Stocks rose slightly in late trading in New York due to rallies by Apple Inc. and Tesla Inc. Then they rebounded following the worst weekly decline in the US stock market since mid-June.

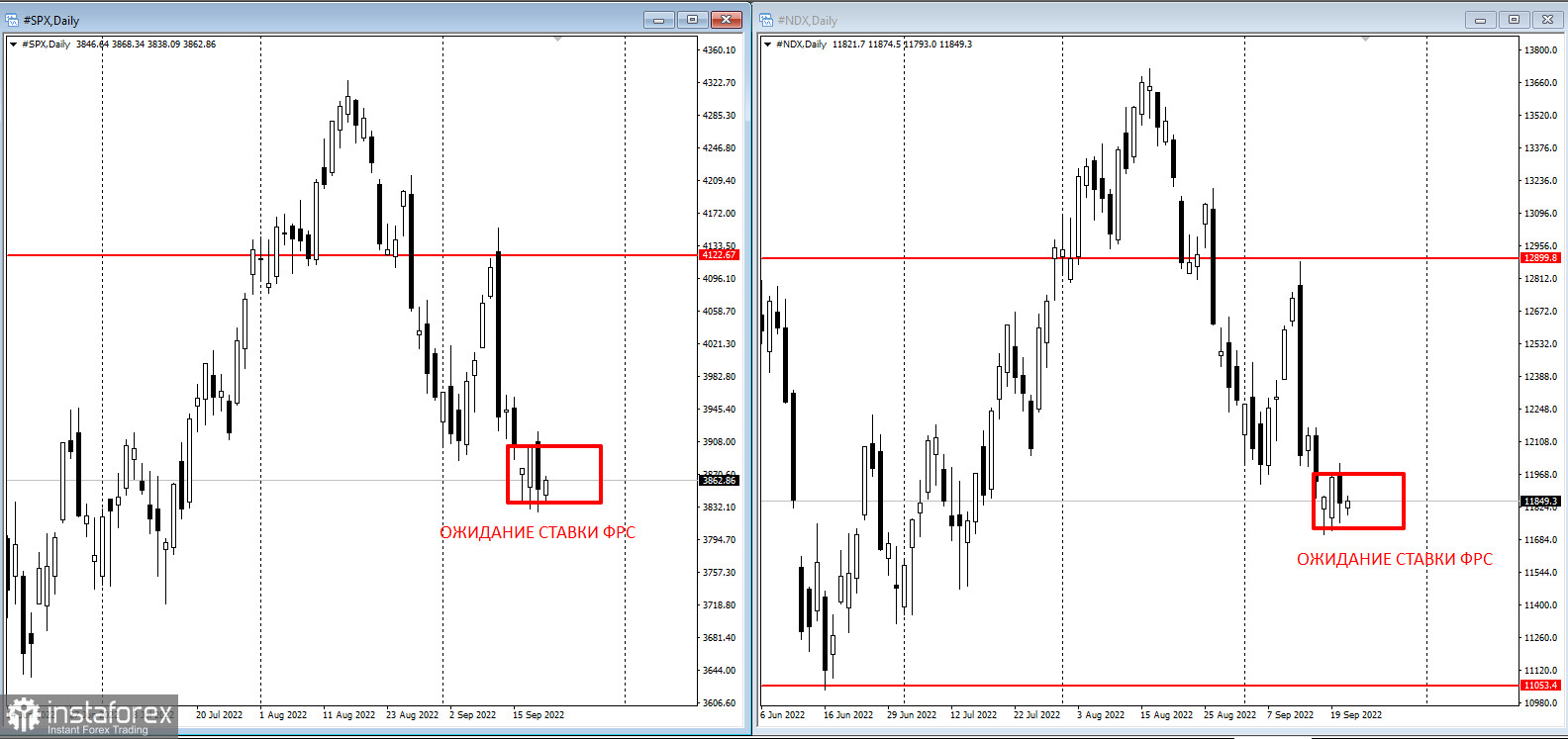

Major stock indexes traded mixed as traders were prepared for another US rate hike amid fears that the Federal Reserve might pursue its hawkish strategy. The 10-year Treasury yield hovered around 3.5%, while the two-year rate, which is more sensitive to inevitable policy changes, hit its highest since 2007.

