While the whole world is discussing the Ethereum Merge update, it is important to finally deal with the consequences of slowing down the rate of decline in the inflation rate. CPI reporting had a negative impact on the crypto market and caused a reduction in total capitalization to the level of $998 billion. However, this is only an impulsive reaction of investors to bad news. The consequences of this process in the medium term may be more disastrous.

Inflation, the position of the Fed and the crypto market

In the summer, Fed Chairman Jerome Powell said that the agency was changing its strategy for raising the key rate. The regulator abandoned the predictive indicator planning model and decided to focus on actual data. The Fed also said that it plans to end the current year with a neutral rate.

Powell's statements removed the element of surprise, made Fed policy more transparent and gave investors hope. Markets took the theses of the head of the Fed as a transitional moment to the gradual easing of monetary policy. The peak of such sentiments occurred at the beginning of August, when the inflation rate fell above expectations.

A glimmer of hope amid the endless fog of the liquidity crisis provoked other positive rumors. One of the initiators of the positive statements was Arthur Hayes, who believes that as we approach the November Senate elections, the markets will pump up the money supply.

The slowdown in the rate of decline in the inflation rate put a bold dot on the likelihood of a change or easing of the Fed's current policy. After the publication of the CPI for August, an increase in the key rate by 75 basis points in September is a settled issue. In addition, the current order of movement of the price of Bitcoin and other financial instruments remains.

New Rules for Bitcoin Price Movement

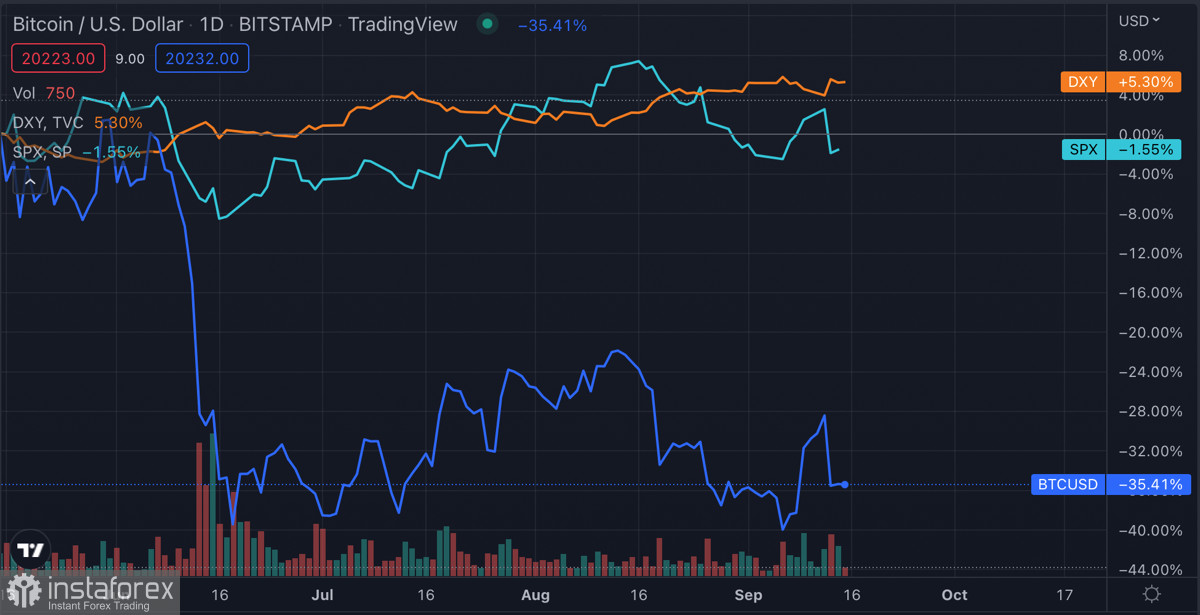

Insufficient rates of inflation reduction are forcing the Fed to maintain the current level of influence on world markets. The withdrawal of liquidity and the increase in the key rate to strengthen the USD will continue. Considering this index, DXY remains the main financial instrument for the coming months.

Bitcoin continues to maintain a close correlation with stock indices. Considering the macroeconomic situation, high-risk assets remain a single category of low-value investments at this stage.

It follows that with active trading of BTC/USD, other cryptocurrencies and stock indices, the rule of mandatory DXY analysis remains. With a high degree of probability, when the US dollar index rises, Bitcoin and other cryptocurrencies go down or move flat.

The publication of CPI reports caused opposite reactions from BTC and DXY. The inverse correlation of the two assets is obvious and should be a key element of active BTC/USD trading.

BTC/USD Technical analysis

Bitcoin managed to hold on to the $20.1k–$20.2k support area. The cryptocurrency successfully defended the $19.1k line following the results of yesterday's trading day, and moved to the stage of consolidation. In the coming days, we should expect a stabilization movement in the BTC/USD price without significant impulse movements.

Technical metrics confirm this scenario. On the daily chart, the RSI index and the stochastic oscillator made a sharp reversal to the side. The MACD indicator has also completed an upward spurt and started moving in a flat direction. The publication of the CPI had a significant negative impact in both the short and medium term.

Given the successful upgrade of Ethereum, we can soon expect a decrease in investment activity and a drop in the level of Bitcoin dominance. The main focus of the market will be on the altcoin, which may cause BTC to be undervalued.

Demand and scarcity

After a short consolidation, Bitcoin may resume its upward movement due to its growing scarcity in the market. Long-term investors continue to actively buy up BTC coins, reducing their volumes in the public domain.

In addition, Bitcoin mining difficulty peaked at 32.045 trillion hashes. This means that mining a BTC block has never been so difficult. Accordingly, in the coming weeks, we can expect a local upward movement of Bitcoin to the $24k–$25k area due to its underestimation and growing scarcity.

Medium-term prospects for Bitcoin

Despite the rising inflation, the situation will begin to improve closer to winter. Most likely, the reason for this will be a significant reduction in liquidity and the aggravation of recession in the US economy. The combination of these factors will force the Fed to resume filling the markets with money, which will positively affect Bitcoin.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română