Futures on US stock indices are trading without any definite dynamics, as investors mostly take a cautious position before the next expected interest rate hike by the Federal Reserve. Yesterday, the market sank slightly, and all indices closed in the red zone at the end of the regular session.

Meanwhile, the yield on treasury bonds declined slightly, and the US dollar rose after Russian President Vladimir Putin signed a partial mobilization of the population in the country.

At the time of writing, S&P 500 index futures had recovered slightly after falling on Tuesday. Many expect that the aggressive actions of the Fed will finally push the economy into recession, so it is not necessary to count on a major recovery of the stock market in the near future. Officials are expected to raise rates by 75 basis points today for the third time in a row. Only a small number of analysts predict a rate increase of 100 basis points at once.

European stocks also rose after the first losses ahead of the Fed meeting. Eurozone bonds jumped, and German 10-year bond yields fell three basis points to 1.89%.

What can help the stock market: if the Fed sticks to the scenario and the committee votes for an increase of another 75 basis points without any changes, the markets are likely to revive somewhat, partly because the risk of a 1.0% rate hike will remain on the sidelines.

Crude oil has risen in price against the backdrop of an escalation of the political conflict in which all developed countries are already involved. The crises in the energy market and the food crisis will certainly not be resolved in the near future, especially after the Russian authorities hold referendums in the territories of the LND and the DPR with the aim of becoming part of Russia. This will continue to put pressure on risky assets, while investor sentiment here will play a more significant role for both stocks and the bond market.

At the same time, bitcoin was hovering around $19,000 amid market unrest. The offshore yuan sank to its lowest level against the US dollar since mid-2020, even after the People's Bank of China set the daily base rate of the currency higher than expected.

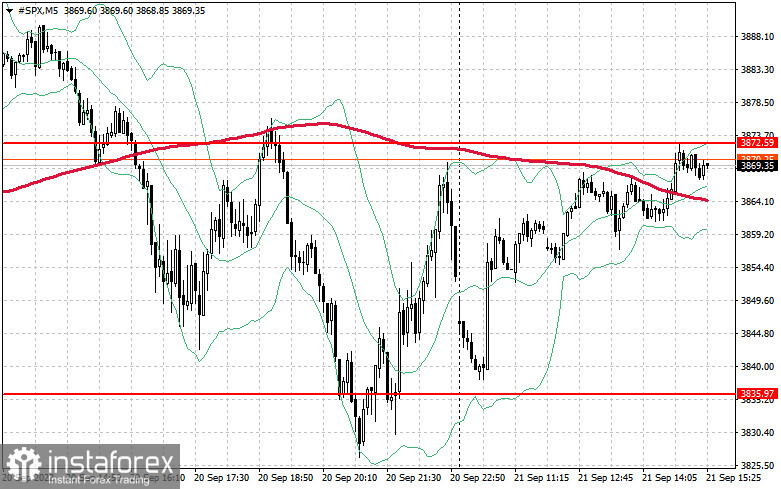

As for the technical picture of the S&P500, after yesterday's sharp jerk down, the markets are returning to their more or less truthful levels. In order to build an upward correction in an attempt to find the bottom, the bulls need to protect the level of $3,872. Only after that it will be possible to count on a second breakthrough to the area of $3,905. The breakdown of this range will support a new upward momentum, already aimed at the resistance of $3,942 and $3,968. The furthest target will be in the area of $4,038. In the case of a downward movement, a breakdown of $3,872 will quickly push the trading instrument to $3,835 and open up an opportunity to update the support of $3,801. Below this range, you can bet on a larger sell-off of the index to the lows of $3,772 and $3,744, where the pressure may ease a little.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română