World markets closed higher last week, indicating that sellers are inactive ahead of incoming US news and Fed meeting next week. The main reason was the ECB meeting, at which the key interest rate was raised by 0.75% to 1.25%. Another factor could be the statements of both Christine Lagarde and Jerome Powell, which once again hinted that central banks would act aggressively when raising rates.

However, some believe that the Fed will not be able to withstand pressure, so they will take a pause in rate increases. They said the central bank will act only when consumer inflation in the US slows down. Forecasts already say CPI is likely to decline from 8.5% to 8.1% y/y, then from 0% to -0.1% m/m.

If the data comes out lower than expected, the Fed will raise rates by only 0.25% in October. In this case, a slowdown in the sale of government bonds and a continuation of the weakening of dollar can be expected. Also, the rally in stocks that began last week may continue, which will spur the growth of risky assets, including euro.

Forecasts for today:

EUR/USD

The pair is trading below 1.0110. Overcoming this mark may push the quote towards 1.0200.

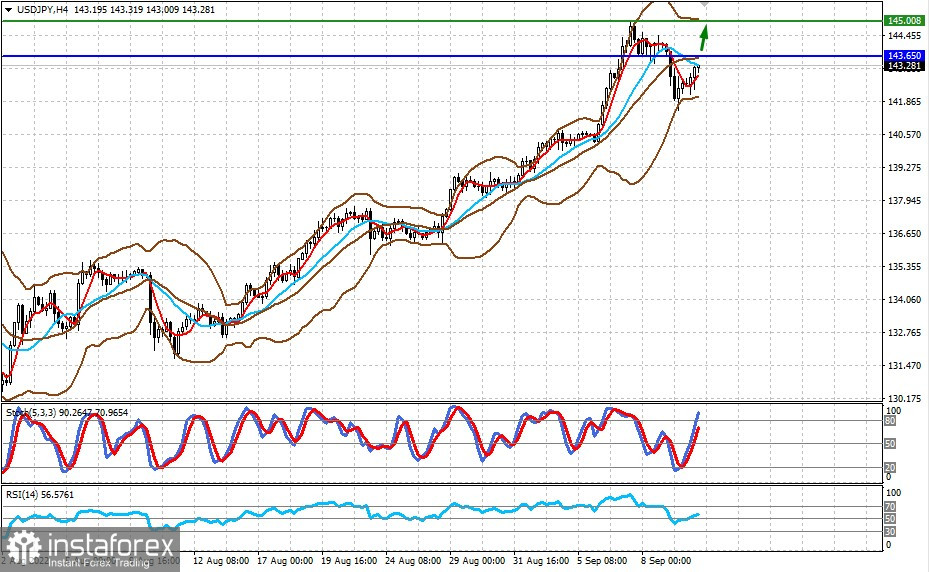

USD/JPY

The pair is rising, thanks to positive market sentiment. This may lead to a further increasefrom 143.65 to 145.00.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română