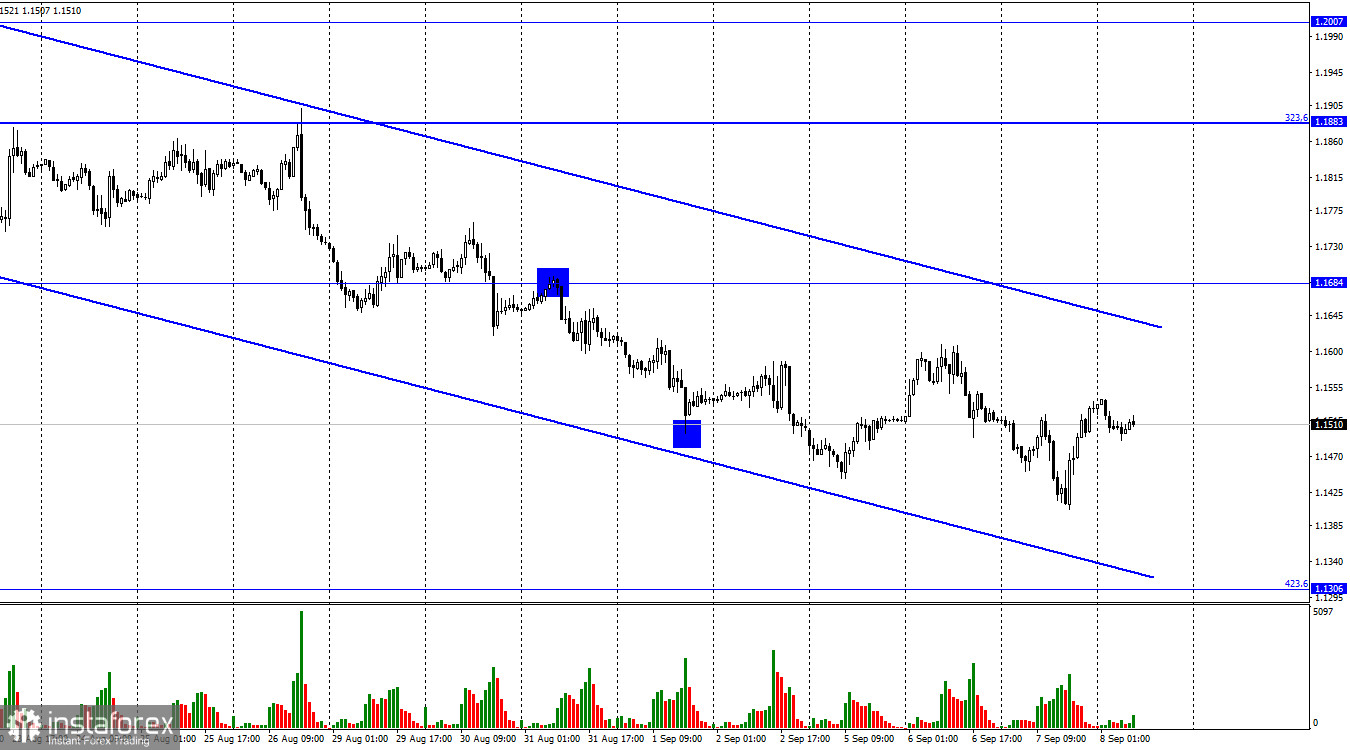

Hello, dear traders! On the 1-hour chart, GBP/USD reversed to the upside and headed towards the upper limit of the descending corridor. However, this growth could stop already today due to the strong bearish bias. Yesterday, the quote fell to 1.1404, well below the 40-year lows. In other words, traders witnessed a historic event. Taking into account the current market sentiment, the sell-off of the pound is likely to continue. Although interesting fundamentals came yesterday, they hardly impressed traders. Thus, BoE Governor Bailey forecasts a further acceleration in the UK inflation and says it could stay at a record level for years.

It remains to be seen how inflation behaves in the long run. Anyway, risks are growing along with consumer prices. The governor also hinted that the Bank of England could hike rates again in the future. So far, six rate increases this year have in no way contributed to a slowdown in consumer inflation. It may well be that the Bank of England raises the interest rate higher than the Federal Reserve. Indeed, US inflation has shown the first signs of a slowdown. Meanwhile, UK inflation is still on the rise. Bailey also pinpoints that the country is sliding into a recession, while high energy prices are posing a serious threat to the economy and households. Yesterday, the Federal Reserve released its economic report, commonly known as the Beige Book. It contains information on the economic situation in 12 US districts and is in no way a summary of forecasts or official statements of Reserve Bank presidents. Unlike Governor Bailey's speech, which caused a fall in the pound yesterday, this report was of secondary importance to traders.

