The markets were once again at the mercy of political factors. Yesterday it became known that referendums on joining the Russian Federation will be held in four Ukrainian regions controlled by Russian troops in September. In addition, Vladimir Putin has just announced a partial mobilization. All this points to a clear increase in tensions in Europe, which could escalate into a full-scale war. In general, we are talking about a sharp increase in risks that lie exclusively in the military-political plane. That is, uncontrollable and unpredictable. The only thing that investors can do in such a situation is to withdraw their assets away from the risk zone as soon as possible. And it is now the whole of Europe. And apparently, tensions will only increase in the coming days, which is why all European currencies, including the pound, will remain under pressure. And it does not matter that the Federal Open Market Committee will have a meeting today, during which the refinancing rate may be raised by 75 basis points. Yesterday morning, this event was considered the most significant for the markets. But everything has changed dramatically. There is no doubt that the dollar will continue to strengthen its position, since the United States is the main direction of capital flight from Europe.

Refinancing rate (United States):

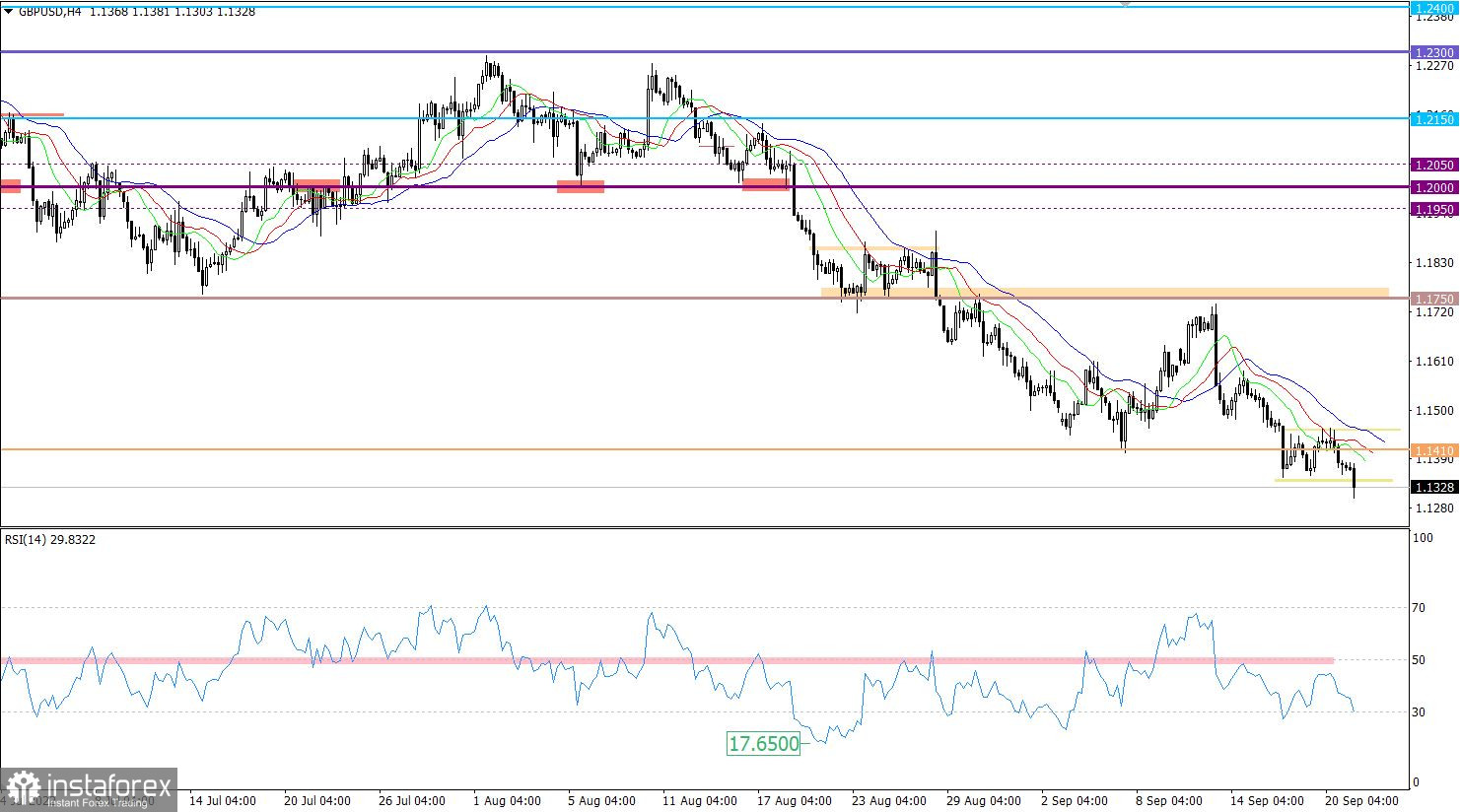

The GBPUSD currency pair moved within the 1.1350/1.1450 sideways range for the third consecutive day, consistently working out the set boundaries. The effective magnitude was classified in the market as a process of accumulation of trading forces.

The RSI H4 and D1 technical instrument is moving in the lower area of the 30/50 indicator, which indicates the prevailing downward mood among market participants.

The moving lines on the Alligator H4 and D1 indicators are focused on a global downtrend, there is also no intertwining between the MA lines.

A prolongation of the long-term downward trend is observed on the daily trading chart.

Expectations and prospects

Since the opening of the European session, there has been a breakdown of the lower limit of the established range, which led to the prolongation of the long-term downward trend. As a result, the quote was again at the levels of 1985, which indicates a high desire of market participants to decline further.

The work should take into account the fact that the current levels are historical, for this reason, speculation is not excluded, which will eventually lead to overheating of short positions and as a result, a technical rollback.

A comprehensive indicator analysis in the short, intraday and medium-term periods indicates a downward mood.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română