Everything ends sometime. The end of the era of easy money for gold means only one thing—hard times are coming. The precious metal was reaching its historical peaks thanks to the colossal cheap liquidity from the Fed, which drove real yields into the negative area. The Fed is now aggressively tightening monetary policy, bringing real debt rates back above zero and is hitting hard across asset classes. Should we be surprised if gold falls below $1,700 an ounce?

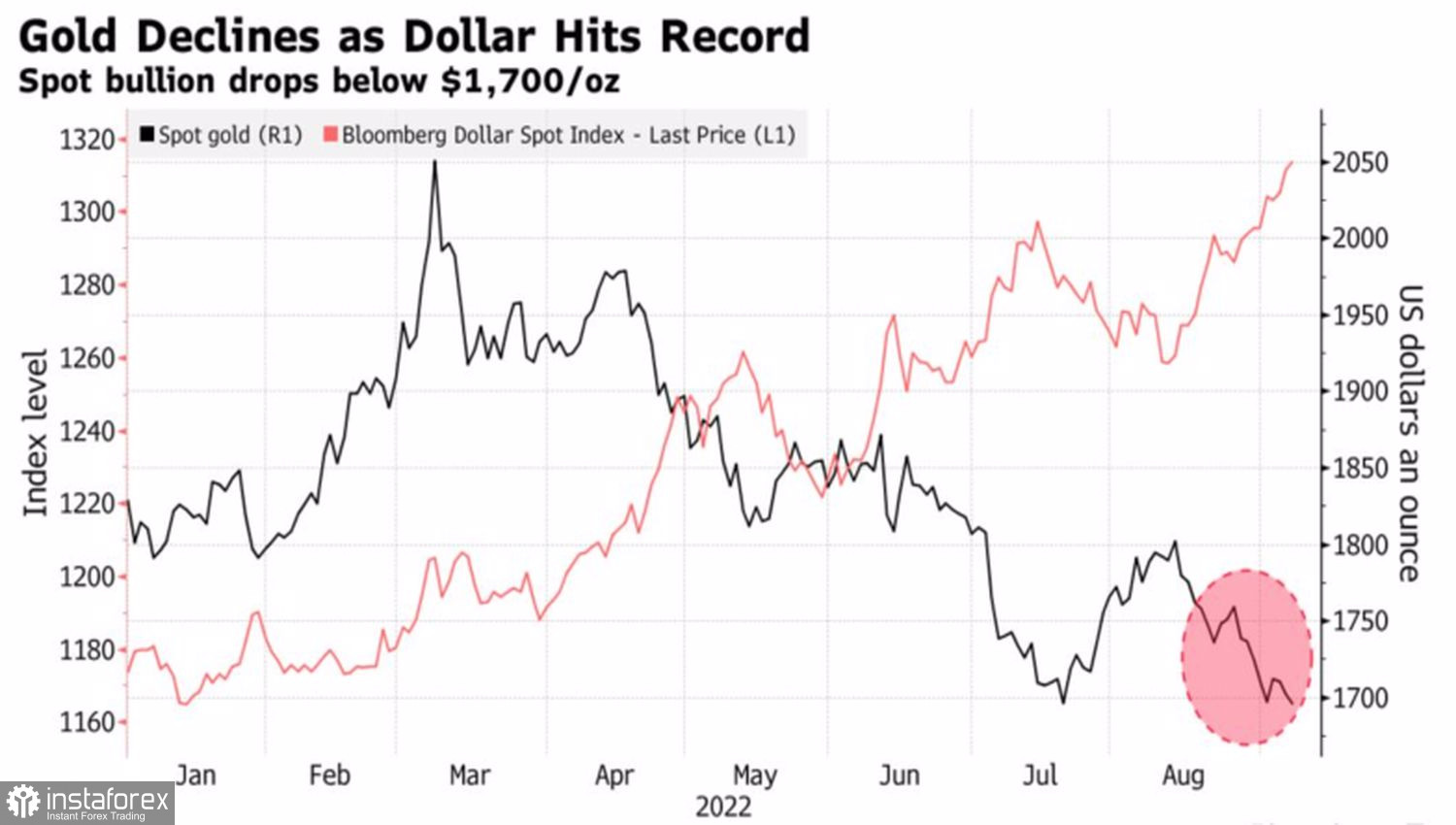

Central banks usually act like a pack. If the leader in the form of the Fed raises rates, most other regulators do the same. As a result, their economies are slowing down, while the US economy, thanks to massive fiscal and monetary stimulus in the era of the pandemic and a strong labor market, remains resilient. The outstripping dynamics of US GDP leads to the strengthening of the dollar, whose index from Bloomberg reached a record high. It is not surprising that the precious metal, which is considered to be the anti-dollar, is falling.

Dynamics of gold and US dollar

Europe's energy crisis complicates the situation, leading the euro to a 20-year bottom and the pound to its lowest level since 1985. The restrictions due to COVID-19 in China are slowing down the local economy and pushing the yuan into the abyss. Meanwhile, the reluctance of the Bank of Japan to normalize monetary policy is drowning the yen, which has collapsed against the dollar to its lowest level in almost a quarter of a century.