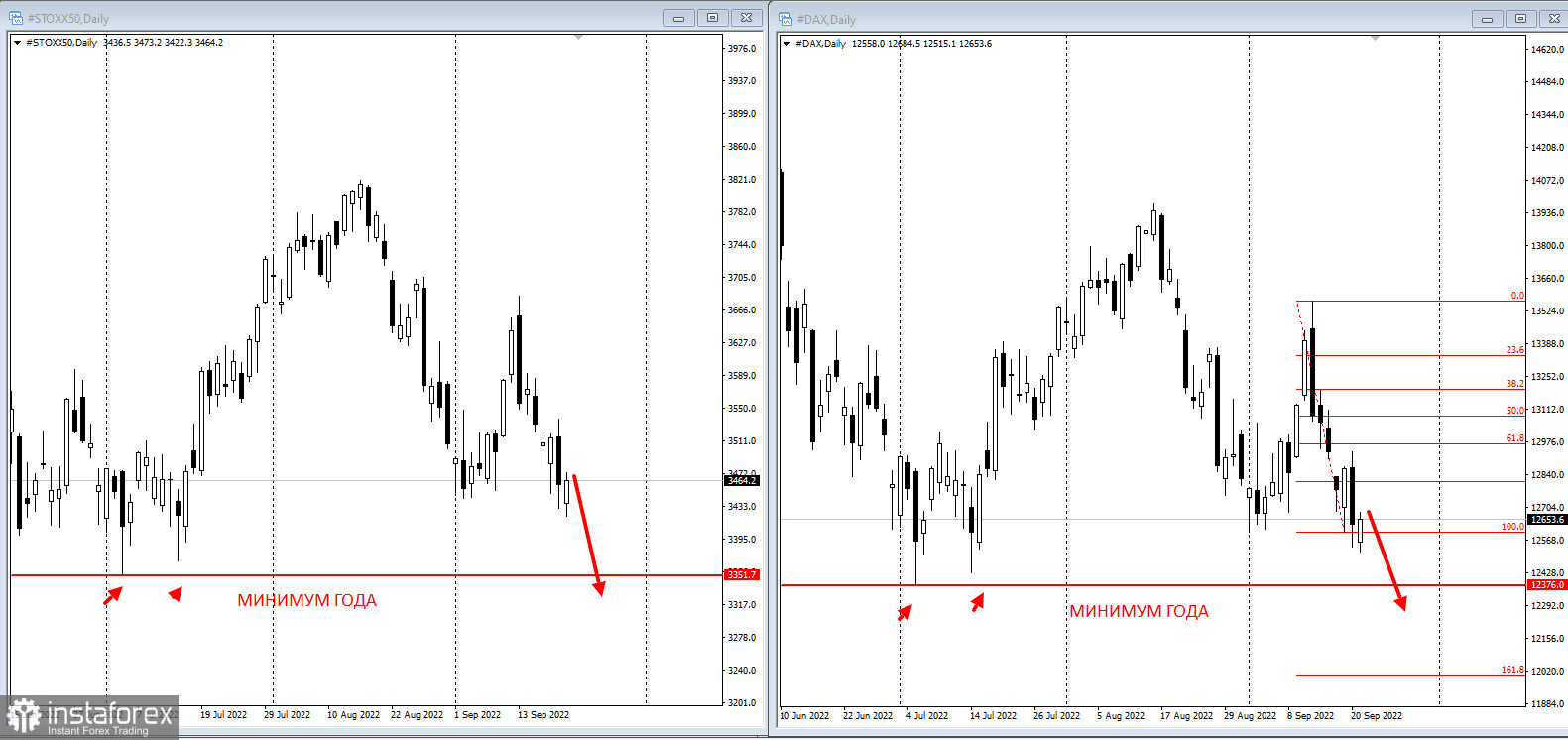

European stock indexes corrected ahead of the rate hike, hitting year lows as winter looms amid the energy and gas crisis:

Traders predicted that the Fed would raise the rate by 75 basis points. The long-term hold strategy is based on the idea that the central bank will avoid the disastrous stop-go policy of the 1970s, which allowed inflation to spiral out of control. Although it is possible to outline arguments for a rate increase, its hike could exacerbate recession fears.

.

According to Sam Stovall, chief investment strategist at CFRA Research, a full-point rate hike will jolt Wall Street as it implies that the central bank is "overreacting to the data rather than sticking to its game plan." He added that following the previous seven rate increases of that magnitude, the US equity benchmark fell four times each over one-, three- and six-month periods.

Ed Yardeni, president of his namesake research firm who nailed the market bottom in 1982 and 2009, believes the Fed will raise rates by 100 basis points this month, with Fed Chairman Jerome Powell and the central bank's economic projections looking hawkish.

