Gold is trading cautiously as market participants are waiting for the results of the FOMC meeting.

At the moment, the yellow metal is trading at 1,673 US dollars per troy ounce, having gained just 1% in yesterday's session.

This goes in contrast to other precious metals. Thus, palladium futures went up by 5.55%, platinum futures rose by 2.28%, and silver advanced by 1.03%. All of the precious metals posted gains amid the weakness of the US dollar. After a decline of 0.15%, the US dollar index is now holding at 109.77.

Traders expect the Fed to announce another rate hike following the FOMC meeting this Wednesday. Starting from March 2022, the US Federal Reserve raised the funds rate by 25 basis points for the first time since 2018. The regulator continued the streak of rate hikes at all consecutive FOMC meetings. As a result, the interest rate moved from almost zero to its current level of 225-250 basis points. According to the CME Group's FedWatch tracker, there is an 82% probability that the Fed will raise the rate by 75 basis points on Wednesday. This will be the third 75-basis-point interest rate hike this year.

The Fed has been focused on bringing inflation down to the acceptable level of 2%. Yet, inflation is very persistent and is running at peak levels. The consumer price index reached a 41-year high in July 2022, hitting 9.5%. The fresh data shows that inflation remains extremely high, coming at 8.3% in August.

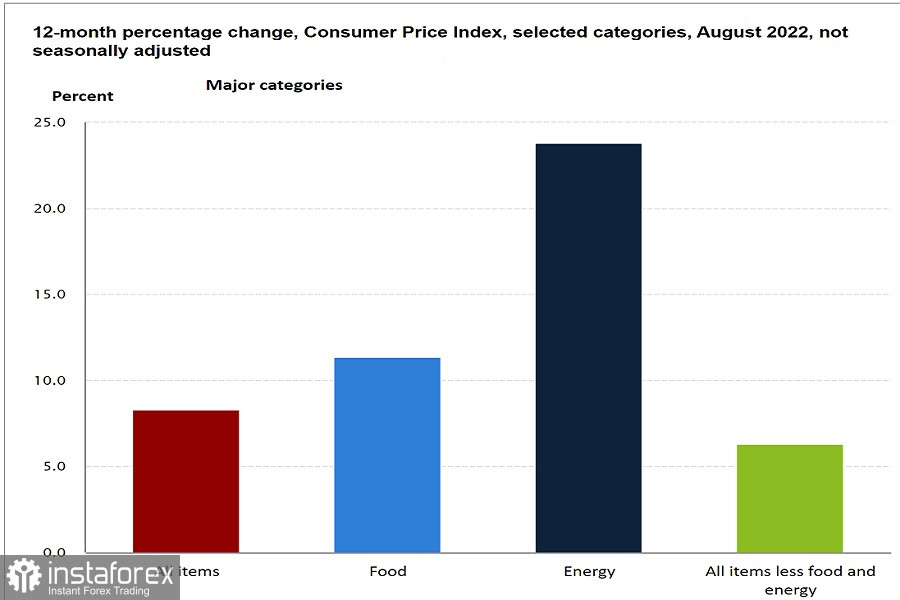

For the most part, the decline in inflation is associated with lower energy costs as the gasoline index fell by 7.7% in July. At the same time, prices for other essential goods continue to stay elevated. Food prices rose by 13.5% for the year ending in August.

According to the US Bureau of Labor Statistics, "Over that period, prices for food at home increased 13.5 percent, the largest 12-month percentage increase since the period ending March 1979. Prices for food away from home increased 8.0 percent for the year ended August 2022, the largest over-the-year percentage increase since an 8.4-percent increase in October 1981."

The graph above shows the 12-month percentage change in four categories of the consumer price index. This clearly shows that the US Federal Reserve is still far from reaching its inflation target of 2%. Apparently, the regulator has had almost no success in reducing inflation even though it was raising rates for the last four consecutive FOMC meetings. This time, the central bank is very likely to introduce another big rate hike of 75 basis points.

Even another rate hike may not bring inflation closer to its target level. The consensus among economists is that the Federal Reserve will raise rates to the range of 3.5-4%. It should be noted that historically the Fed had to increase rates to the level equal to the inflation level in order to lower it. Besides, even the most aggressive rate hikes made by the Fed in the past were carried out over several years.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română