Bitcoin continues to trade within a crucial support zone at $21,000-$21,400. The cryptocurrency has tested $21,000 four times in the past five days but bears cannot fix the price below that level. Bitcoin has formed three weak candles in a row, indicating seller/buyer parity. On the other hand, we can conclude that the formation of Doji candles is due to low trading volumes in the crypto market.

Over the past three months, Bitcoin and the crypto market have been moving within a wide range of $18,000-$25,000. The clash between bulls and bears takes place in this range. Some analysts consider this range within a bearish trend a sign of stability. On the other hand, when trying to go above this range, the price meets strong resistance and goes down to the support area. However, if we compare the stock and crypto markets, we can conclude that the capitalization of digital assets has slightly changed over the past three months.

The correlation between Bitcoin and stock indices is one of the reasons why the crypto cannot start full-fledged growth. Market participants avoid big risks, which makes stock indices and BTC interrelated. Therefore, the end of the DXY correction, which hit stock indices, also affected Bitcoin. There is no direct correlation between BTC and DXY due to the fact that the cryptocurrency has much broader opportunities than stock indices. After the mass capitulation of investors in June, the rate of BTC accumulation has increased significantly, which may gradually lead to its scarcity and, consequently, to the demand for it.

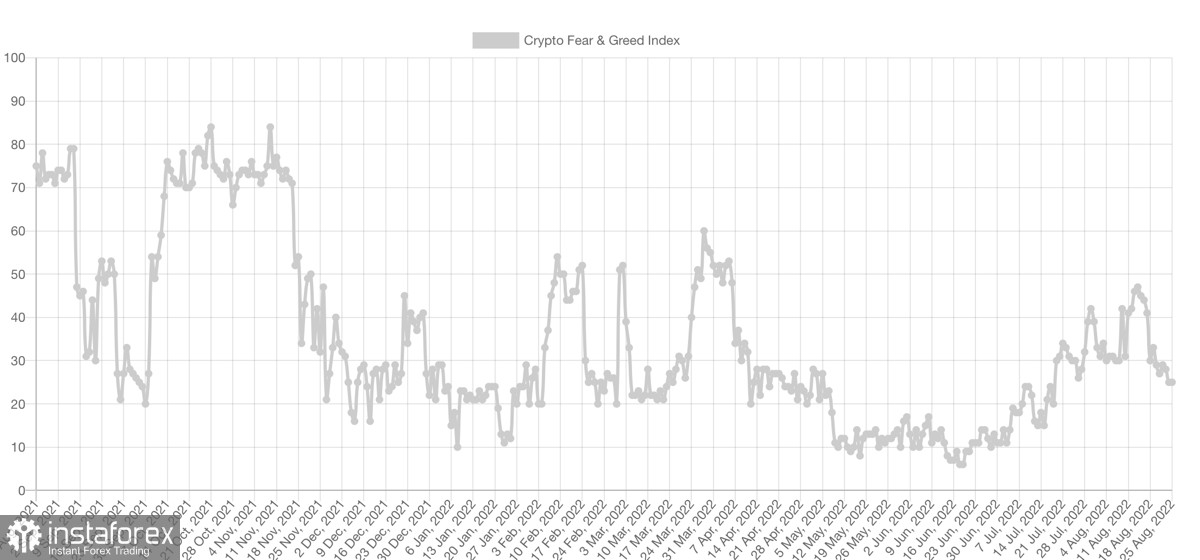

Edward Moya, a Senior Market Analyst at Oanda, agrees with this statement. The expert believes that more and more investors appear in the market, ready to buy significant volumes of BTC and other cryptocurrencies. This indicates the end of the extreme fear in the market when trading activity was reduced to a minimum. Notably, this trend has only just begun and risk appetite is gaining strength. However, it will take time for investment volumes to grow. Therefore, in the medium term, Bitcoin is likely to continue the current trend without significant changes.

At the same time, in the short term, cryptocurrency's uptrend may be fueled by positive news. In the coming days, there will be a speech by Fed Chairman Jerome Powell. He is expected to outline the regulator's further plans and the overall situation with the US economy. Hedge funds are confident that the Fed will continue their hawkish policy of key rate hikes and deliberately go short on the euro/dollar. In August, the volume of short positions tripled. This trend may force the Fed to change its current policy to prevent the euro from falling.

If this scenario comes true, Bitcoin may get momentum and try to climb above $23,000. Today, the US GDP report will be published, and if it shows weak values again, the Fed may officially declare a recession. Judging by the fact that the regulator removed this metric from the report, there will be no recession announcement.

However, this could be a signal for another revision of the investment strategy. Despite this, there are no clear signs of how Bitcoin will behave. There is no doubt that the US is beginning to curb inflation, but the economy is approaching a recession and the EUR/USD pair has its problems, too. There is no chance that the Fed's current policy will continue in the long term, and Bitcoin is likely to take advantage of that.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română