The Ethereum Merge has opened a new chapter in the history of the crypto industry. The successful transition of ETH to the Proof-of-Stake (PoS) protocol is twice as important because it took place in the midst of crypto winter.

Ethereum Merge

The Merge has many perks. It could attract significant institutional investments in ETH in the long term. Moreover, Ethereum's power usage is anticipated to decrease by 99.9% after the update.

It also resulted in a reduced supply of the cryptocurrency. This means that ether has become a deflationary asset. In other words, bitcoin will now have to compete with ether for investors' attention.

Ethereum's capacity increased to 100,000 transactions. The Merge has made Ethereum more scalable to some extent, which could boost the expansion of the NFTs and DeFi industries.

ARK Invest's Brett Winton says bitcoin and ether will trigger an unprecedented bull run in the market when the crypto winter is over. In spite of all the euphoria felt by investors, ETH tumbled following the update.

Why did the ETH price fall?

Fundamentals are the main reason behind the decline in ETH quotes. Inflation remains stubbornly high, affecting global markets. Fitch Ratings even downgraded its 2022 growth outlook for the world economy to 2.4% from 2.9%. This could indicate that economists have underestimated the inflation problem.

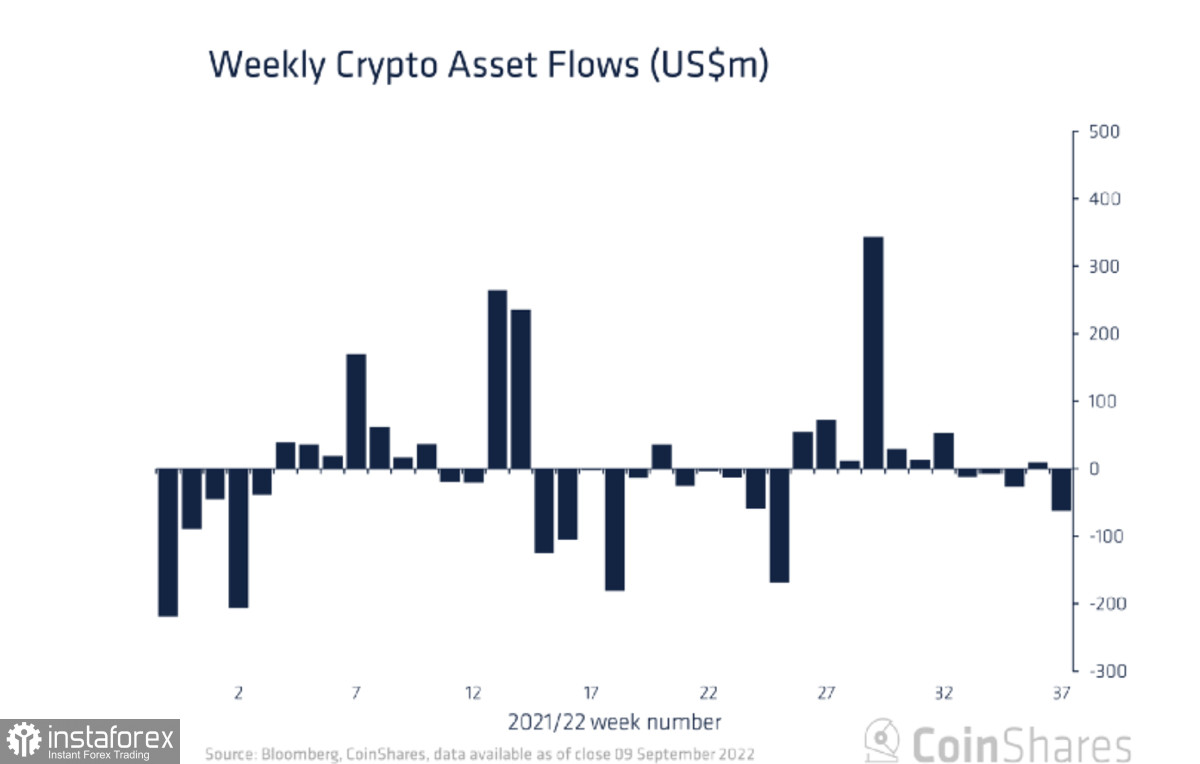

The negative fundamental background is also weighing on investment flows in the crypto market. Analysts at CoinShares have recorded a considerable outflow of crypto funds since June 2022. The crypto market saw outflows of $63 million between September 3 and September 9. Outflows from Ethereum-focused crypto products continue for the third week straight, amounting to $61.6 million.

Over the past few weeks, crypto exchanges have seen significant inflows of ETH coins. Some analysts say investors are preparing to lock in profits following the successful Merge. Still, there are those who are alarmed by the transfer of ether to exchanges and say investors do not trust the upgrade.

Technical analysis and outlook for ETH/USD

Yesterday, ETH dropped by 9% and posted a weekly loss of 14%. The altcoin broke through the important support level of $1,500 and slowed the pace of its fall near the second support level of $1,420. The price then retraced up to $1,460 but failed to extend the rise.

On the daily chart, technical indicators signal the continuation of the bearish trend. The Stochastic Oscillator and the RSI have made an unsuccessful attempt to reverse. The MACD is moving in the red zone, reflecting the downtrend in the medium term.

In light of gloomy forecasts, ether is likely to extend the bear run. In case of a breakout through $1,420, the next support zone is seen at $1,280-$1,340. Should the price break through the zone, the asset will head towards $1,150.

The current decline in ETH quotes has nothing to do with the Merge. Rather, it is influenced by many fundamental factors. Taking into account the release of disappointing CPI data right before the update, there were reasonable grounds for a drop in the price of ETH.

Undoubtedly, the Merger will be more beneficial for the altcoin in the medium and long term. Increased attention among institutional investors, a new chapter in the development of DeFi and NFT, and lower energy consumption will be driving up ether for at least a year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română