UK's next prime minister Liz Truss has to face a lot of problems: the dollar close to its lowest level in decades, an unprecedented rise in public borrowings, and a record decline in domestic reserves.

The British pound fell over 15% against the dollar in 2022. Moreover, it has just achieved its worst monthly performance since Brexit in 2016. Meanwhile, the cost of business borrowings has jumped after six successive Bank of England's rate hikes, while expectations of further increases have risen amid warnings of out-of-control inflation.

Some upper business circles speculate that the country has already been facing a recession, according to rising energy prices. Declining household spending and real wages have triggered a series of strikes in all sectors as the cost-of-living crisis has intensified.

Liz Truss will most likely win the race to succeed Boris Johnson as UK prime minister. As the results of the election are announced today, investors will be monitoring whether the new policy will ease or worsen the decline in British assets. Strategists fear that Truss may borrow heavily to fund tax cuts, further damaging the UK's balance sheet.

Brief overview of current situation in UK markets:

Pound sterling

After dramatic decline this year, the pound is trading below $1.15, close to its lowest level since 1985. The momentum indicator, i.e. the Fear and greed, implies that sellers firmly control prices. The pound's weakness increases the cost of imports, fueling already rapid inflation.

Government bonds

The 2-year government bond yield rose by more than 3.1%. It was considered the highest rate since the global financial crisis in 2008. Moreover, investors abandoned their hopes that the worst sell-off ended. Swaps related to the Bank of England's policy meetings show that expectations for a rate hike have risen, implying that the key rate will more than double from 1.75% by the end of 2022.

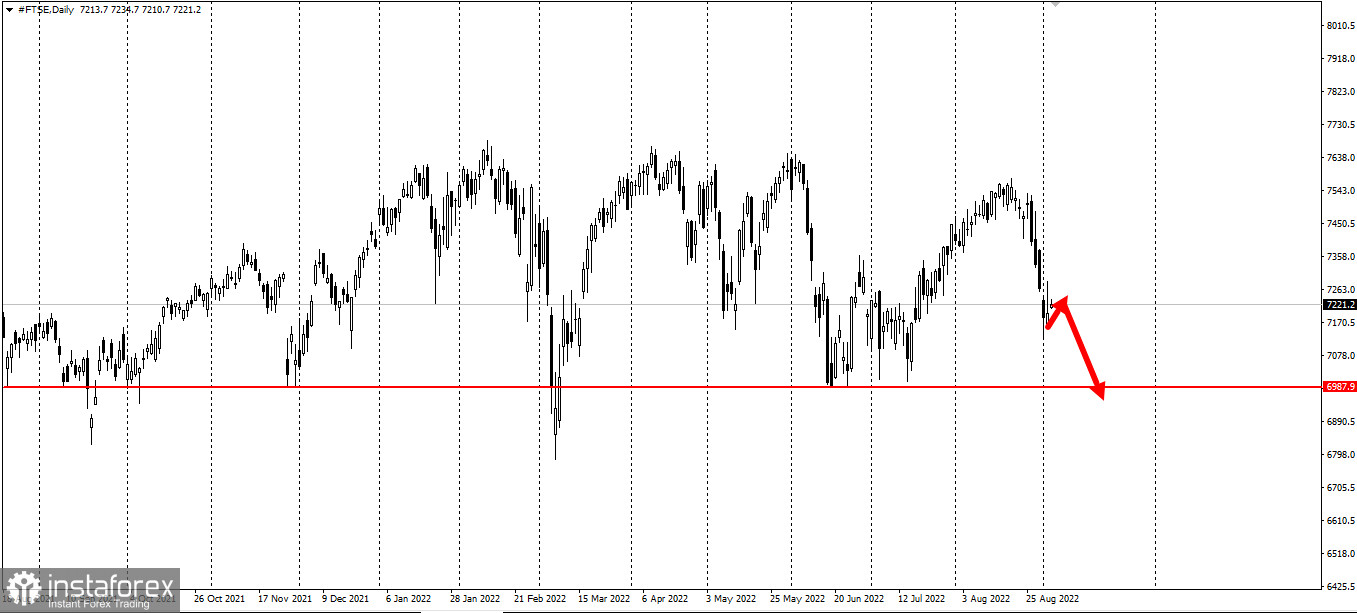

UK stocks

The mid-cap FTSE index, whose member companies are heavily dependent on the domestic economy, is on course for its biggest-ever annual underperformance versus the exporter-focused FTSE 100. That's as the blue-chip FTSE 100 continues to be supported by mining and energy firms, which are getting a windfall from booming commodities markets, as well exporters, who benefit from the sterling's decline.

Corporate debt

Borrowing costs for blue-chip British companies have exceeded 5% for the first time in more than a decade, as skyrocketing inflation hammers the country's corporate sector.

The yield spread between sterling and dollar-denominated corporate bonds is the widest since 2014, reflecting particularly acute pressure in the UK.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română