When there is no choice, it is easier to make a decision. Do investors have a choice? The latest report on US inflation allows us to give a negative answer to this question. While consumer prices peaked in June, core inflation may not have done so. It continues to accelerate, which means the Fed still has a lot of work to do. It will raise the stakes. Bad news for securities, good news for the US dollar.

For bonds, the price is the inverse of the yield. When the Fed tightens monetary policy, yields rise. Investors are dumping bonds as new ones with better features can be purchased at subsequent auctions. As a result, the dollar wins.

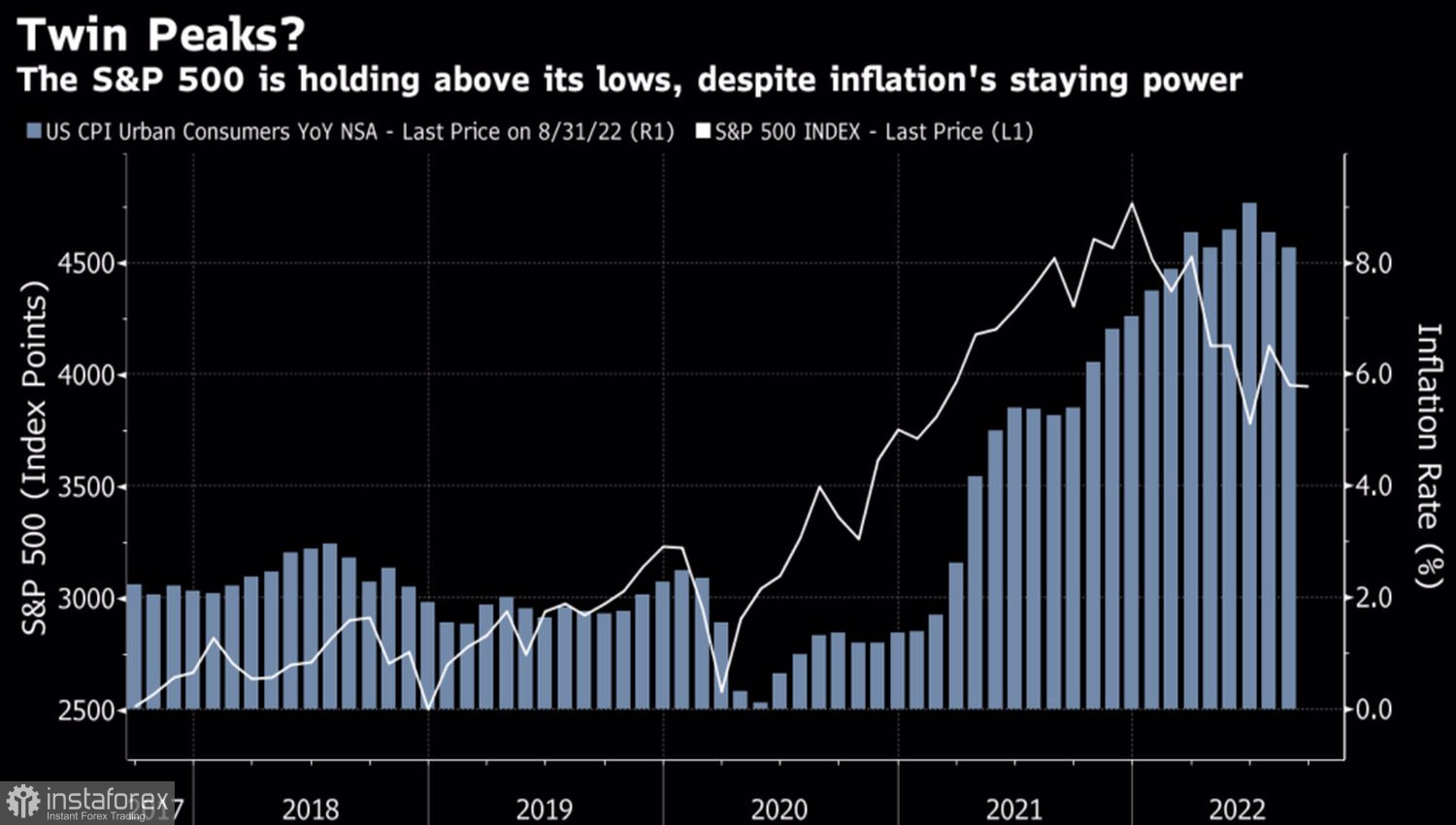

Rising US debt rates change the fundamental valuation of stocks. It's starting to look overpriced. It makes sense to get rid of such papers. Sell and buy a dollar. There is an opinion in the market that the increase in the federal funds rate to 4.5% is fraught with a fall in the S&P 500 by 20% from current levels. Moreover, no one knows the answer to the question of where consumer prices will move next. Historically, their peak corresponds to the bottom of the broad stock index. After the end of World War II, it fell for 12 months until the moment when CPI climbed to the top, by an average of 5%, and then rose by 17% after it passed.

