In order for the Federal Reserve to turn off the path of tightening monetary policy, one of three conditions must be met. If inflation reaches the 2% target. Or the US economy is facing a severe recession. Or complete chaos begins in the financial markets. In such scenarios, the central bank will understand that it would be dangerous to move on, but the current rally in US stock indices, on the contrary, indicates that everything is fine with the economy and markets. The latter obviously put on rose-colored glasses, pulling EURUSD to the stars.

With US gasoline prices falling over the past 13 weeks, oil returning to early year levels, lower inflation expectations from the New York Fed and rents, consumer prices have peaked. It was recorded in June and amounted to 9.1%, after which the decline began. It is difficult to dissuade investors that inflation in August will be lower than in July, and in September it will be lower than in August. If so, there is no need for the central bank to aggressively raise the federal funds rate, and its current CME derivatives forecast of a peak of 4% seems too high. Is it time to sell the US dollar?

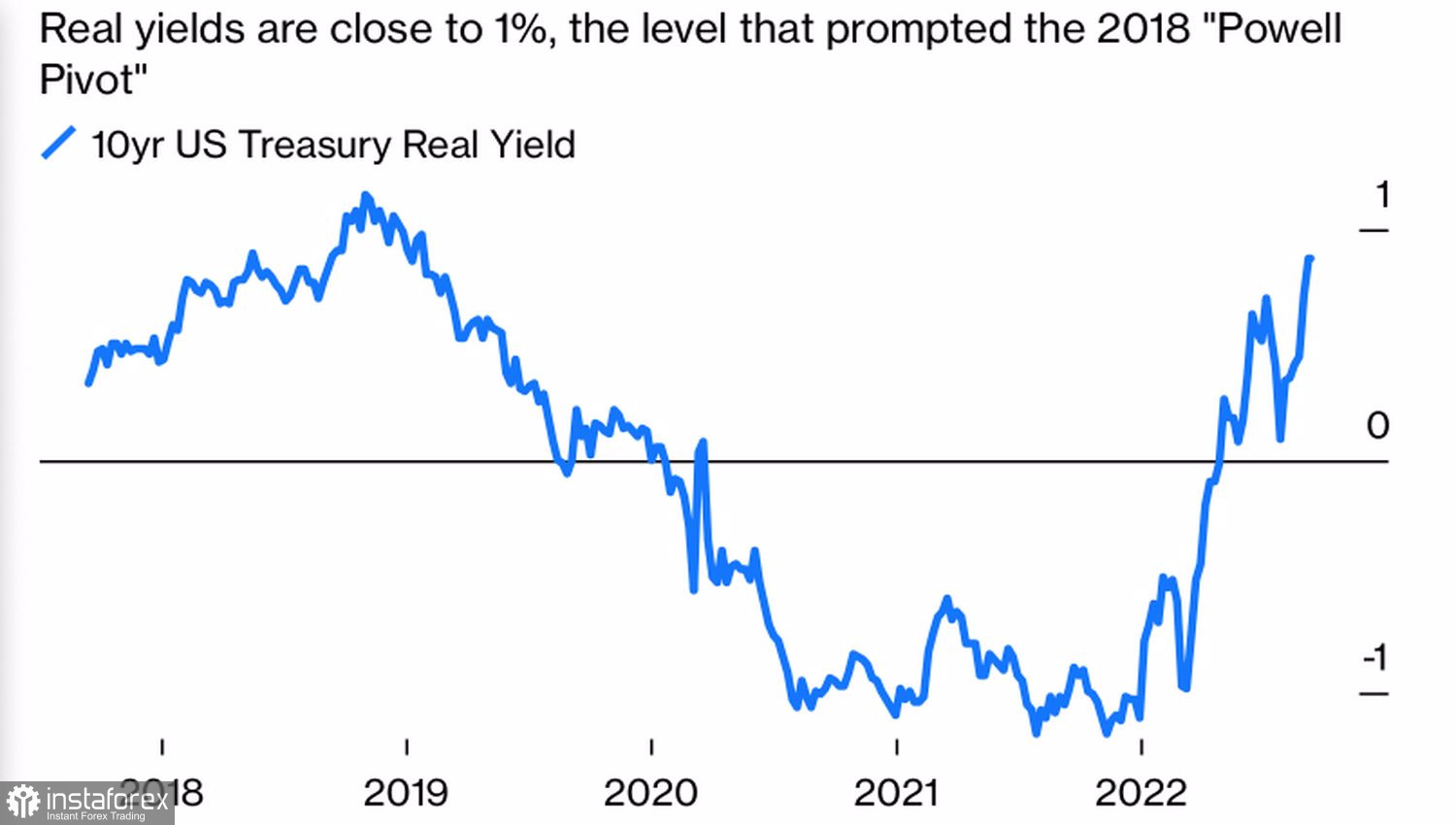

Markets are still hoping for a Fed dovish turn in 2023, and the rise of the 10-year inflation-protected TIPS yield to the critical 1% mark is further convincing. The fact is that after a series of increases in the federal funds rate in 2015-2017, the central bank began to reduce it in 2018. Similar story?

