Today, the US Federal Reserve will finally announce its decision on interest rates and present new economic projections as well as the dot plot. On Wednesday morning, the futures market saw an 82% probability of a 75 basis point rate increase and an 18% chance of a hike by 100 basis points at once, which is in line with the earlier forecasts. Meanwhile, the greenback is edging higher but its upside potential is limited.

During the day, demand for risk assets could increase as the Kremlin is preparing to hold a referendum in four partially occupied regions of Ukraine on joining Russia. This could trigger geopolitical jitters and change the course of the military confrontation.

USD/CAD

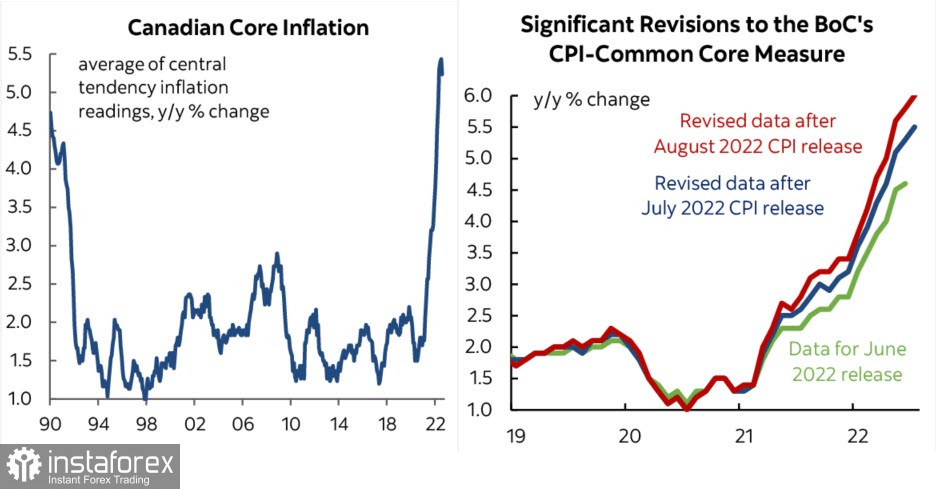

Inflation in Canada slowed to 7% in August from 7.6% in the previous month, beating economists' forecasts. Core inflation came at 5.8% versus 6.1% a month earlier. In this light, expectations of the hawkish Bank of Canada could ease, causing a drop in the loonie.

The Canadian regulator will hold the board meeting in a week. Now there is a high probability of a more than 50 basis point rate rise. Otherwise, the Bank of Canada could choose to pause with tightening as the CPI, excluding food and energy prices, grew by 2.6% on a seasonally adjusted and yearly basis, the lowest rise since February 2021. In other words, with a slowdown in the inflation rate, the Bank of Canada could take some time – at least 5 weeks until the next meeting – to see how things unfold.

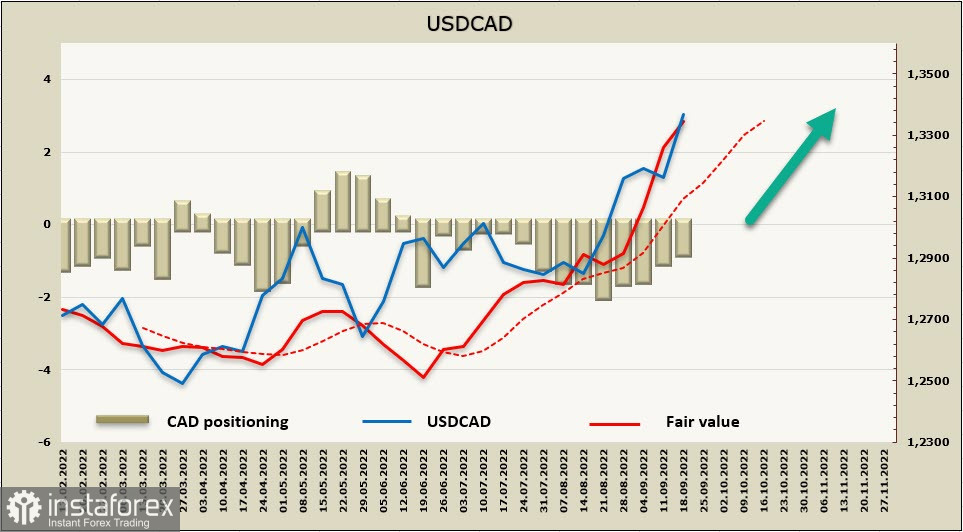

The net long position on CAD dropped by 481 million in a week. CAD positioning is still bullish although bearish sentiment is increasing. Meanwhile, the fair value is rising.

