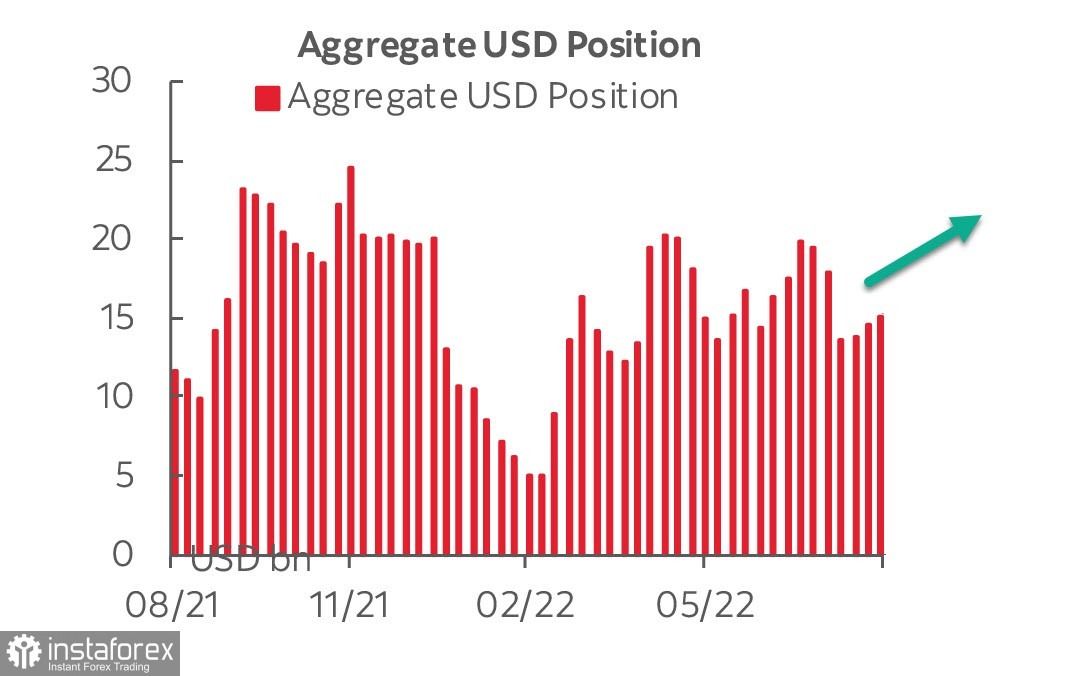

According to the CFTC, the overall balance in favor of the US dollar continues to rise, but the pace remains weak. The total speculative net position against major currencies increased by 455 million over the week and reached 15.1 billion.

Also noteworthy is a noticeable reduction in the long position in gold by 1.7 billion, which indirectly indicates an increase in demand for the dollar as the main defensive asset. The lack of a clear increase in demand for the dollar may indicate that traders are not confident in the continuation of the Federal Reserve's hawkish position, as the risk of a quick recession is growing.

The US labor market report, the expected main event of the week, came out broadly in line with expectations. 315,000 new jobs were created, which is slightly higher than the forecast, the last two months were revised downward by 107,000. Unemployment rose to 3.7%, but the average wage growth was less than forecast, which will slightly reduce inflation expectations. There were first signs that tensions in the labor market are easing, markets interpreted the report as a decrease in the chances of a 0.75% Fed rate hike on September 21, now this probability is 55% against 75% earlier.

The US banks are closed due to the celebration of Labor Day on Monday, we expect low volatility.

OPEC+ confirmed the decision to reduce oil production in October by one hundred thousand barrels per day, returning to the levels of August, oil prices reacted with growth, it is obvious that there is no need to expect a drop in energy prices due to reduced consumption.

