The euro and the pound reacted with a decline to the news that economic activity continues to weaken worldwide, and Europe was no exception. It has increased fears that rising prices and a special military operation in Ukraine will lead the world into recession. Accordingly, nothing is surprising in that the euro has fallen below parity against the US dollar as the demand for safe-haven assets has increased again.

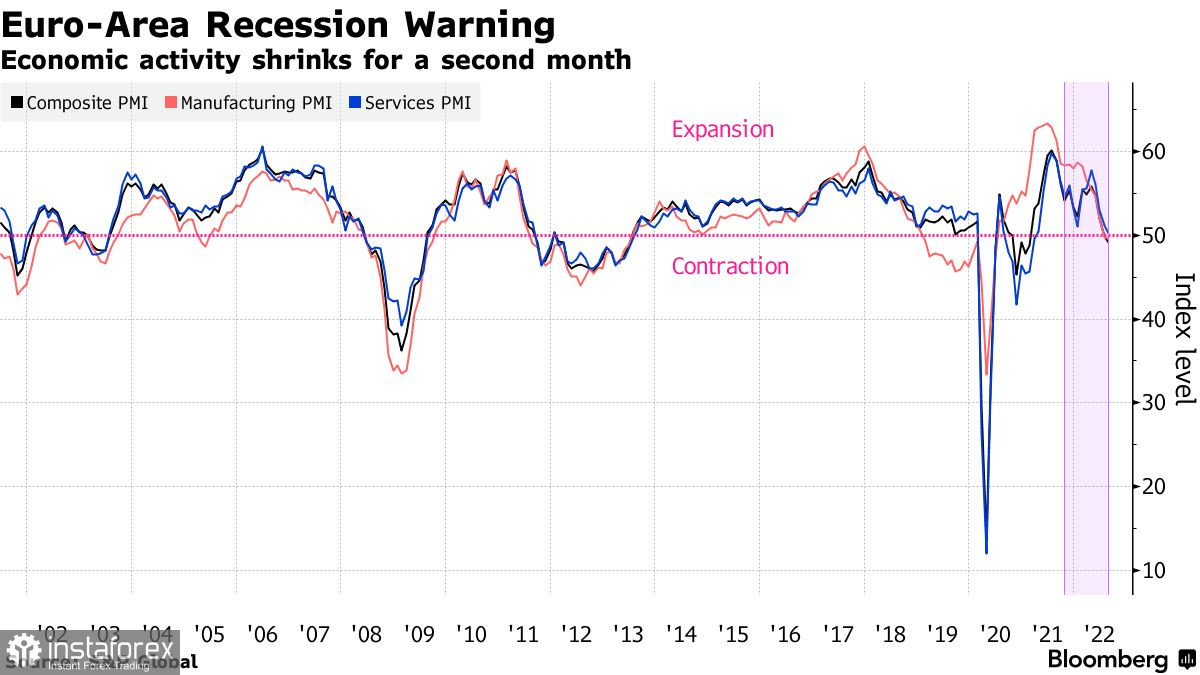

As today's data showed, the volume of production in the eurozone, which includes 19 countries, decreased for the second month. In August, record inflation for energy and food severely undermined demand, pushing more and more sectors down. The problem also lies in the high activity in the service sector, such as tourism, which has almost stopped.

Only in the UK did the purchasing managers' index manage to stay above 50 points, which indicates an increase in activity. But this is what concerns the service sector. Manufacturing activity showed an unexpectedly large drop. In Asia, Japan's output also declined due to a surge in COVID-19 cases, further reducing demand, which is already struggling with the weight of rising inflation. Australia's services sector contracted for the first time in seven months, somewhat offsetting tourism growth.

All these data paint a bleak picture for the global economy, as most central banks remain focused on curbing inflation by raising borrowing costs.

A little later today, several US PMI data will be released, showing improvements in manufacturing and services. But the published figures of the eurozone indicate a contraction of the economy in the third quarter of this year because the decline in production is currently observed in several sectors, from manufacturers of basic materials and cars to companies engaged in tourism and real estate.

Even more painful for investors was the news that Germany began to sink, which showed the sharpest decline since June 2020. All the efforts of the authorities to reduce dependence on Russian natural gas against the background of a reduction in supplies after the start of the military operation in Ukraine have not yet been successful. In France, things are also no better – activity there has decreased for the first time in a year and a half. Europe's largest economies cannot withstand record inflation and growing uncertainty.

The indicator of the French private sector activity in August reached the lowest level since the failures and amounted to 51 points, while production activity decreased to 49 points. New orders declined both in the service sector and manufacturing, while companies quickly lost confidence in their future.

In Germany, the index of business activity in the manufacturing sector turned out to be slightly better than economists' forecasts, but this did not help much, as it amounted to 49.8 points – this indicates a decline in the sphere. The index of business activity in the services sector completely collapsed to 48.2 points. The European economy is experiencing a deepening decline in private sector business activity, riddled with further uncertainty.

Against this background, the euro continues to fall. Bulls need to correct the situation very quickly and return to 0.9940 since the problems will only increase without this level. Going beyond 0.9940 will give confidence to buyers of risky assets, opening a direct road to 1.0000 and 1.0130. If there is a further decline in the euro, buyers will certainly show something around 0.9860, but this will not help them much since updating the next annual minimum will only strengthen the bear market. Having missed 0.9860, you can say goodbye to hopes for a correction, which will open a direct road to 0.9820.

Nothing good happens for the pound. Buyers need to do everything to stay above 1.1730 – the nearest support level. Without doing this, you can say goodbye to the hopes of recovery. Moreover, in this case, we can expect a new major movement of the trading instrument to the levels: 1.1690 and 1.1640. A breakdown of these ranges will open a direct road to 1.1580. It will be possible to talk about stopping the bearish scenario only after the breakdown and consolidation above 1.1780, allowing the bulls to count on a recovery to 1.1820 and 1.1870.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română