Dynamics of the S&P 500 and US inflation

In fact, the range of options is very wide, and the current situation before the recession is unique. One thing is important to know: the Fed will not stop until it does its job. And this circumstance leads to an increase in treasury bond yields, a fall in stock markets and a strengthening of the US dollar.

What can change the situation? At first glance, the economic downturn. When it occurs, investors tend to buy up debt, and the fall in their yields weakens the dollar. At the same time, rumors are growing that the Fed will sharply lower rates and launch a quantitative easing program to save the economy. Not this time. Jerome Powell and his colleagues are determined and ready to sacrifice the US economy in order to defeat inflation. The dominance of the dollar in Forex is serious, and has been a long time. And whatever its previous successes, the USD index has not yet revealed its potential.

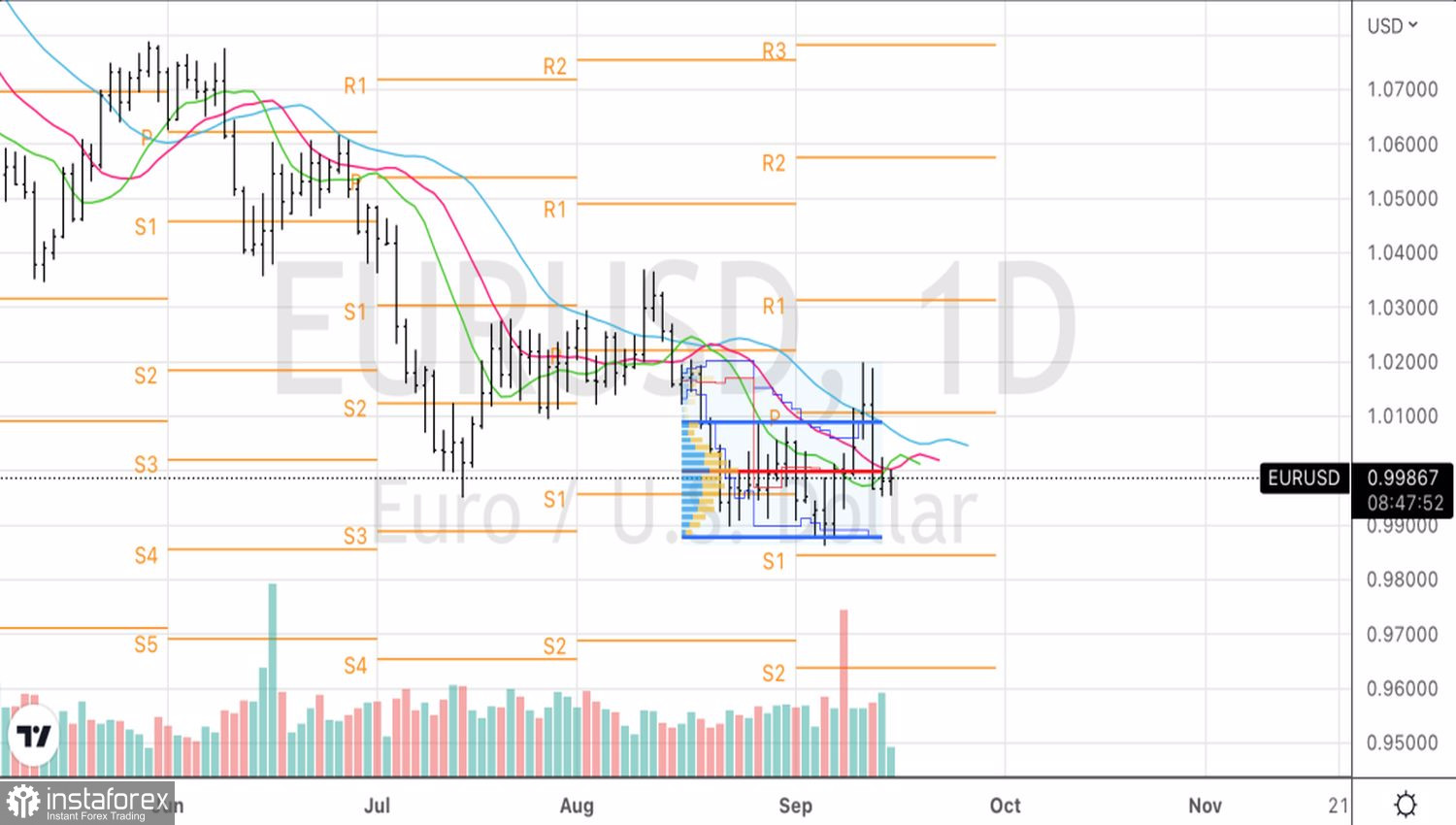

As for the euro, of course, it can snap back. If the recession in the eurozone turns out to be shallow. If the energy crisis factor has already been taken into account in EURUSD quotes. If the ECB is more aggressive than expected. If the elections in Italy do not stir up the financial markets. If the armed conflict in Ukraine ends. There are too many conditions. They can become a reason for short-term corrections, but there is no doubt about the strength of the downward trend for the main currency pair.

Technically, on the EURUSD daily chart, the rebounding of the false breakout pattern allows you to build up shorts on a break of support at 0.995. The initial targets are 0.985 and 0.965.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română