On Monday, markets were digesting the hawkish statements of Chairman Powell, who stressed the importance of rate hikes and restrictive measures to tame inflation. US Treasury yields soared, and stocks closed in the red zone. Earlier on Tuesday, however, they somewhat retraced up.

The CME is currently showing a 69.3% chance of a 75 basis point rate hike at the September FOMC meeting. The dollar is stronger against the basket of major currencies. However, due to high recession risks and raging inflation in all Western countries except Japan, the greenback can rightfully be called the best of the worst.

WTI and Brent gained about 4% after Iran had accused the United States of procrastinating in efforts to revive the nuclear deal. Whatever the reason, a drop in energy prices is unlikely, even if demand decreases due to recession concerns.

NZD/USD

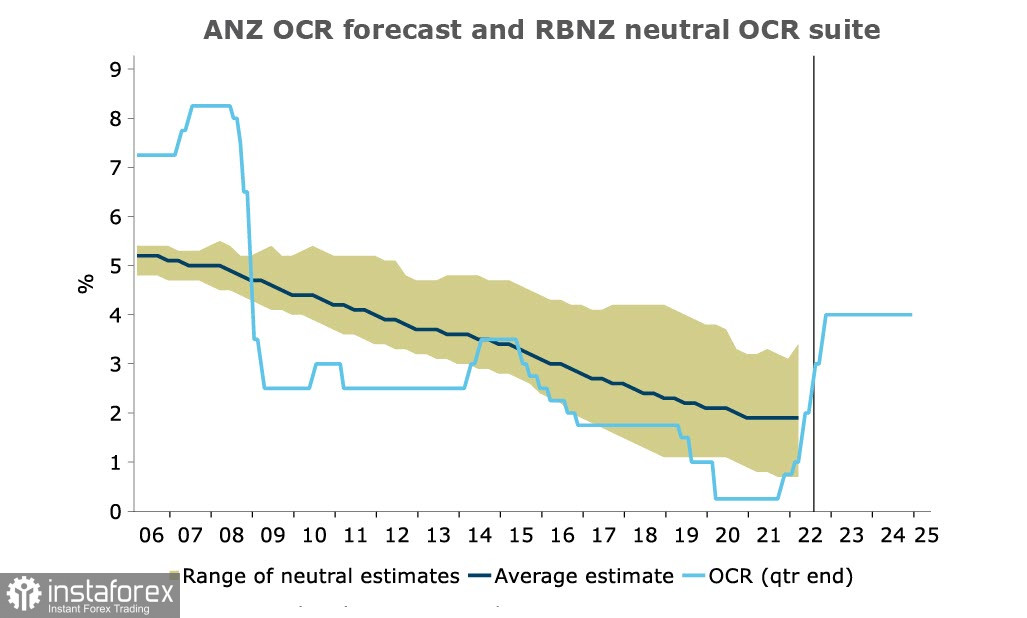

The ANZ Bank has reviewed its outlook to rule out the possibility of a rate cut cycle in 2024. This indicates that the state of New Zealand's economy is far from perfect and is hard to forecast. The interest rate is seen climbing to 4% by the end of the year.

There have been signs that high inflation is becoming an integral part of the economy. In the second quarter, private wages grew by 7.0% y/y, the proportion of employees receiving annual wage increases of more than 5% hit the high unseen since 2008, core inflation ranged between 4.8% and 6.1%, non-tradable inflation rose to 6.3%, and inflation expectations remained too high.

An increase in wages means that the economy is adjusting to high inflation. Therefore, the RBNZ is highly likely to raise the cash rate to 3% from the current 2%.

Due to the earlier start of rate hikes, New Zealands may now slip into a recession sooner than any other economy. Therefore, demand for NZD is gradually decreasing.