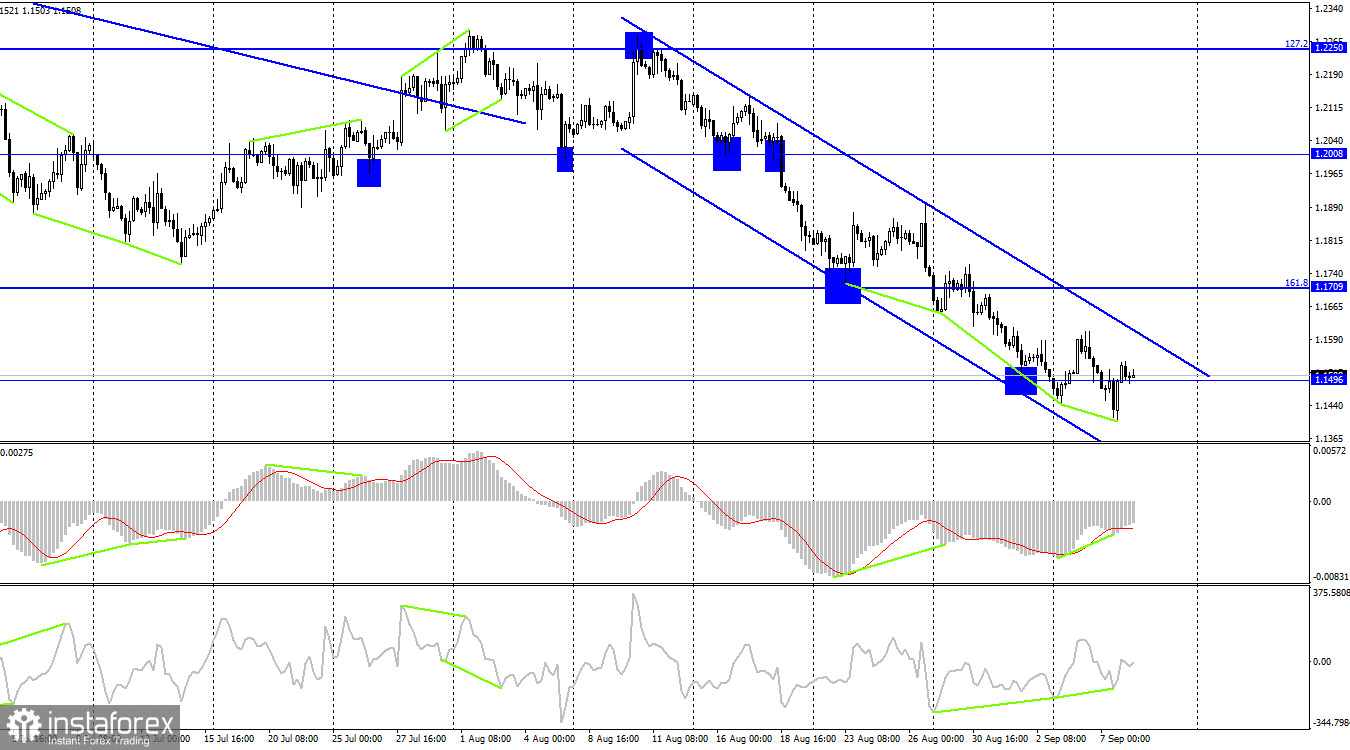

On the 4-hour chart, the pair reversed to the upside and showed some growth after the CCI and the MACD had formed divergence. The pair is moving in the descending corridor and market sentiment is currently bearish. In this light, the pound may rise only after consolidation above the descending corridor, with the target at the 161.8% retracement level of 1.1709.