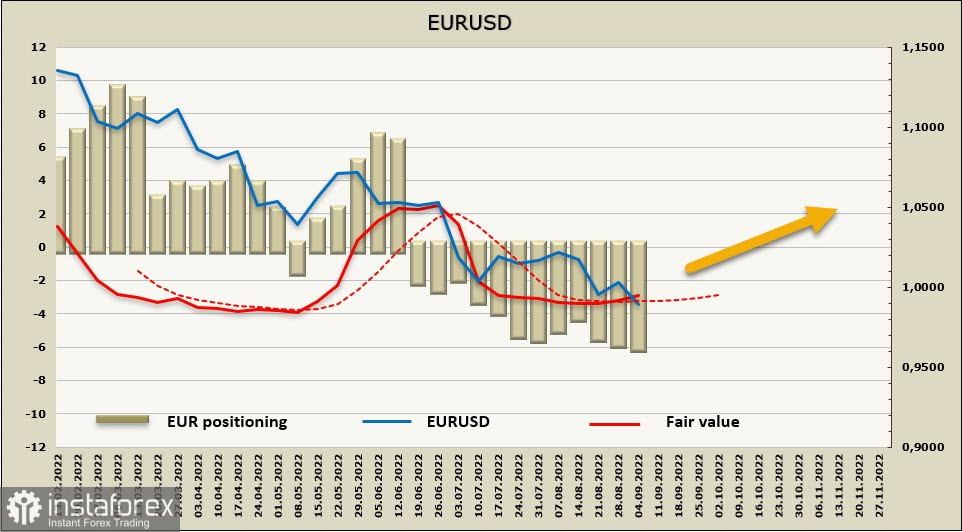

EURUSD

The main news for Europe is the complete shutdown of the Nord Stream gas pipeline, which provoked a sale of shares, a decrease in bond yields and a weakening of the euro. Energy rationing is just around the corner, but you don't have to be Nostradamus to predict that no amount of rationing under the current conditions will be able to keep heavy industry afloat unless supplies resume.

The German economy will no doubt enter recession in the coming months. The Sentix investor confidence indicator fell to -31.8p, which is much worse than expected, S&P Global PMI indices fell below the 50p expansion border, that is, the process of economic collapse has begun.

The euro net short position is up 471 million to 5.97 billion, bearishly strong, but the settlement price is not turning lower, indicating two factors at once. The first is that European stock indices are holding up no worse than American ones, which is somewhat unexpected in the face of the threat of an energy crisis in Europe. And the second is the outstripping growth of euro bond yields, which indicates growing confidence that the European Central Bank will start implementing more aggressive methods of curbing inflation. Thus, Thursday, September 8, becomes decisive for the future prospects of the euro.

The consolidation of the euro below parity was an expected event, and it happened, but a new driver is needed for further decline. Let's assume that the euro will try to find a base near the current levels (the middle of the bearish channel), after which an attempt to recover to the local high of 1.0357 will follow.

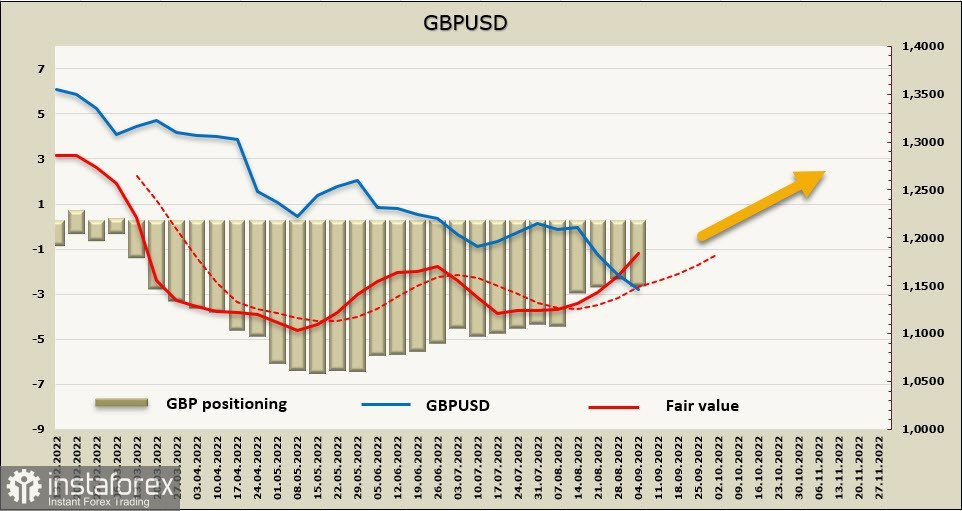

GBPUSD

Liz Truss has been elected head of the British Conservatives and will take over as prime minister, Graham Brady, head of the ruling Conservative Party's steering committee, said. Truss is considered more radical than her rival Rishi Sunak, so the pound reacted to the news of her election with a slight decline.

The pound's net short position edged up slightly to -2.125 billion, but UK GKO yields are rapidly approaching US treasures, reflecting growing investor confidence in the Bank of England's readiness to fight inflation even more aggressively. Rising yields, despite the fact that stock indices are stable, will cause an increase in interest in the pound. This is what we see from the behavior of the settlement price, which does not want to fall, despite the obvious weakness of the pound.

We expected an attempt to hit lows before a bullish pullback, however, the pound went even lower, almost reaching the 1.1414 support. We assume that there will be a struggle for further direction near this level, and, judging by the volume of bond sales, the bulls will have a good chance to win back part of the losses. We need to see a very strong statement from the BoE on September 15 for resistance at 1.1758, 1.1900 to move higher. Technically, the bearish momentum is strong, but a number of fundamental factors give reason to expect corrective growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română