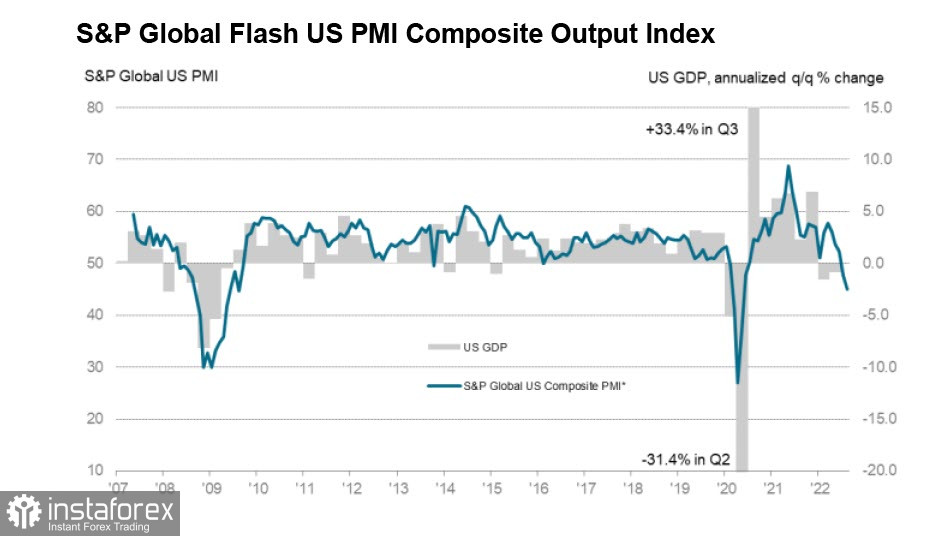

The PMI data compiled by the IHS Markit is disappointing as both services and manufacturing sectors are slowing down. The composite index reportedly fell to 45 points, which is a 27-month low. This signals that business activity in the US is rapidly declining.

Earlier this week, Japan, France, Germany, the Euro area and the United States published their PMI reports, which deviated from expectations. The UK is the same, but unlike other countries, its composite index does not point to a direct economic downturn. The Confederation of British Industry (CBI) said the number of orders fell from +8 to -7, and the selling price index jumped from 48 to 57.

Also coming, today in particular, is the report on orders for durable goods in the US, which is expected to be negative. Following is the speech of Minneapolis Fed President Neil Kashkari. Fed Chairman Jerome Powell will also speak, but it will be on Friday.

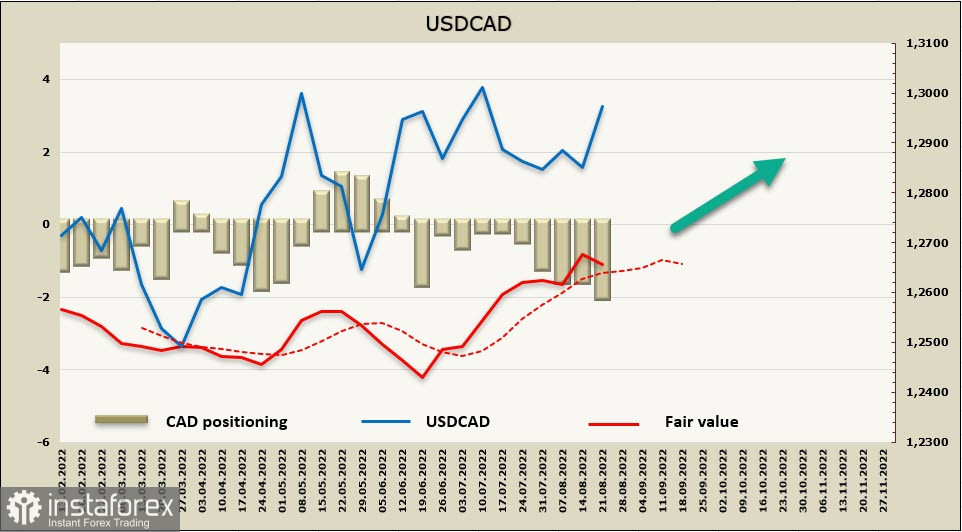

USD/CAD

Bank of Canada head Tiff Macklem will attend the Jackson Hole symposium, but he is not scheduled to speak. As such, USD/CAD will react only on changes in the Fed's monetary policy.

In terms of positioning, net long positions in CAD increased during the reporting week by 445 million to +2.092 billion. But the settlement price has not fallen below the long-term average, which means that financial flows are still in favor of dollar, not the loonie.

USD/CAD continues to trade in a range, but the direction is upward. The nearest target is the local high of 1.3222, followed by the resistance area of 1.3280/3330. The probability of declining to the local low of 1.2725 is minimal.

