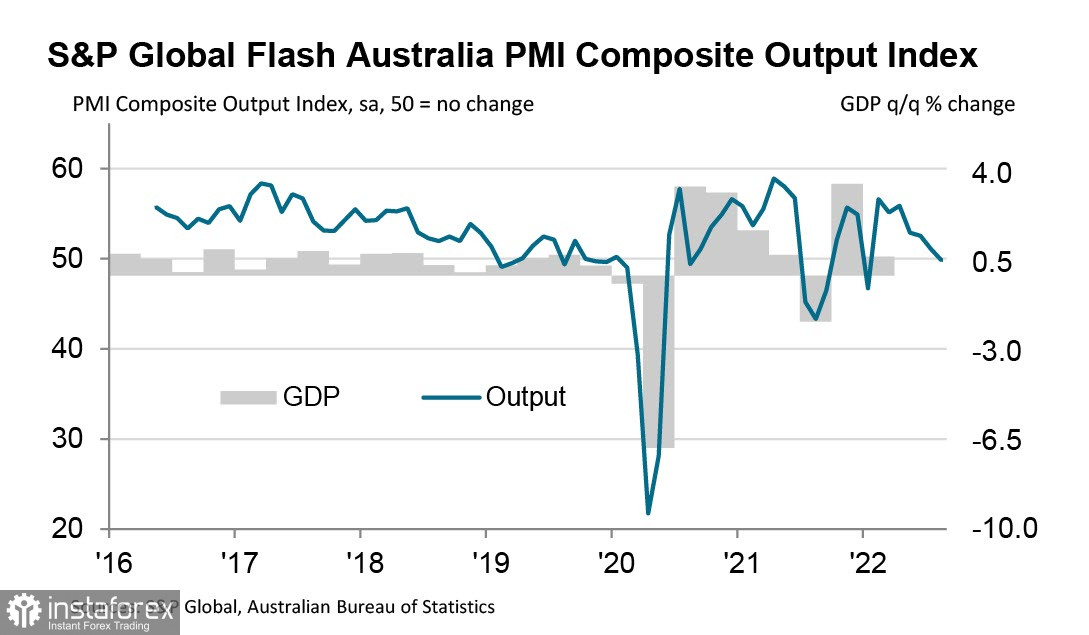

The PMIs showed that the Australian economy is turning from expansion to contraction. The composite index fell to 49.8 from 51.1 in August. The decline was largely driven by a contraction in services sector activity, 50.9 against 49.6 a month earlier. New orders growth is at a six-month low and business confidence has fallen to its lowest since March 2020.

Production is still in positive territory, rising for the seventh straight month, but the 12-month outlook for the manufacturing sector has fallen to its lowest level in 28 months, the level of panic at the start of the pandemic. This means that the sector is preparing for a winding down of activity and a reduction in production.

The RBA's recent interest rate hike and persistent inflationary pressures have begun to weigh on overall demand. As the RBA is expected to continue to raise rates, business activity and consumer demand are likely to continue to decline.

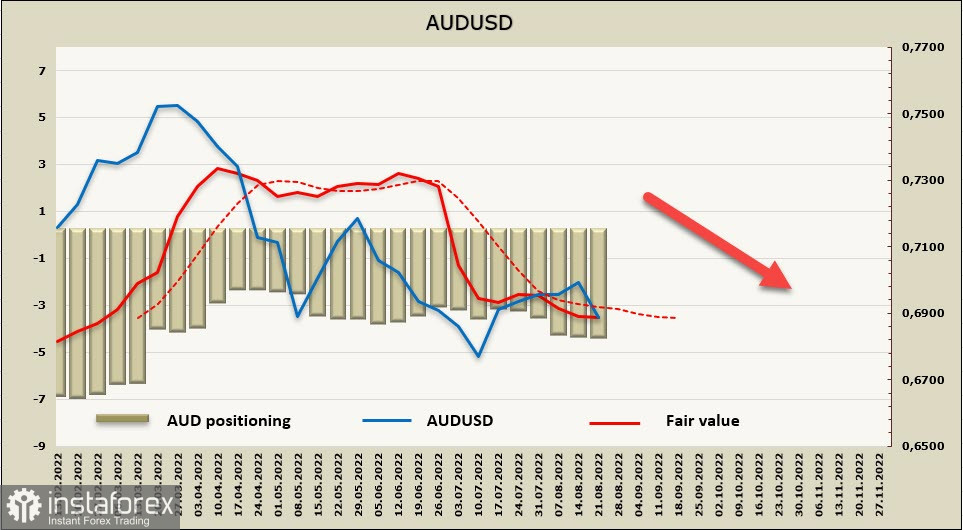

The AUD net short position is up 149 million for the week, bearish outperformance is -4.16 billion, and the probability of a bullish reversal is low. The estimated price continues to hold below the long-term average.

The AUD is under pressure, and it would be better to use the growth attempts to sell, the nearest target is located at 0.6829. We expect a slow decline to the swing low of 0.6684, the long-term target is still at 0.6464.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română