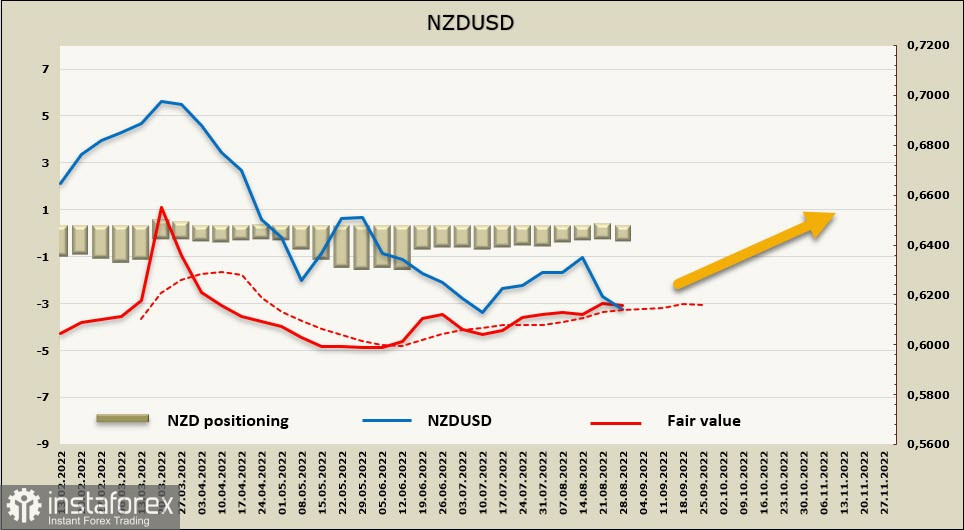

According to the CFTC report, positions in NZD are now hovering around zero. The weekly change in NZD is -204 million, the net short position reaches -92 million, settlement price holds above the long-term moving average, attempting to go further down.

Last week, it was assumed that the kiwi would settle above the 0.6050 low and attempt to retrace up. On Monday, it became clear that such a scenario is unlikely. The price is expected to test the mark of 0.6050 and move sideways ahead of US labor market data due on Friday.

AUD/USD

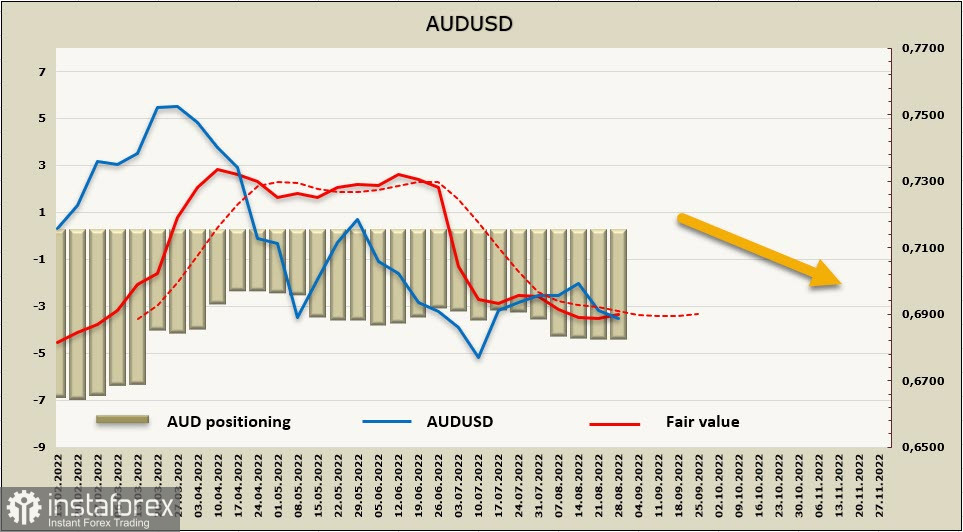

No important macro events are scheduled for this week in Australia. A sharp decrease in building permits (-17.2%) in July indicates a possible fall in demand. On Thursday, if mortgage lending data for July comes lower than forecast, the Aussie dollar could feel additional pressure.

Next week, the RBA will hold a meeting, which will become the driving force for the pair. Like in New Zealand, high wage growth means that inflation will hardly slow down fast. In this light, the RBA will have no other choice but to raise the interest rate and resort to monetary tightening due to the high risk of an earlier recession.

Surprisingly, there is a zero weekly change in AUD. The net short position is at the level of -4.161 billion, and the settlement price is below the long-term moving average.

Last week, the Aussie dollar failed to reach 0.6829 support. The pair is likely to trade sideways, and there is no reason for a bullish reversal. A rise above the 0.7012 high seems improbable, so all growth attempts should be used for selling.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română