In the last few days before the Fed meeting, Bitcoin lost about 7% of its capitalization. Cryptocurrency quotes reached the dangerous level of $19k, but the bears did not have enough strength to break through it. The outcome of the Fed meeting helped the sellers increase pressure and bring the price of BTC to $18.8k.

Results of the Fed meeting

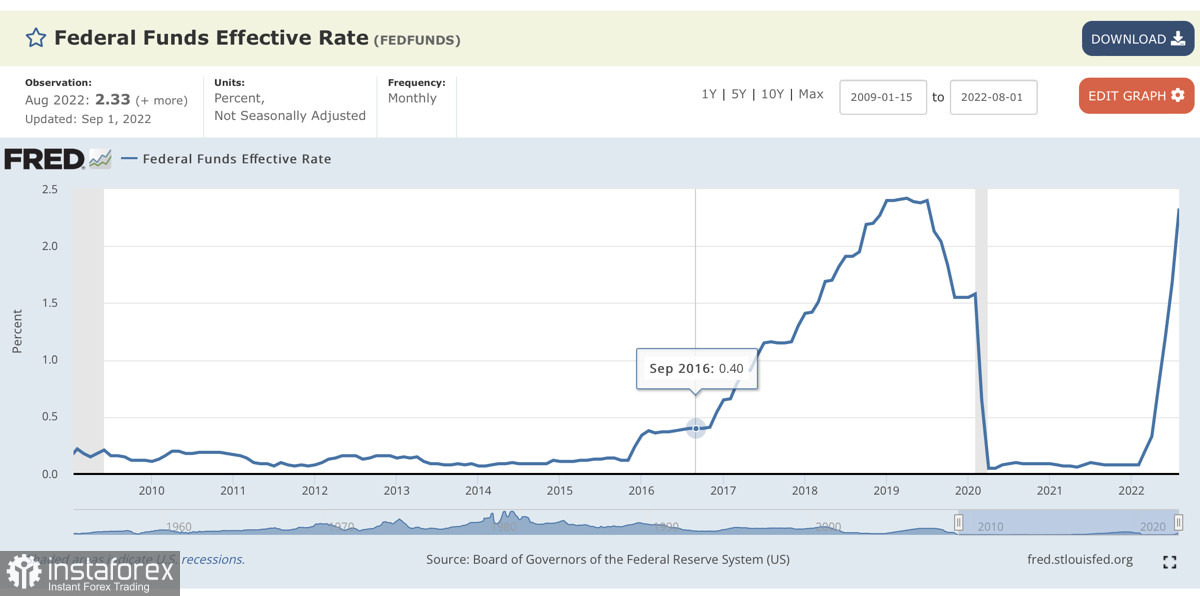

Fed members voted unequivocally to raise the key rate by 75 basis points. As of September 22, the key rate is at the level of 3.25%. At the same time, the Fed is actively withdrawing liquidity from the markets, but it is not possible to curb inflation.

And here it is worth paying tribute to BBG analysts, who stated that the market lays a high probability of a rate at the level of 4.5% by the end of 2022. Fed Chairman Jerome Powell confirmed these intentions. The agency plans to bring the figure to 4.5% by the end of 2022.

This means that the Fed has underestimated the scale of inflation and maintains an aggressive monetary policy. That is why a statement was made about the need to maintain the current policy in 2023. According to the results of the meeting, key rate easing is not planned until the end of 2023.

Long term forecasts

Considering that the bullish movement of Bitcoin is completely dependent on the policy of the Fed and the movement of the DXY index, this is extremely negative news for the cryptocurrency market. The Fed has signed up for the ineffectiveness of its fight against inflation, and you can forget about the promises to start easing monetary policy in the second half of 2022.

Fed Watch believes futures markets have an 89% chance of raising the key rate by 75 bps in November. Given the Fed's theses, this should be the last increase in 2022 in increments of 0.75%. The situation remains negative, and the liquidity crisis will continue to worsen over time. Given this, with a high degree of probability, a significant increase in BTC/USD in 2022 should not be expected.

Correlation of Bitcoin and stock indices

Analyzing the movement of the price of Bitcoin and actively trading this instrument, it is necessary to pay attention to stock indices. The preservation of the current state of the market, at least until the end of 2022, indicates the continued correlation of cryptocurrency with stock indices.

The S&P 500 formed a large bearish candle at the end of yesterday's trading day and started trading inside the support zone. Considering that the price of Bitcoin remained practically unchanged at the end of the trading day, we should expect a similar movement of the cryptocurrency after the opening of the American markets.

Bitcoin: Technical analysis

As of writing, Bitcoin has broken through the $19k support zone and is trading near $18.8k. It is noteworthy that the price drop was provoked by the bulls' attempt to reach the $20k level. However, the lack of sufficient volumes provoked a price reversal and a breakdown of the $19k support zone.

On the daily chart, technical metrics point to buying activity in the $18.8k–$19.1k area. The RSI index and the stochastic oscillator resumed their upward movement in parallel, however, on the chart, we still do not see the bullish momentum working off. Given the fundamental background, there is a high probability that we will not see it.

Despite the fierce resistance of the bulls, sellers manage to push the price lower and lower. Gradually, the range of price movement decreases towards the local bottom, which hints at its imminent retest. Over the past week, the price of Bitcoin has tested the final support level of $18.1k twice. The bulls repelled the attack on $18.1k, but there is every reason to believe that after the Fed meeting, the boundary will be broken, and the price will update the market bottom.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română