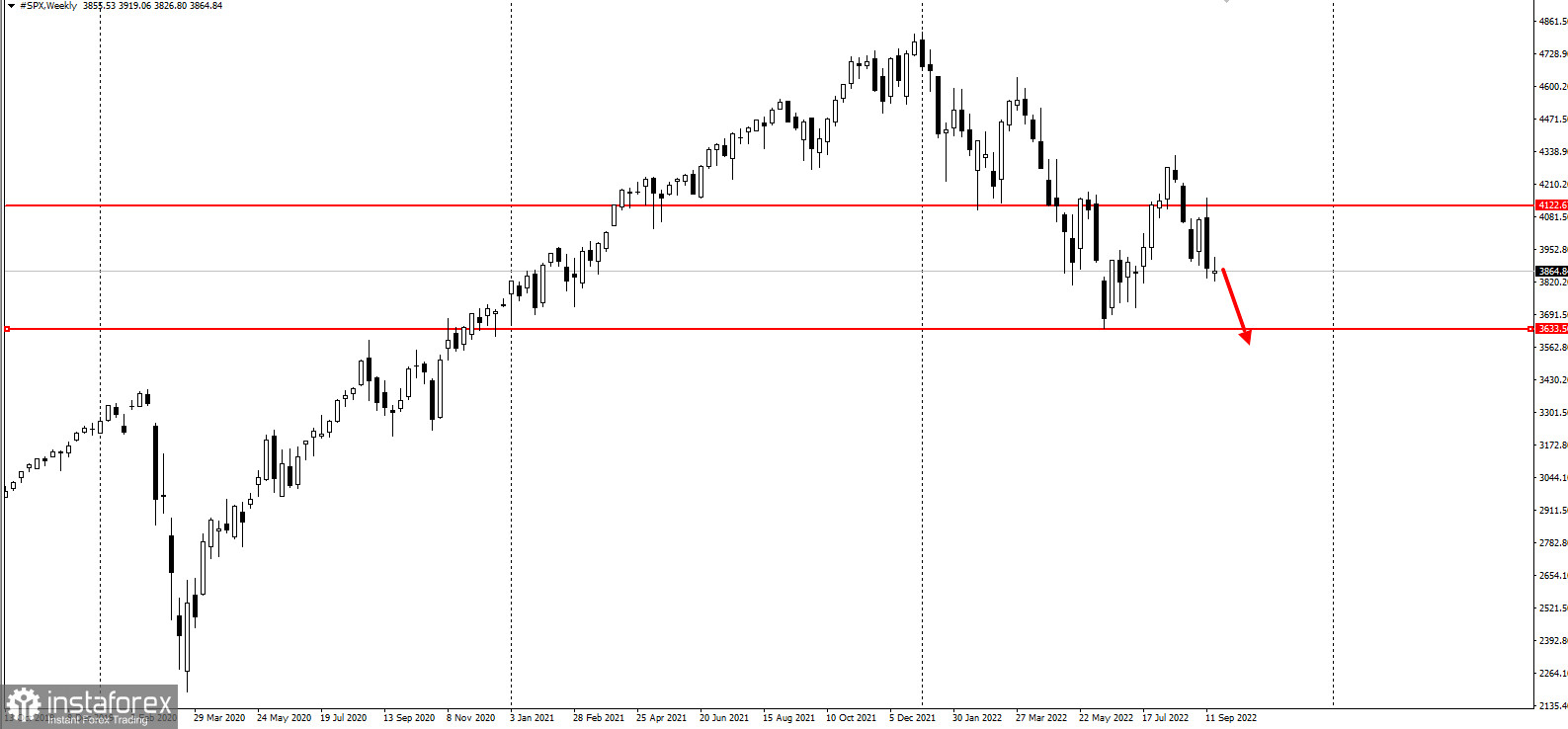

He noted that this could cause the S&P 500 to retest its June 16 low of 3666.77, nearly 6% below its current levels.

"The question to focus on isn't whether the Fed will hike rates by 75 basis points or 100 basis points," Phillip Nelson, head of Asset Allocation at NEPC, said. - What we're looking for is how aggressive Powell will be in the next six to 12 months. The messaging we get in the next few weeks could be a bigger data point and a shock to investors."

In a sign of t how severe the equity beatdown has been, the S&P 500 has been trading below a key technical level for the longest period since the global financial crisis.

The Moscow Exchange index collapsed by 500 points before and during Russian President Putin's speech. He announced plans to hold referendums and declared partial mobilization in the country.

Key events this week:

- US housing starts, Tuesday.

- EIA crude oil inventory report, Wednesday

- US existing home sales, Wednesday

- Federal Reserve decision followed by a press conference with Chairman Jerome Powell, Wednesday

- Bank of Japan monetary policy decision, Thursday

- The Bank of England interest rate decision, Thursday

- US Conference Board leading index, initial jobless claims, Thursday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română