On Monday, BTC started another round of declines and finally broke through the $20,000 level. The cryptocurrency is close to retesting the local bottom at $17,700. Buyers tried to hold the $20,000 level and enter the consolidation phase during the weekend. However, significantly increased trading volumes, which were mostly bearish, triggered a final breakout of the $20,000 round mark. Bitcoin's decline beyond this level could have a dramatic psychological effect and reinforce the cryptocurrency's bearish trend.

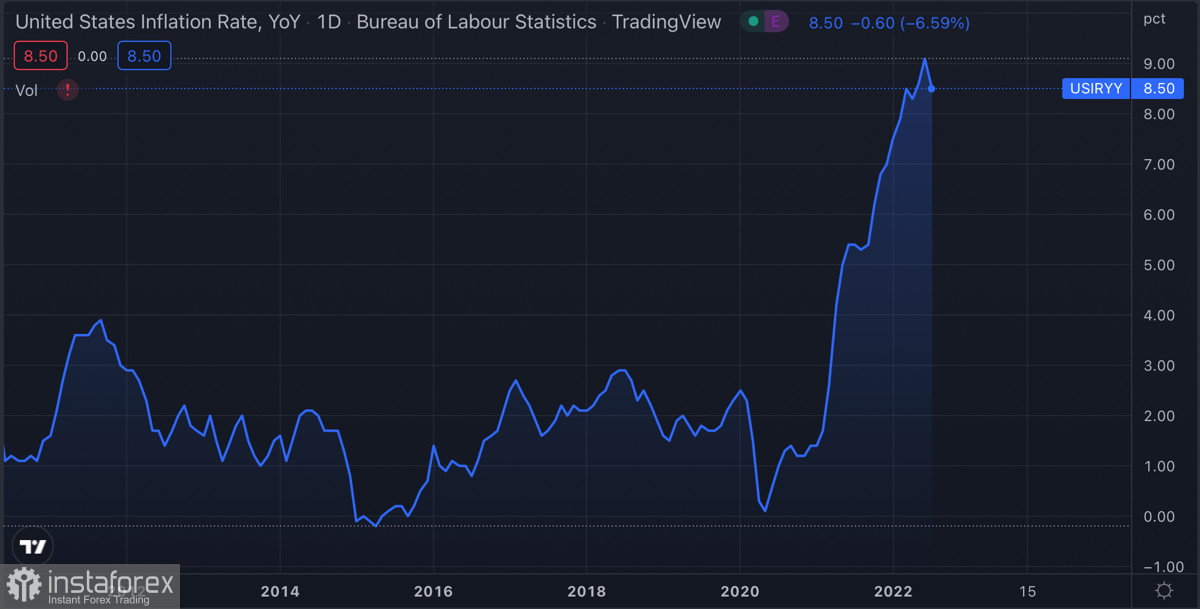

The reason why Bitcoin's price has fallen so significantly is the most paradoxical aspect of this situation. US Fed Chairman Jerome Powell's 8-minute speech at a symposium in Jackson Hole caused the crash of the cryptocurrency and stock market. Powell noted that the ultimate goal of a hawkish policy was 2% inflation. Notably, the CPI is at 8.5% at the end of July. The decision to further raise the key rate will be based on specific economic data. Powell also added that curtailing aggressive monetary policy was out of the question, and the US economy would withstand a slowdown due to strong fundamentals.

Powell's speech had a negative effect on the markets due to several important factors. Rumors about stimulation of markets in the run-up to the Senate elections in November started spreading in the press. The above-average decline in inflation in July also added optimism to investors and made them believe that the worst was behind. Experts from JPMorgan said that inflation would continue to fall in the second half of 2022 after peaking in June. The markets were not ready for such categorical Powell's statements due to a combination of these factors. Therefore, this triggered the decrease.

Apart from the decline in capitalization, the crypto market was filled with negative news, which only worsened the situation. Analysts report that after Powell's speech the chance of raising the key rate by 75 basis points has increased again. Moreover, unverified rumors abounded the cryptocurrency market that the long-bankrupt Mt.Gox exchange was going to distribute 140,000 BTC among creditors. The potential launch of such BTC volumes into the market has provoked panic and vigorous discussion. However, Mt.Gox trustee Nobuaki Kobayashi denied all rumors regarding the distribution of 140,000 BTC.

Despite the denial of the rumors, the series of FUD in the market continued. Forbes conducted an investigation and claimed that about 50% of all transactions in the BTC network are fake. The magazine's experts analyzed more than 150 crypto exchanges and came to the conclusion that more than 50% of trading volumes are not confirmed by real transactions. This is extremely negative news for potential investors which significantly undermines Bitcoin's fundamental value.

All these aspects had a profound impact on Bitcoin's decline. As for technical factors, the stock market played a major role. Initially, stock indices such as the SPX and NDX started to decline following Powell's speech. The high correlation of cryptocurrency with the stock market triggered a drop in Bitcoin's price and the entire market. Taking into account the forecasts of a key rate hike of 75 basis points, there is no doubt that the prices of financial instruments will adapt to the negative changes in the coming weeks.

Bitcoin was down to the $20,000 level and made its bearish breakthrough. As of August 29, the cryptocurrency is trading below the psychological mark near $19,800. However, technical indicators show that Bitcoin's price is likely to recover above $20,000. In this case, the cryptocurrency's daily chart will form a bullish false breakout pattern which could trigger a local bullish momentum. Technical indicators point to active buyers around $20,000. A stochastic oscillator has formed a bullish crossover and crossed the bullish zone boundary, while the RSI rebounded from the lower boundary of the bullish zone and resumed its upward movement.

In the short term, it is possible to see signals for the end of the current stage of decline caused by Powell's speech and the correlation with the stock indices. Cryptocurrencies will probably make a local upward rebound. Buyers intend to defend the $20,000 mark and begin the consolidation phase. However, the price will most likely fall below $20,000, and even $17,700 in the long term. This strong Bitcoin's decline can trigger another wave of bankruptcies and make the situation of miners even worse. Therefore, even a local bullish scenario looks unlikely in the coming weeks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română