The upcoming FOMC meeting and the key interest rate hike in the US have a considerable influence not only on the greenback and the US stock market but also on the global markets. That is why traders should take into account these factors to avoid significant financial losses.

What market situation do we see two days before the meeting?

First of all, traders clearly understand that the Fed may raise the benchmark rate by 0.75% to 3.00-3.25%. The fact is that 81% expect a 0.75% rise, whereas only 19% suppose that the interest rate will be hiked by 1.00%.

This is a very strong market signal, which points to the fact that the recent disappointing data on consumer inflation deeply affected traders. In August, the indicator advanced on a monthly basis and showed a minor decline on a yearly basis. Against the backdrop, traders lost hope for a more dovish stance. However, Jerome Powell and his colleagues, heads of other central banks, have made it clear that combating inflation is the key aim and they will do everything to reach the goal.

What results may the 0.75% rise in the key interest rate have?

On the one hand, traders have already priced in this fact, manifesting a massive sell-off in the US stock market after the publication of the recent inflation report. As a result, the US dollar surged. In this light, investors are more interested in the Fed's real plans for the foreseeable future. At the moment, all forecasts are far from the reality since the Fed has not decided on its strategy yet. It means that all inflation reports will be of vital importance. Any change will seriously affect the regulator's decision.

What market sentiment will prevail today and during the whole week?

If the Fed raises the benchmark rate by 0.75% and inflation stabilizes, Powell may switch to a looser approach. In the event of this, traders will receive a strong signal to buy stocks and US government bonds, thus weakening the greenback. What is more, other stock markets may also show a rally, whereas demand for commodities may jump. Against the backdrop, precious metals may become more expensive.

Today and maybe tomorrow, investors could become less active. As a result, the dollar pairs may settle within the sideways channels. However, they may show some changes without a clear direction. In other markets, the situation could be the same. All this could be explained by the expectations of the Fed meeting.

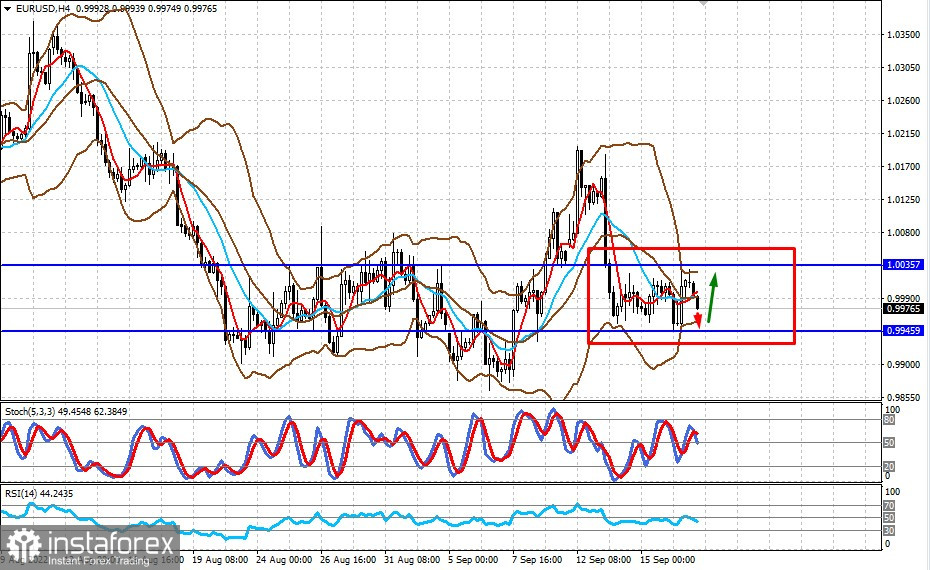

Outlook for EUR/USD:

The pair is showing bearish dynamics within the range of 0.9945-1.0035 amid the upcoming meeting. It is likely to go on hovering within the range.

Outlook for USD/JPY:

The pair is displaying extremely low volatility, remaining in the channel of 141.80-144.80. It may stay within the price range for the next two days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română