Markets collapsed on Tuesday after the release of consumer inflation data in the US. The report has indicated that inflation increased by 0.1% m/m and 8.3% y/y in August, instead of a decline that economists have been expecting.

Of course, traders reacted negatively to the news, primarily because it is likely that the Fed will continue raising rates aggressively in order to curb high inflation. But if the figure declines, albeit gradually, the Fed may consider not a 0.75% rate hike, but a 0.50%. That would return risk appetite and lead to a decrease in both Treasury yields and dollar.

So, positive market sentiment will return, perhaps starting today as an upward movement is seen in European and US stock indices. A rebound is also brewing in the forex market, prompted by the slight weakening of dollar.

That being said, attention should be paid to the data on manufacturing inflation in the US as a slowdown will increase positive market sentiment.

Forecasts for today:

AUD/USD

The pair is trading below 0.6725. If negative trends continue in the markets, the quote will continue to decline towards 0.6685.

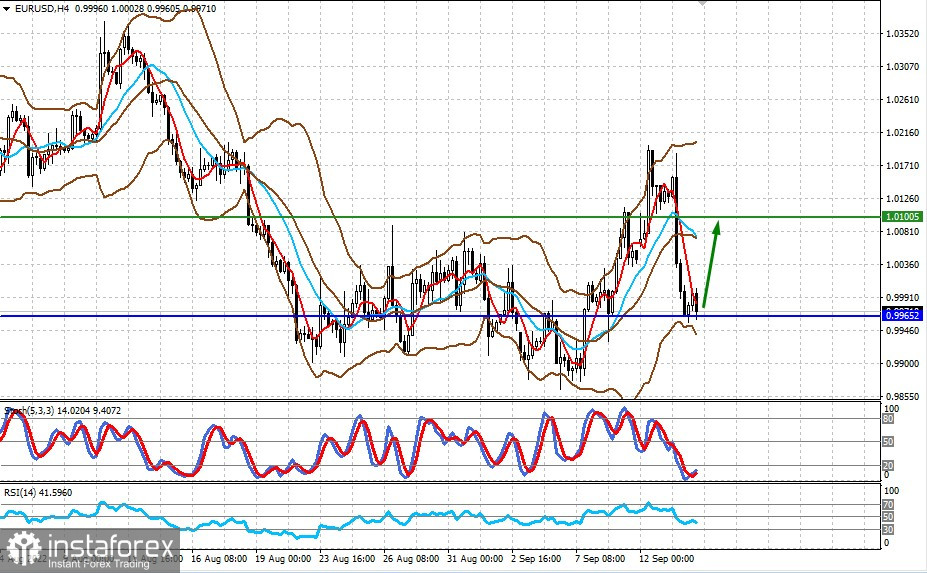

EUR/USD

The pair is consolidating above 0.9965. Further buying pressure will push it to 1.0100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română