The pound sterling was unable to regain momentum even after a rise in the euro. It kept extending losses. The fact is that the Fed and the ECB have already pledged to stick to a hawkish stance, while the BoE is sitting on the sidelines. The BoE was the first to raise the interest rate. It's time to take a pause and assess the effect of monetary tightening. Today, the UK will unveil the House Price Index, which is projected to decline to 9.4% from 11.0%. Given the importance of reports on the real estate market, a drop may signal a potential slowdown in inflation. If so, the Bank of England could slow down monetary tightening.

UK House Price Index:

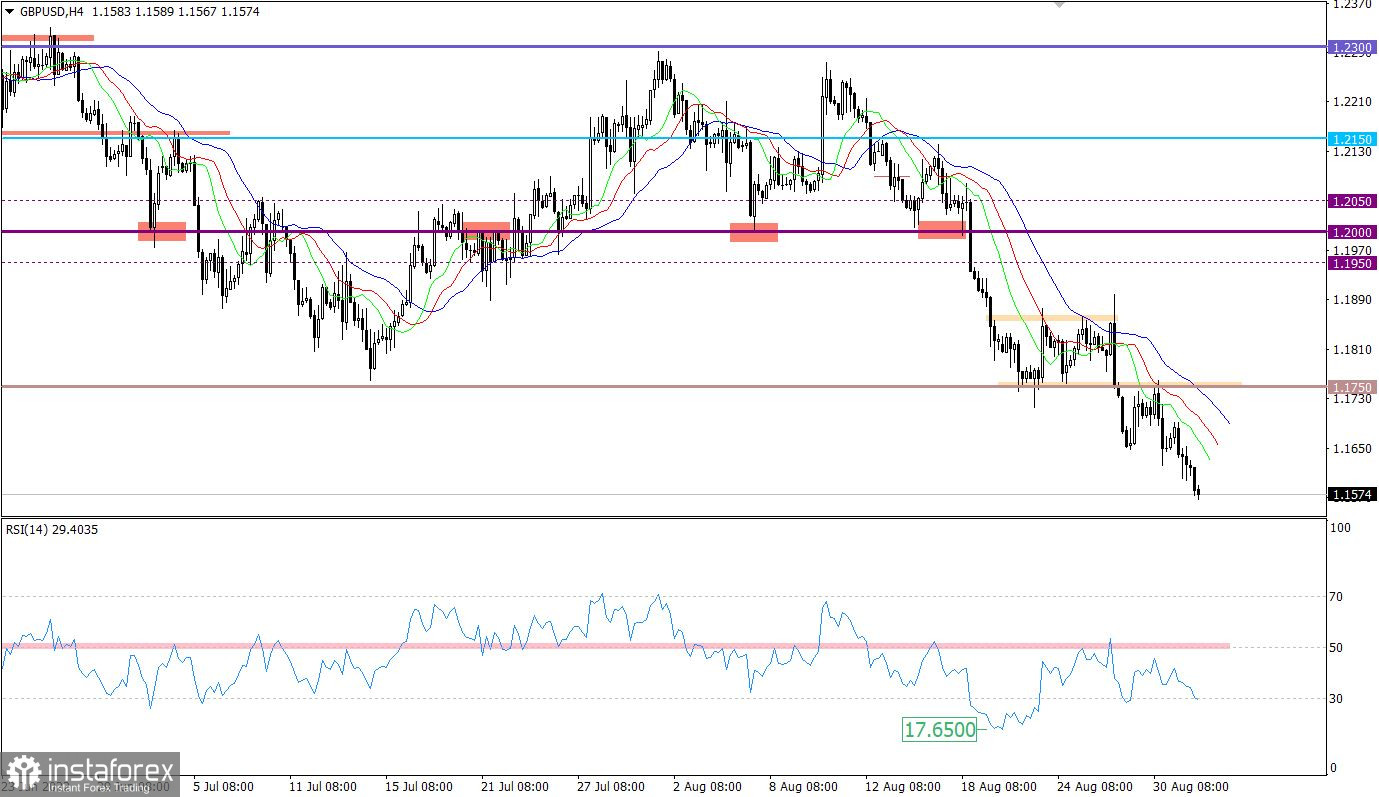

The pound/dollar pair is gradually declining, which facilitates the prolongation of a downtrend. Since early August, the pair has lost 700 pips, which is rather a strong change. The pair may become extremely oversold.

On the D1 and 4H charts, the RSI indicator is moving within the oversold zone. It confirms the scenario that the pair could become oversold.

The Alligator indicator shows that the moving averages are pointed downwards on the H4 and D1charts, which is in line with the direction of the main trend.

Outlook and recommendations

The pair is likely to reach a swing low of 2020. It is trading not far from this level. So, a technical correction may occur in the near future.

The complex indicator analysis indicates a bearish cycle on the short, intraday, and medium-term charts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română