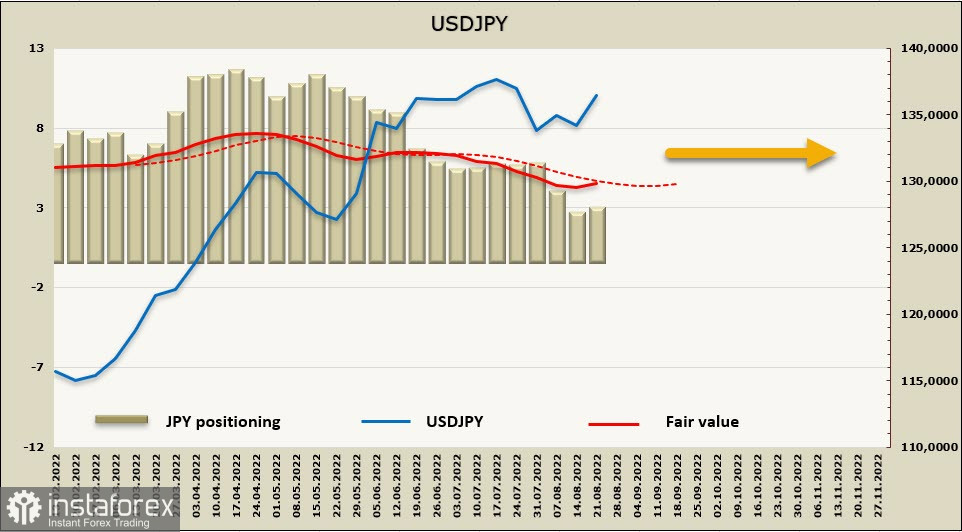

USD/JPY

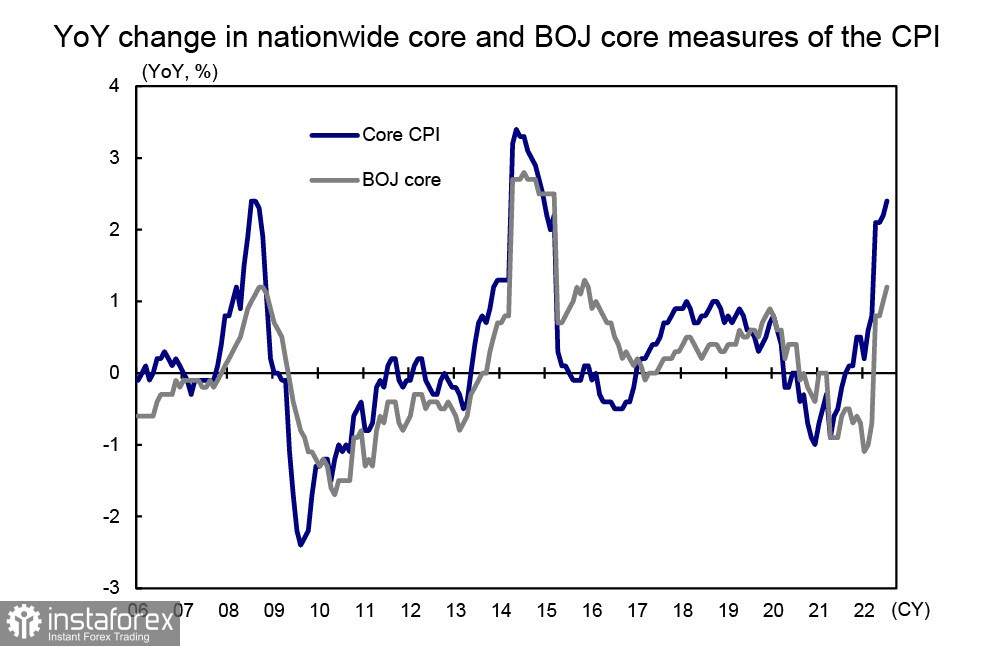

Consumer inflation in Japan reached 2.4%, which is high for the country, but low compared to global trends. Core inflation is only 1.2%, well below the 2% target set by the Bank of Japan. This means that there are no objective reasons for adjusting the BoJ's monetary policy.

Inflation expectations will adjust only after the release of the inflation index in Tokyo. The index has been rising for 11 consecutive months and has outperformed the national inflation rate. In July, the index stood at 2.3%, the highest since 2013. Now, the forecast is even higher at 2.7% and 2.5% for the core index.

Most likely, the Treasury will continue to throw bonds on the market to support liquidity, but the volume will be relatively small. At most, it will be £ 500 billion with maturities from 15.5 to 39 years, which will not have a significant impact on the rate of yen.

Talking about positioning, net short positions on JPY rose during the reporting week by 374 million to -2.691 billion. Although the trend was interrupted, it is not clear whether the current move is a reversal or only a slight correction. After all, the estimated price is near the long-term average and there is no clear direction.

The most likely scenario in the current conditions is range trading. A breakdown of the local high of 139.40 is unlikely, as it will mean another speculative attack on the yen. As long as the yield on 10-year bonds is below 0.250%, the Bank of Japan will not intervene.

Depending on the position of the Fed, there may be a shift in expectations, which will either lead to an increase in demand for defensive assets, or, conversely, to a decrease in demand. In a calm market, USD/JPY growth is unlikely because the real yield of assets denominated in yen is higher than that of dollar due to relatively low inflation. Expect trading in the range, the upper limit of which is 137.50, while the lower one is 131.70.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română