Last week, the target stood at the swing high of 1.3222, The quote broke through the barrier and approached the technical resistance level of 1.3335. The impulse is still strong and is unlikely to end any time soon. The new target is seen in the 1.3640/60 resistance zone. The price could approach the range already by the end of the week.

USD/JPY

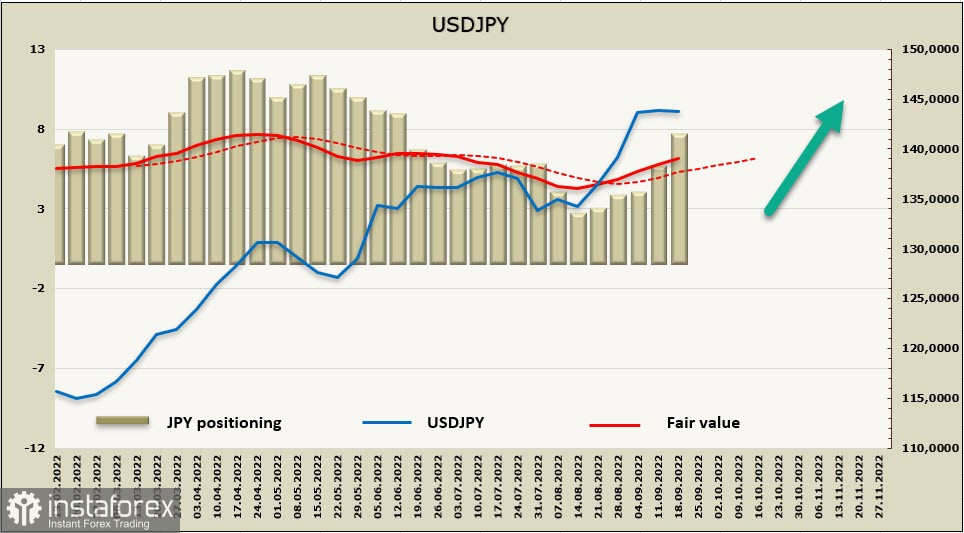

In Japan, inflation hit 3% year-over-year in August, coming above market expectations. Still, Japan is not one of those countries that are now dealing with soaring inflation. Although the price of goods in the country accelerated by 5.7% year-over-year, the price of services saw an uptick of just 0.2% (49.54% of the whole index). This is due to a sluggish rise in wages and long-term prospects of decreasing internal demand amid the depopulation and aging of Japanese society. The Bank of Japan simply cannot set the same inflation target as in the West, given its significant structural differences. In other words, while other central banks, including the Federal Reserve and the ECB, are doing everything to tame inflation, the Bank of Japan should do the opposite.

Therefore, the Japanese regulator will hardly change its stance on monetary policy.

The Bank of Japan has recently checked to see how the yen is doing. It called dealers at commercial banks to find out about the current state of the foreign exchange market. The bank does this, expecting intervention from the government (the Minister of Finance), which is legally responsible for the country's exchange rate policy. Exchange rate checking serves a dual purpose. Firstly, it lets the market know that the government is ready to intervene. Secondly, it signals that the authorities are concerned about the speed of market change. Oftentimes, after such checks, the government intervenes to stabilize the yen, especially since the yield on 10-year bonds has been holding 1 point above the target (0.251%) for several days. In other words, intervention is the only thing that can be done.

This is also a signal of an imminent inflow of liquidity. So, the yen is likely to deepen its weakening.

The net short position on JPY is still increasing, with a weekly gain of 1.883 billion. The currency is likely to stay bearish, with the fair value above the long-term MA.

In this light, short-term consolidation slightly below 145 is coming to an end and could be followed by a breakout above the mark. The psychologically important level stands at the next target of 147.71. Still, it could hardly be reached. The Federal Reserve's monetary stance is likely to be exactly the opposite of the Bank of Japan's in the long run. So, the yen will remain in a bear trend unless, of course, sudden geopolitical events change the balance of risk.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română