Bitcoin is once again trading below $20k and is in danger of finally losing buyer support. This threatens to update the local low or form a new market bottom. Fundamental and technical factors indicate a high probability of a bearish scenario.

Is the Fed losing control of inflation?

The main factor in the fall of Bitcoin's capitalization is inflation in the United States. In August, it seemed that the Fed had worked out a fairly effective mechanism to counter the rise in consumer prices.

According to the latest CPI report, the inflation rate fell to 8.3% against the forecast of 8.1%. The disappointing dynamics of the decline in the CPI has become an alarm signal indicating the loss of control of the US Central Bank over inflation.

General forecast for BTC/USD

In the short term, this means maintaining the Fed's hawkish policy, aggressive liquidity withdrawal, and a key rate hike. After the CPI report, markets had no doubts that the key rate would be increased by at least 75 basis points. It is for this reason that investors are rapidly getting rid of high-risk assets, including Bitcoin.

In the medium and short term, the situation is also deteriorating significantly. Powell said in July that the agency plans to leave the rate at a neutral level by the end of 2022. This gave investors hope for the end of the aggressive monetary policy in the near future. The approaching elections to the US Congress in November warmed up the positive markets and allowed us to hope for a weakening of the current policy of the Fed.

As of the end of September, markets should lower their hopes for a quick resolution of the situation as inflation falls more slowly than the most modest forecasts. The Fed is in a difficult position as, on the one hand, inflation is becoming unmanageable and, on the other hand, the US economy is entering a phase of a protracted recession.

Bitcoin correlation with SPX and DXY

The combination of these factors allows us to draw disappointing conclusions for the crypto market and Bitcoin. The key rate will continue to grow, and the liquidity crisis will worsen. This means that BTC will continue to maintain a correlation with stock indices. The US dollar index holds the title of the main financial instrument for the coming months. Therefore, Bitcoin will grow only in the event of a local DXY correction.

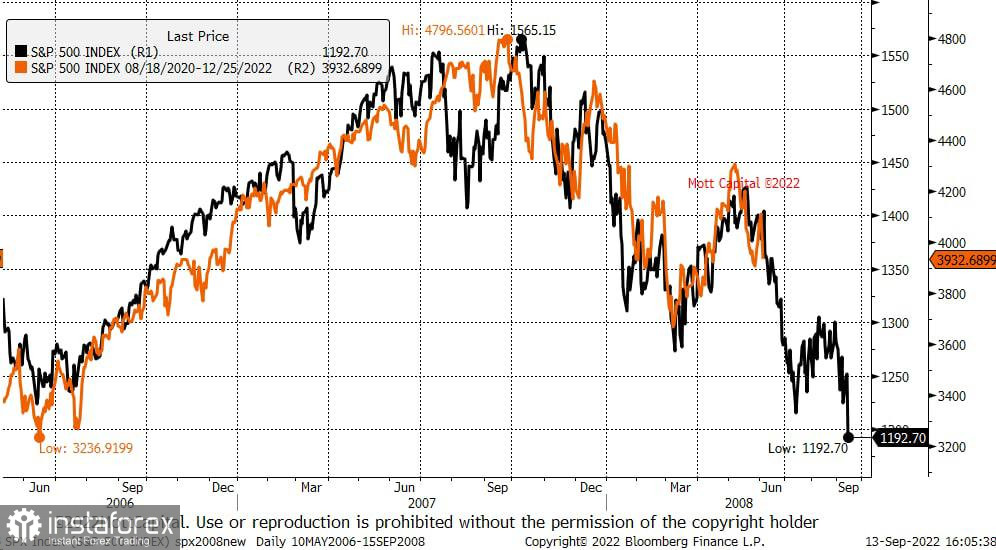

I would like to dwell in more detail on the situation with the stock market, which directly affects Bitcoin quotes. Analysts say that the price movement of the S&P 500 completely repeats the events of the 2008 global crisis. And considering where the bottom of the index was during the crisis at the end of the 2000s, the SPX expects another and very painful stage of decline.

BTC/USD Technical analysis

In the short term, there are two options for Bitcoin price movement. Tomorrow, September 21, there will be a meeting of the Fed and a speech by Chairman Jerome Powell, where a key rate increase of 75 bps is expected. Most likely, the market will react calmly, as the current price reduction is a preparation for the disappointing decisions of the Central Bank.

However, it is likely that the rate will increase by 100 basis points. In this case, Bitcoin will start to decline and reach the local bottom at $17.7k. Given the general downward direction of the markets, the probability of a new low in the price of BTC is at the highest level in the last month and a half.

Unpopular but likely scenario

At the same time, there is a possibility of a bullish price rebound above the $20k level. This is hinted at by several important factors, the main of which is the retest of the $18.2k level and the confident defense of the frontier by buyers.

The rebound formed a green candlestick with a long lower wick, which may indicate a second or third bottom. In addition, the stochastic oscillator rebounded from the lower border of the bullish zone, which may indicate a local price reversal.

Given the general bearish sentiment and the formation of an interesting bullish pattern, we can expect a local rebound in the BTC/USD price after the Fed meeting. However, this probability is estimated at 20%–30%. We should expect that the price will continue to decline or remain flat based on the results of Powell's speech.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română