Strong data from the US pushed markets up ahead of next week's meeting of the Federal Reserve. Reportedly, consumer inflation rose in August, while manufacturing inflation fell by 0.1% m/m and 8.7% y/y. The positive reaction of investors obviously indicated the growing hopes of a slowdown in inflationary pressures, which led to the rise of US stocks and slight correction of Treasury yields and dollar.

Now, a lot depends on the Fed's decision on raising rates, more precisely on the level at which it will increase. The central bank will base its decisions on the level of inflation.

So far, stocks are trading in both directions, with Asian ones having multidirectional dynamics before the start of the European trading session. Meanwhile, local investors won back yesterday's losses in European and US stocks. Dollar is also moving in different directions after Treasury yields rose by 0.46% to 3.428%.

While it is not necessary to say that trading in Europe will definitely start in a positive way, a rebound may be seen in markets if positive sentiment continues. This may happen if data on retail sales and jobless claims in the US do not turn out to be disappointing.

Forecasts for today:

USD/JPY

The pair is trading below 0.6725. If negative trends continue, the quote may continue to decline towards 0.6685.

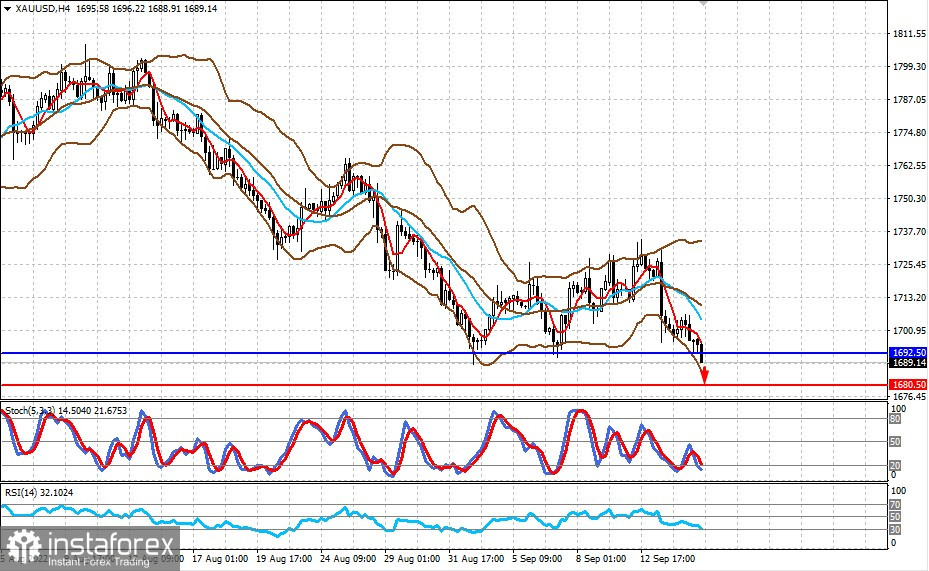

XAU/USD

Spot gold fell below 1692.50 due to the uncertainty over the results of next week's Fed meeting. Quotes may continue to drop to 1680.50.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română