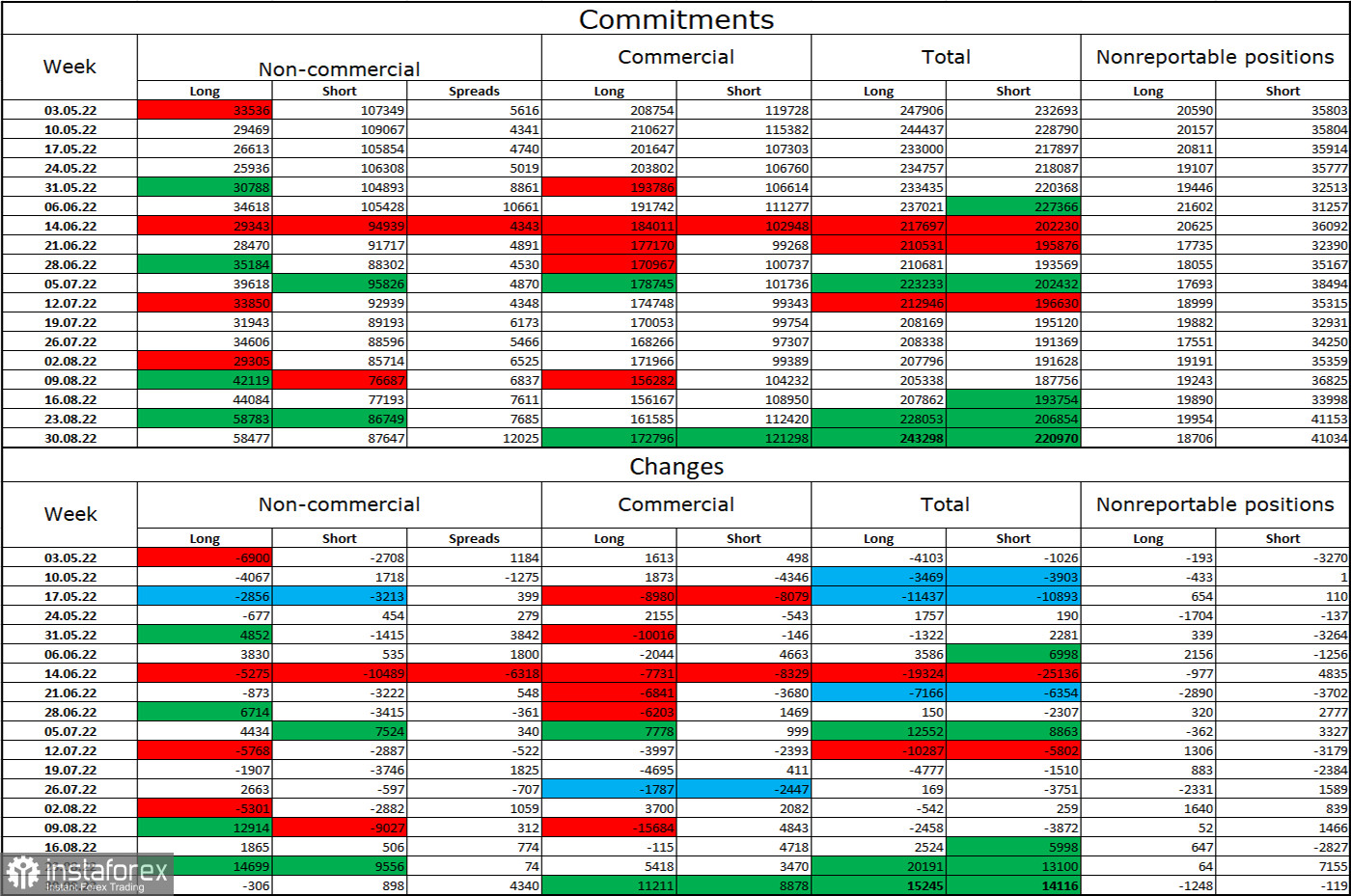

Commitments of Traders:

The sentiment in the group of Non-commercial traders grew more bearish last week. Long positions decreased by 306 and short positions increased by 898. In other words, there is a strong bearish bias, with the number of short contracts still exceeding long ones. It will take a lot of time before bearish sentiment turns bullish. Based on COT data, the downtrend has resumed and the pound is likely to remain weak rather than get stronger.

Macro events in the United States and the United Kingdom:

United States: Initial jobless claims and Fed Chairman Powell's speech

On Thursday, the UK's macroeconomic calendar contains no important releases. The focus will be on Fed Chairman Powell's speech. The fundamental background could be weighing on the market today.

Outlook for GBP/USD:

It would be wiser to go short after the price has closed below 1.1496 on the 1-hour chart, with the target at 1.1306. Trades could be held open for now. Once the price settles above the descending corridor on the 1-hour chart, with the target at 1.1883, buy trades could be considered.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română