Dynamics of real yields of US bonds

In my opinion, no. Four years ago, there was a storm in the financial markets, and the Fed admitted that financial conditions were being tightened too much. Tightening financial conditions is now a mandatory requirement to curb inflation. The situations are fundamentally different, and the central bank is not going to make any reversals. What FOMC officials are talking about in unison. The market doesn't listen to them. It put on rose-colored glasses and will surely pay for its carelessness.

The question is not whether inflation is slowing down or not. The question is, how fast does it do it? Bringing down the growth rate of consumer prices from 9% to 5-6% may be easier than from 3-4% to 2%. Blame the strong labor market, which will continue to fuel wages and inflation. Under such conditions, the federal funds rate is likely to remain at 4% for a very long time, and its differential with peers from Fed rival central banks will support the US dollar.

Thus, the Fed will not change its plans, no matter how inflation slows down in the United States in August. This gives grounds to continue selling the euro against the US dollar on the rise.

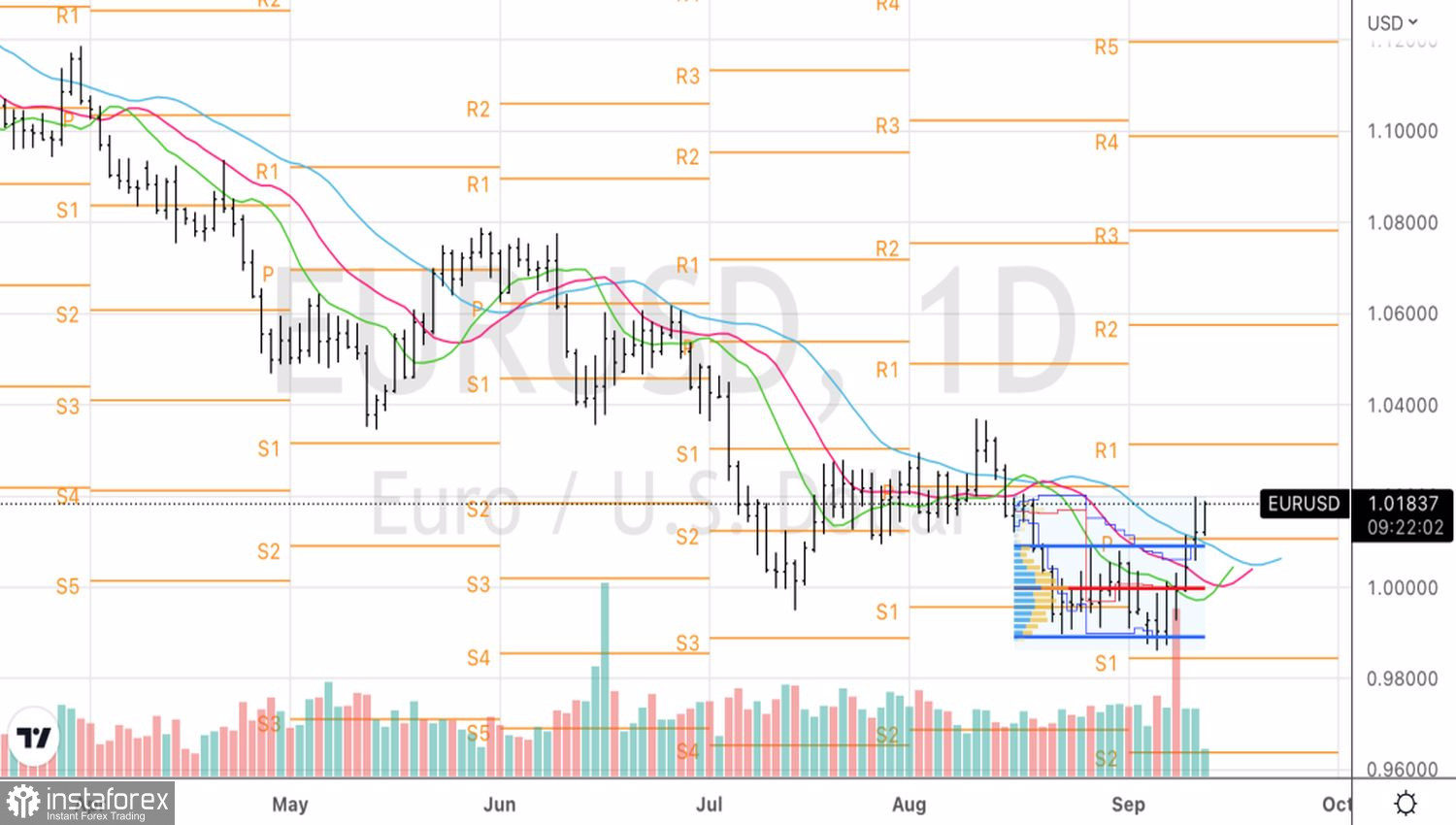

Technically, there is a correction to the long-term downward trend on the EURUSD daily chart. The bulls' inability to storm the resistance in the form of pivot levels at 1.022 and 1.03 will be evidence of their weakness and the reason for forming short positions in the euro against the US dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română