The combination of a strong US currency and high real yields on US Treasuries is deadly for gold. And it could get even worse as the market underestimates the impact of the quantitative tightening program. When the Fed exited the previous QE, Treasury Secretary Janet Yellen argued that it should be done very slowly, as if watching the paint dry. Now the highest inflation in 10 years is pushing the Fed to take aggressive action. From September, monthly QT scale will rise to $95 billion, which Bank of America estimates could lead to a 7% peak in the S&P 500 before the end of the year.

Falling stocks are perceived by investors as a deterioration in global risk appetite, which strengthens the demand for the US dollar as a safe-haven asset. Gold is losing again. Moreover, Fed's reduction in balance sheet will accelerate the process of increasing the yield of Treasury bonds.

What can help the "bulls" on XAUUSD? It's difficult to imagine. Theoretically, a further slowdown in inflation could weaken the dollar on expectations of less Fed aggression. However, it will lead to a further rally in real bond yields, which is bad news for the precious metal. Most likely, corrections in its performance will be short-lived.

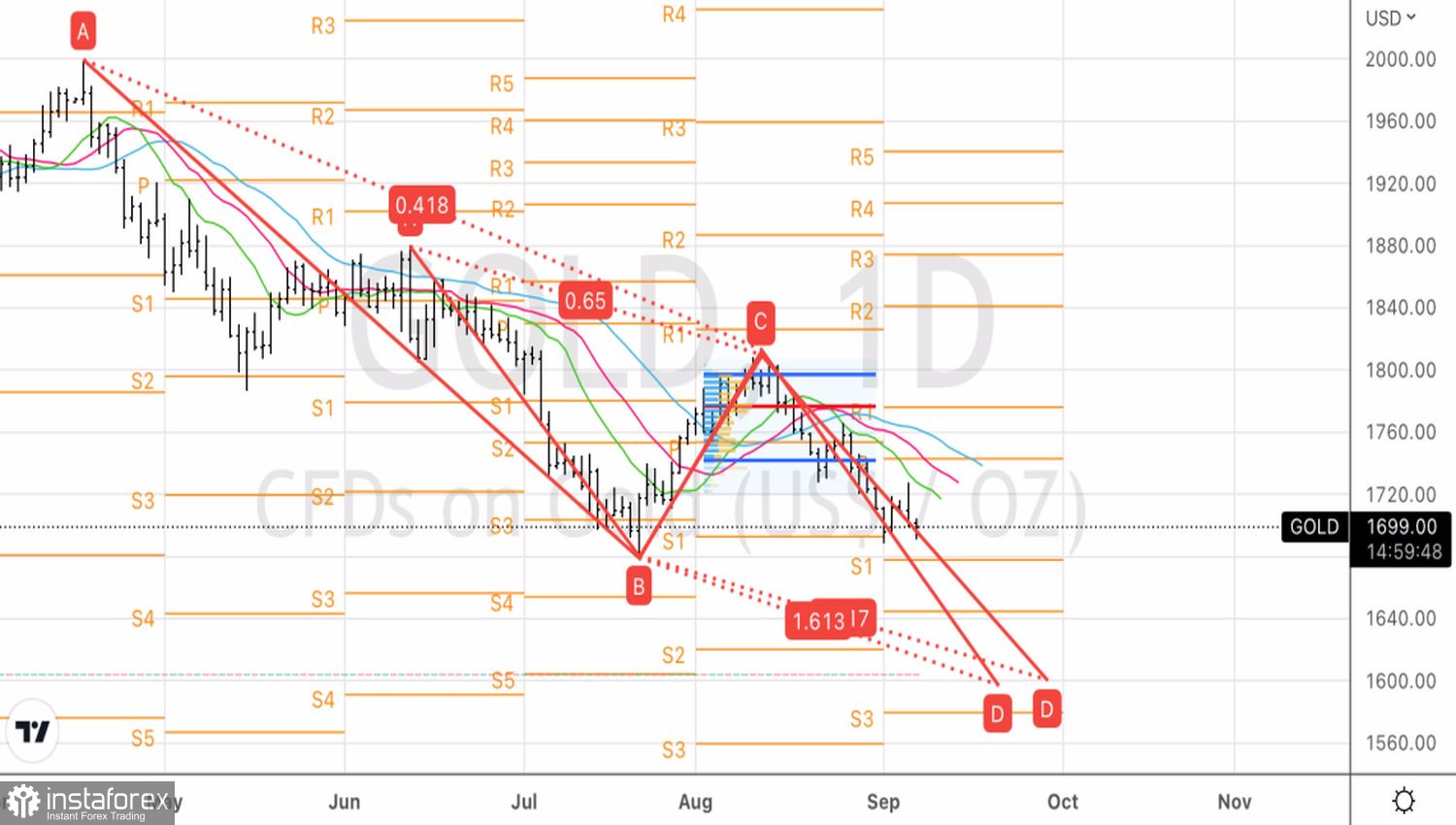

Technically, on the daily chart, gold continues to fall towards the 161.8% targets on the AB=CD parent and child patterns. We will use the breakout of the pivot point at $1,692 to build up the previously formed shorts towards $1,600 per ounce.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română