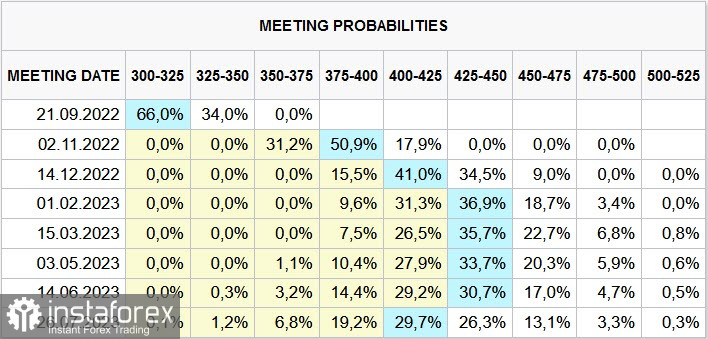

In August, the US core CPI increased to 6.3% on a yearly basis, significantly exceeding forecasts. As a result, markets launched a massive sell-off. The NASDAQ dropped more than 5%, whereas the yield of the US 2-year Treasury bonds surged by 29 basis points.

The euro declined below the parity level. The likelihood of the 75-basis-point rate hike by the Fed is almost 100%. What is more, the possibility that the Fed will raise the benchmark rate by another 75 basis points in November has already exceeded 50%. In other words, markets realized that the US regulator may resort to even more aggressive measures. Some analysts even suppose that the Federal Reserve may raise interest rates by 1%. Such assumptions are reflecting traders' grave concerns about surging inflation, which is very difficult to cap.

The Fed will continue limiting consumer demand. That is why there is no use to speculate on what level the Fed may stop the interest rate hike.

In this light, the US dollar is gaining in value. The fact is that the Fed is likely to remain a leader among large central banks. That is why the US dollar may receive long-term support.

Meanwhile, the UK unemployment rate declined to 3.6% from 3.8%, whereas the average weekly income without bonuses jumped to 5.2% from 4.7% in the last three months. In other words, inflation is likely to rise despite the limit of energy bill increases. According to NAB, Australia's inflation continues climbing, primarily due to the rapid growth in the average income.

Traders should understand that the combat against high inflation could be long-lasting. It will hardly end without a deep recession, caused by limited consumer demand.

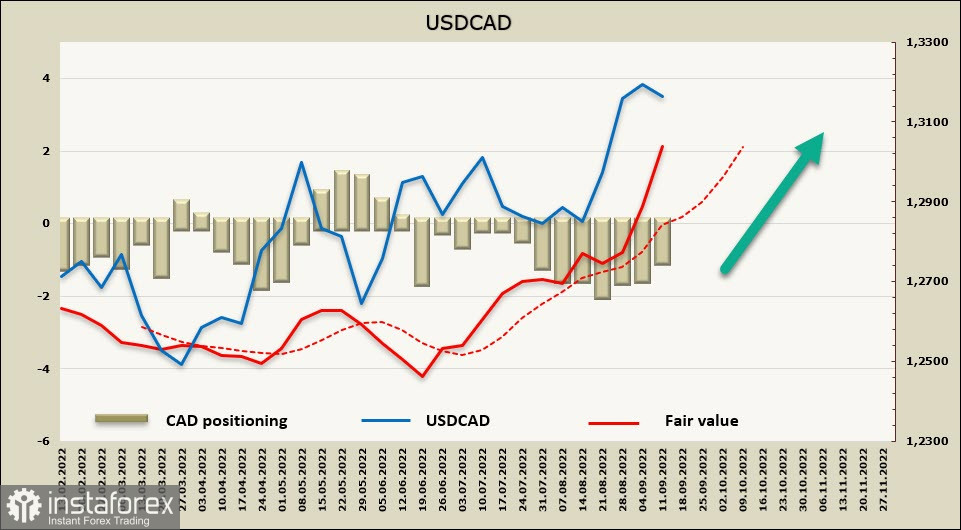

USD/CAD

The yield of Canadian securities is growing along with the yield of UST. It is highly possible that the Bank of Canada will raise the benchmark rate above 4% by December or even earlier.

The price pressure remains very strong. Retail sales continue increasing, whereas consumer demand is showing no signs of slackening. It means that the Bank of Canada is dealing with the same issues as the Fed. That is why almost the same approach to monetary policy tightening and a similar magnitude of interest rates hike may make the USD/CAD pair less volatile and more predictable.

In the given period, the net long position on the Canadian dollar declined by 485 million. USC/CAD is highly likely to go on climbing.

The Canadian dollar is confidently hovering near the upper limit of the correctional upward channel. It is likely to move up. The nearest target is located at the local high of 1.3222. Then, it is a technical level of 1.3335. The increase could become faster at any time.

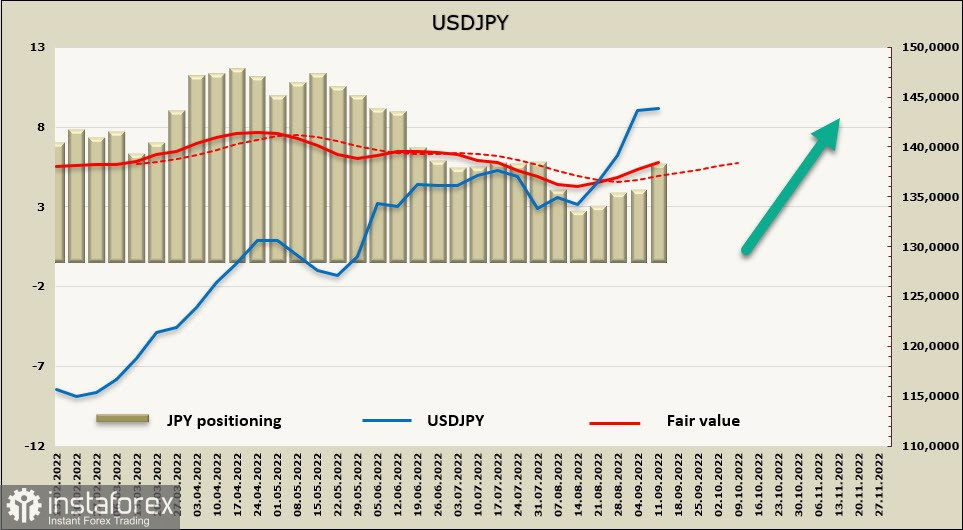

USD/JPY

Japan's economy looks stable. In July, orders for engineering products in the private sector (excluding ships and electricity) increased by 5.3% on a monthly basis, surpassing the forecast. On a seasonally adjusted basis, the indicator reached 966.0 billion yen, the highest level since June 2019.

According to the data published on September 13, businesses expressed optimism concerning future economic growth.

The Bank of Japan is still doing its best to boost consumer demand, unlike in the US and Europe. Against the backdrop, the yen may continue losing value.

The net short position on the yen resumed rising, adding 1.252 billion to exceed 5 billion. There are no reasons that may prevent a decline in the currency. Only a jump in demand for risk assets may somehow improve the situation.

The dollar/yen pair faced a resistance level of 144.93. However, the pair may break this level soon. The target is located at a high of 147.71, an important psychological level. The upward impulse is quite strong to push the price to this level in the next few weeks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română